Because of my interest in finance, I’ve been approached by many family members, friends and coworkers to discuss a myriad of financial issues. It’s usually a very lively and animated discourse that ends up with me excitedly promoting (or defending) the subject of long term index investing while being met with some skepticism and doubt by those who insist that such an approach is just “too boring” and “slow growth” for their taste. They then proceed to tell me that they’d rather do it their way by “supercharging” their portfolio with carefully picked hot stocks.

Okay, so I then prod them to show me their portfolio, and it typically looks like what I’ll present below.

What My Friends’ Portfolios Look Like

Before I proceed, let me say that there are “many ways to skin a cat”, especially when it comes to investing. However, I’d like to share what I’ve found to be a common thread in many portfolios I’ve had the chance to analyze and observe. It turns out that some investors are enamored by a particular form of asset allocation which I describe as “passive aggressive” (in fact, I tease my friends that this portfolio is schizophrenic).

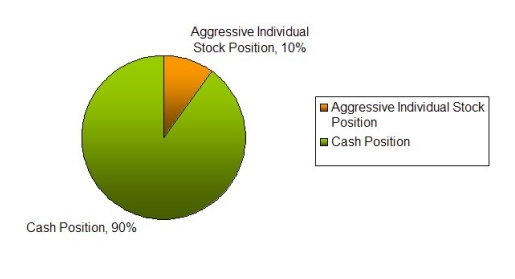

As an example, I was shown a portfolio that was made up of 10% aggressive, individual stocks and 90% cash in CDs and money market funds. I don’t think it’s an exaggeration to say that a lot of people have portfolios that bear a strong resemblance to this set up. When I ask my investor friends how their portfolios are doing, they immediately give me the awesome news that their stocks are going gangbusters, but under more careful scrutiny, I see that their overall returns are more lackluster. Let me add that those individual stocks are also churned very heavily in that portfolio, where any short-term capital gains become subject to taxes.

Let’s see how the returns of this investor’s portfolio work out. The assumption is that cash is pegged at its recent return of 1%. So let’s take a hypothetical basket of aggressive stocks that have done well and which represent the 10% allocation of this particular investment portfolio — these stocks would have to return the equivalent of 75% to bring up the average return of the overall portfolio so as to match the returns of a simple index fund that tracks the U.S. Total Stock Market. That’s because the average annual return of the U.S. Total Stock Market has been between 8% to 9% over the long term.

Cash Return + Stock Returns = Overall Portfolio Return

(.01 X .90) + (.75 X .10) = .084, which if multiplied by 100% yields 8.4%

So we must ask ourselves: just how feasible is it to expect a 75% return from your stocks over the long term?

More realistically though, my colleagues’ stocks have returned 25% yearly at best (because they practice trading and only stay in these stocks for short periods of time throughout the year!). While on average, their returns have typically registered more around 15% before applying transaction fees from trading churn and the tax bite. If we plug in this 15% stock return to our portfolio calculations, what we get is an overall portfolio return of a measly 2.4%, very close to the equivalent return of a pure cash portfolio. Clearly, this allocation model shows the extreme dilution that is caused by an under-diversified portfolio.

(.01 X .90) + (.15 X .10) = .024, which if multiplied by 100% yields 2.4%

Let’s go through a second example. You may recall that there was a time when the long term stock market results were 11% while savings rates for cash accounts hovered at 4%. Even then, it would have taken the equivalent of a 75% rate of return for a 10% stock allocation to yield an 11% total return for the entire portfolio.

Cash Return + Stock Returns = Overall Portfolio Return

(.04 X .90) + (.75 X .10) = .111, which if multiplied by 100% yields 11.1%

So we’re seeing similar outcomes here, despite some of the adjustments that have been made with performance returns over the years.

All that effort and energy spent on stock picking, trading and worrying was for nothing much, really, because in reality, this 10% aggressive portfolio is, on the flip side, really just a 90% cash portfolio.

What you see here are plays often done by ordinary individuals who believe they are “investing” in the stock market, when in fact they are committing the sins of:

- rampant trading

- portfolio under-diversification

- actively focusing on a small section of their portfolio

What I’ve learned is that many people make the mistake of compartmentalizing their returns according to the type of assets they hold. Actually, I’d been doing the same thing for quite some time and only after years of study, experience and losing money did I realize that I should really take a closer look at diversified asset allocation.

Don’t Be Deceived By A Passive Aggressive Portfolio

It is very easy to become hyper-focused on a single type of asset for its gains or losses, when in fact, we aren’t seeing the true big picture. When looking at our net worth and asset allocation, it is very important to take stock of all our positions, liabilities and assets before we formulate any thoughts about our financial status. The basis for any further financial decisions we make may hinge on how we evaluate our current financial health. All too often, I’ve seen people feel artificially over-confident about their situation (such that they formulate big spending and big budget plans, or proceed to make high risk bets) all because their confidence is boosted by a handful of well-performing stocks or the sudden found wealth generated in appreciating property values. But their account statements can tell an all too different story.

We could do much better if we shed the illusions we have over our money.

“There may be better investment strategies, but the number of strategies that are worse is infinite.” – John Bogle

Created December 17, 2007. Updated May 25, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 13 comments… read them below or add one }

Great post.

Here are a couple of extra points:

Especially before the New Year:

Ditch the losers – Lock in losses for this tax year. Sometimes hard to pull off the band-aide, but losses (especially when you make a few outsized gains)can help balance out tax liability.

Don’t forget fees/taxes – Many jump in to a “hot new fund’ only to find that their return do not match up and fees/taxes are high. Weigh all the options, but factor in your tax level and time to retirement.

I am one of the above investors you comment about in this post.

Here’s the cold, hard truth and facts.

It’s the end of the year and my 10% stock portfolio (which is invested in diversified mutual funds that have a 10+ year track record) are worth less than last year, despite my putting in more money.

My 90% sure-fire CD’s, money market etc, are still the same amounts PLUS the 5% interest they have earned.(I’m in a low tax bracket)

For me, it’s a no-brainer. The stock market sucks. Always did and always will.

@RacerX, ditching the losers to take on the capital gains loss is a good idea especially when you’ve been waiting a long time for these stocks to recover and they don’t… The common tendency is to want to break even on the stock but it may actually be a better strategy to unload the underperforming stock to claim the tax break.

@Boomie, the type of investor I refer to is one who has sought volatile, aggressive stocks to represent a small portion of their portfolio in order to chase those high returns. The irony of the situation is that the performance of such a small segment of their portfolio really does not have too much bearing on their overall portfolio — which I point out in this example.

I think that being mostly in cash is a strategy one should take if that is where you are most comfortable. Investing is a personal thing and your own risk profile and level of comfort in the market should dictate how much you have in the stock market.

What I am confused about is the strategy some of my friends have taken, which is to take great risks with small amounts of stock yet for the most part, have most of their money in cash. They claim that they would like to pursue and maximize their returns in the market but they do it in this fashion. My argument is that this approach won’t optimize their returns and they’d do much better with a balanced portfolio of some sort with greater representation in the stock market using more stable stocks and funds. They’ve told me that strategy was just “too boring” for them and they’d prefer to play with a small portion of their assets.

If the goal is to have some excitement with a handful of stocks, this is the way to go, but I am arguing that this is not going to optimize your portfolio returns.

Lastly, the past year (and potentially the years following) may not be so kind to stocks, but if you have representation in other areas such as bonds, international funds, precious metals and so forth, you may find that your returns improve.

Also, the stock market has sucked for specific periods but has done very well over the long term. It all depends on which time periods we’re looking at.

I like the point that there are so many worse ones. I know that I may not be the most perfect investor out there, but I’m planning to stick with Vanguard’s S&P index, a good bonds index, and perhaps a few other funds–foreign maybe?–and take the decent returns.

I also expect I’ll save a lot more than involved people who, even if they average 18%, probably churn the difference in fees anyway while they’re chasing that perfect number.

A couples of years ago, you could pick stocks like cherries and make a lot of money out of it. But 2007 was quite a hectic year and 2008 doesn’t seem to be much brighter.

I think I’ll stick will a few mutual funds and see how things go…

@Boomer:

Um, just because you invested in mutual funds doesn’t mean that the stock market sucks. It just means you don’t invest wisely.

The more I learn about investing the more I don’t want to put money into mutual funds. I do, however want to invest in the market. You can’t judge the whole market on one segment that has proven to suck. I can’t remember the numbers, but much of the 1900s you wouldn’t have had any return on your mutual funds (from Rule #1 by Phil Town.)

I love that post. Yes, index investing isn’t sexy, but the reality is over the long term, it’s the best way to invest. It’s a real winner.

when people talk about stocks versus funds, I get the feeling that people forget that funds are made up of stocks. i’m also getting this odd sense that people think that funds aren’t part of the market. since funds are made up of stocks and stocks make up the market, how can people disassociate funds from stocks from the market? doesn’t make sense to me.

yes, there are plenty of volatile stocks out there. if you want to play that game and have the risk tolerance to do so, then power to you. if you don’t want to, you can hold stock in companies with good fundamentals and keep them for the long run.

I agree with Tim. You can make up your own “mutual fund” by purchasing stocks with good financials. If you’d rather let someone else do the picking for you that’s fine, but it doesn’t mean that by picking your own you’re going to do worse than an index fund.

This is an interesting post. Unfortunately, the illusions that you refer to are ingrained in the minds of people who came into the markets in the giddy days of the dot com mania!

Just reading the comments above suggests that many people still just do not get it. Studies after studies have demonstrated conclusively that the primary determinant of portfolio returns over a long investment horizon is asset allocation with little benefit ascribed to stock selection.

That is not to say that there is no room for short term trading or stock picking – just that it should represents a small potion of ones overall portfolio.

Besides, a key issue here is transaction costs and a major factor in favor of mutual funds is the very low expense ratios that they incur. One of the comments above advocating that people create their own index fund obviously fails to realize this crucial fact.

I will never understand why anyone puts their money in a Bank CD. There are so many other ways to make higher returns on their money.

All investments strategies usually come with a certain amount of risk. Some with more than necessary. I choose mutual funds in sectors that are doing well in the market place at any given time.

Doug T….The mutual fund guy

The risk is what causes the reward so there will always be risk but understanding the market and how to work within it minimizes the risks and maximizes rewards. If you are practiced at anything, the risks are massively reduced. Stocks, Forex and spread betting/trading is the same.

dave