Being quite a frugal person, I thought hard about what motivated me to be so careful with the money I earned. It turns out that it was because I was afraid: afraid that one day I wouldn’t have enough. Fear motivated me to watch how I was spending because in the back of my head I knew that it wouldn’t take much to bring someone’s financial roof down on their heads. Whether or not it was a rational thought depended on the kind of grip this need for control had on my life. But one good thing about this is that it is very unlikely for me to go bankrupt.

It just seems too easy to run out of money. It doesn’t really take much at all. It could just take one bad move, like in the case of this hapless Star Trek fan who ended up both divorced and bankrupt. Somehow these two events often go hand-in-hand, with unfortunate events building up into a snowball of bad mojo.

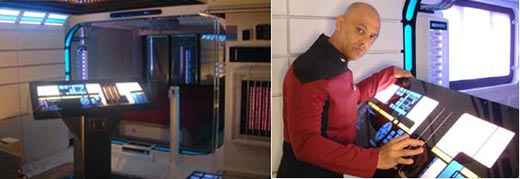

Tony Alleyne spent £100,000 he borrowed with 2 big loans and 14 credit cards to turn his flat into a Star Trek home. His idea was that other Star Trek fans would then pay him to do the same thing to their homes. Unfortunately, he went bankrupt doing this.

Tony, who split from his wife Georgina after he replaced their fridge with a “warp coil” said: “I was convinced Trekkies all over the world would want a house like mine and pay me to do it.

“But I was wrong and just overstretched. Building it in my apartment was the enjoyable and easy bit. But then I got hooked up with marketing and merchandise people here and in America and it all got out of hand.

“I’m still proud of what I created but it’s been a financial disaster.”

Something like this happened to a far flung acquaintance, although I don’t think he ended up completely bankrupt. But at one point his wife walked out on him with kid in tow, and he lost his house. Why? In the middle of the dot com boom, he inherited $800,000 from his grandmother. Then he proceeded to build his dream home as a reflection of his vanity — it was a “smart” home and fully customized to his every whim. Eventually, he ran out of money and couldn’t continue paying the builders who then walked out on him. He had no choice but to give up the house but that was after his wife had had enough.

So it goes to show, it really doesn’t take much to end up in skid row even if you’re loaded to begin with. Let’s review a bunch of really good reasons why we can run out of money. In my mind, there are only three — any conceivable, specific problem falls under one of these reasons.

Why Do People Go Bankrupt?

#1 Bad luck

Let’s face it, sometimes, no matter what you do, you can fall prey to bad karma. Stuff happens beyond our control and the saying “bad stuff comes in threes” was made up for a reason. You may have all the resources you thought you needed to build your financial buffers, but when unexpected disasters befall you one after another, those resources dwindle and vanish. The #1 reason for bankruptcy in America, responsible for more than half of bankruptcies filed nation-wide, happens to be ill or failing health. Medical and health problems cause a legion of other issues such as unemployment and large medical bills that can easily cripple your bank account. These are other events that can wipe you out even if you are reasonably well off: accidents, natural disasters, economic shifts, even crime. A loss of income brought about by any sudden event can do that damage. The question is, how formidable is your financial fortress so that despite the gravity of any situation, you’re still able to get back on your feet and recover. Don’t let that fortress be a house of cards.

#2 Lack of preparation

Depending on how well prepared you are with handling unexpected, unpredictable and undesirable situations that cost a lot of money, you’ll be able to determine if you sink or swim with the consequences of misfortune. How thick are those walls you built around your pocket book? This is where emergency funds, insurance policies and estate planning enter the picture. Part of a sound financial plan is to make sure the caulking is tight and you’ve got a strong defense to protect your assets and valuables. For instance, do you have enough savings to tide you over the next tax season? There are those who’ve gone bankrupt when the IRS decided to pound them with penalties along with their accumulated back taxes.

#3 Foolish financial mistakes or other decisions gone wrong

We can certainly blame the heavens or bad karma for our losses, but many causes for bankruptcy do stem from our own actions. The rest of the reasons I can think of, such as divorce, bad relationships, massive debt, overextension, gambling, self-destructive behavior, business and job losses are within our control to avoid or even just to mitigate. Being on any side of a financial crime will take you down as well, so don’t get into that suspicious sounding investment, join in that Ponzi scheme, nor even think of perpetrating something that sounds remotely too good to be true. As they say, there’s no such thing. Either way, you’re bound to lose big.

To put things into perspective, here are some interesting facts about bankruptcy, thanks to BankruptcyAction.com. I’m reprinting some of their data here.

Some Bankruptcy Statistics

According to Bankruptcy Action, historically, the average number of Chapter 7 bankruptcy filings has been about 100,000 a month. Last year, however, it appears that the numbers have plateaued to around 30,000 – 35,000 a month from March 2006 to September 2006.

And isn’t it telling that consumer bankruptcies have skyrocketed whereas corporate bankruptcies have stayed level or gone down?

And lastly, here’s a personal picture of bankruptcy in America.

Bankruptcy Profiles

- Average age: 38

- 44% of filers are couples

- 30% are women filing alone

- 26% are men filing alone

- Slightly better educated than the general population

- Two out of three have lost a job

- Half have experienced a serious health problem

- Fewer than 9% have not suffered a job loss, medical event or divorce

- Highest bankruptcy rates: Tennessee, Utah, Georgia, Alabama

Source: The Fragile Middle Class: Americans in Debt; Elizabeth Warren, Harvard Law School; Smith Business Solutions

The typical family filing for bankruptcy in 1997 owed more than one and a half times its annual income in short-term, high-interest debt. A family earning $24,000 had an average of $36,000 in credit card and similar debt.

Source: Federal Reserve (1997)

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 36 comments… read them below or add one }

That Star Trek story is unbelievable! I am a fan of star trek but to turn my home into the set of ST would be a little too much. 🙂

Calling “bad luck” one of three reasons people go bankrupt, is like saying death is the one reason for people ending their life… 🙂

What can be defined as bad luck typically has more basic, and diverse reasons behind it.

Actually, I thought “bad luck” was not as obvious a reason for going bankrupt. That’s because in my mind, I used to think one goes bankrupt because of something they did, when in fact in most cases, that’s not true. I was wrong in making the assumption that most bankruptcies were caused by one’s past fiscal irresponsibility.

But yes, good point you bring up! As you can see, I tried to shoehorn all the possible reasons into 3 categories. And yes, each category contains numerous other reasons that fall under it. Bad luck, to me, meant that things happened out of one’s control that truly tipped the scales.

So to make things simple, we can blame:

bad luck, bad preparation and bad choices.

But under bad luck, bad health is cited as the #1 cause of bankruptcy! I was a bit surprised by that because this was one time one could actually blame the heavens or fate for one’s dire straits. I can imagine that even the best preparation cannot prevent someone from becoming ruined financially if a truly HUGE disaster (or series of random disasters) strikes. Being big on control myself, that’s something a bit hard to realize and accept.

Loved your article on bankrupcy here in Ohio just last week our paper had so many forclosed homes that they had to make a book out of the forclosed homes . People who have worked hard all of their lives are lossing the homes they spent their whole life acquiring because of factor shut downs . Part of the move to Mexico program . The French brought the company I worked for they had us work 58 hours a week for about a year and continuiosly told us we were not fast enough . Then moved the plant to Mexico any way . They told us we would get help with medical care and schooling they gave us neither one . I tried to take off some of the cobra I paid off my income tax and they took 500 dollars off my income tax that I was suppose to get back then when I called them they said I had to be still unemployed but out of this one trasition area which I guess in the long run only happened for a month or to so I gave up .

I actually thought the idea was great. The problem is that I would never have a whole room or a whole house turned into star trek, that’s too much for me.

I wanted a few panels here or there on my wall. I emailed him regarding pricing and it is just not affordable.

He had a great idea but I believe he went about it the wrong way. I dont think there was enough planning that went into it before he spent the big bucks and got carried away.

One thing he should have done was hired a graphic artist to make a 3D dimensional model instead of actually building one.

A more telling look at causes of bankruptcy is found in Liz Warren’s study: 90% of bankruptcy is driven by job loss; illness; and/or divorce. Less than 10% is what we think of more traditionally as “bad judgment”.

In Silicon Valley, I find that the availability of credit masks the fact that many people cannot afford to live a middle class life here; a house in a good school district sucks a disproportionate sum from the family budget.

Remember too that Chapter 13 bankruptcies can be palliative: catch up on mortgage arrears; repay taxes without interest over time; gain time to sell rather than suffer foreclosure. So not all of the filing statistics represent liquidations.

Cathy Moran

Moran Law Group

Mt. View

My boyfriend filed for bankruptcy last weekend in a case that can be attributed to simply bad luck. Two years ago a woman’s vehicle slid into our car- both vehicles totalled, boyfriend was pinned in car and his right leg was shattered, ambulance, emergency room, surgery the whole deal. Hospital bills totalled over $50,000. We just had the standard regular mimimum state required insurance as did the woman who hit us… after lawyer’s fees he only gets $10,000 which would go directly towards hospital bills then he had to come up with the difference. We’re graduating from college this upcoming May and, paying the difference of at least $40,000 in medical bills plus student loans kicking in he would have been facing MAJOR payments. He was advised to file for bankruptcy and hopefully that will wipe away the medical bills which probably wouldn’t even be there had we decided to stay home that evening instead of going out to get ice cream.

and a soon to be 4th point. borrowing too much money out of their california homes, investing in more ‘investment’ homes at the peak of the market and watching everything go bad as the market tanks!

Most people go bankrupt because they do not know how to manager money. Business people go bankrupt because of poor financial decisions!

I am really surprised that no one mentioned another major factor in bankruptcy: children. Having kids can be a real financial drain- it takes nearly $250,000 to raise one to age 18, according to something I read once.

The Two Income Trap

Scary. Kids will bankrupt you.

Statistics clearly shows, that most people file bankruptcy because of some major problems such as serious health problems or job loss. That’s pretty amazing, because most people believe that bankruptcies are usually caused by immature financial management.

How about refusing to work a 9-5 and trying to make a living on the computer, while saving nothing and living from month to month… That’s a road to bankruptcy 🙂

I read an article about the guy who built that Star Trek house. He sold it for $838,563. Which is quite a return on investment.

it is actually a fact that when people are out of shape or their health is failing, they wouldn’t be able to perform their work or whatever their doing to such an extent that they’ll be successful about it…especially with all the stressors agitating them…if people continue on neglecting their health, then whatever you call ‘bad luck’ will soon actually befall you up to the point of several serious slashbacks on you in this case, bankruptcy…obviously, health or our even ability to cope up with our environment is a big factor in our lives be it in relation to our financial situation or not…just take care of our health and everything else will follow…afterall, it all starts and depends on how we tackle things…taking care of our bodies includes regular healthy exercises, especially aerobic ones, healthy food and balanced diet, and of course, our environment we are exposed to plays a big role in staying away from diseases.

Great story on the Star Trek house and good work on the charts! Very interesting reading. Isn’t it amazing what kind of ideas people get for making money? It’s both amusing and inspiring at the same time. I like the research you put into the article. Keep it up!

Can stupidity be one too? I have seen a lot of people who send their money unwisely and go bankrupt because they just don’t care.

Interesting story about bankruptcy; I have to say that I am amazed at how people end up declaring bankruptcy. Having been through this myself a year ago because of some bad business decisions; I understand how it feels to have to start all over.

It is not the easiest thing to do; however I fully intend to make my business work this time around!

Great article it got my attention!!

Clearly it’s individuals who file in for bankrupcy more than businesses do. Now that’s scary…

Bankruptcy is a very sad situation to find yourself in.

But most of the time, the people who end up in it are to blame in the first place.

Poor Trekky Fellow.

This sucks! Can that guy build me a Star Wars house, or am I too late?

The real 3 main reasons that individuals have to file for bankruptcy are these:

1. loss of job

2. divorce

3. personal or family illness

It is not always because of poor money management. That is a misconception. As for your chart of bankruptcy filings between 1980 and 2005, that is skewed. This is due to the fact that the bankruptcy laws were changed in October of 2005. There was a mad rush for people to file before the laws changed because it was going to be so much harder to file under the new laws. That pushed people who might have filed 6 months to 1 year later to file before October 2005. There was historically low number of filings in 2006. It began to creep back up in 2007. Now that the economy is in crisis and people are losing jobs (reason #1) filings are almost up to the level they were prior to October of 2005.

Regarding your bankruptcy profiles, you forgot to mention that a large number of people filing bankruptcies are over 65 due to the fact that they cannot live on their retirement or social security. Add to that the fact that during the housing boom, many of them had to pay ridiculous amounts of taxes for homes they had lived in most of their adult lives.

Being divorced and bankrupt…what else could go wrong??

I have to agree that the majority of bankruptcies we see at our firm are divorce-related. It’s a shame, too, because it doesn’t have to be the case. But there is hope! More people find that they qualify for Chapter 7 personal bankruptcy than you’d expect. Thanks for this very informative article.

What is really sad about all the bankruptcies that happen in the US as a result of health issues is that more than half of those who reach that state started with health insurance, but simply didn’t have enough coverage and were tossed out once they cost their insurance company too much money.

The claim that half of all bankruptcies are because of ill or failing health is not true. Read the explanation–and debunking–here.

I don’t feel gambling has anything to do with bankruptcy or as you put it luck.

I would have to agree that the 3 main reasons for bankruptcy are as earlier stated,

1.Loss of Employment,

2. Divorce and

3. Personal or family illness.

Find the “Money Mechanics” video on the net and learn the truth about how the American money system works and the fraud that all of you are going through!!! Your money does not exist and its fraud and money laundry/forgery!!! For those in Canada the “Oh! Canada Movie” is very similar as both systems are debt based and they on go in a downward direction. If one watches the movies and does the research you’ll find all the information on the net for yourselves and court cases and court files of people who are filing class action suits or have won/lost and how to sue the banks/ gov’t/ IRS for fraud!Even the IRS has no law saying you have to pay but they insist though! They have broken laws and violated the constitution. In Canada for example you do not require a license to practice law or even joining the bar association which is a “club”. The primary requirement is passing the university courses which qualify you not going the club!!! If they don’t join then there persecuted for it. Under ultra vires, contract laws and promissory notes and failure to disclose the method of money supplied it’s void contract “people” and you can withhold payment during the dispute!!! If you hire a real lawyer they will defend you and show you how to do it cheaply to represent/educated yourself or get aid and how to fill out the right forms. Even advise you without putting there career in jeopardy!! For fear of the “bar association”!!!! If your going broke what do you have to lose! Sign your name on petition’s and through numbers we can put it back the way our forefathers had it because they new this would happen!!! Under the law if you claim bankruptcy you and “idiot”/mentally incapable and like slaves its a seven year’s before your FREE………..You don’t have to be a lawyer to win just well versed in the law!!

(LAWYERS/JUDGES)THE STUPIDITY IS THAT UNLESS YOU’RE THE ‘ELITE’ ALL YOU SAVINGS AND MONEY WILL DISAPPEAR WITH THE BANKS GOING BROKE!! SO UNLESS YOU’RE A BILLIONAIRE OR HIGHER YOU CAN SERVE THEM BUT IN THE END YOU’LL GO BROKE AS WELL BECAUSE YOU’RE NOT HIGH ENOUGH ON THE FOOD CHAIN!!! THINK ABOUT IT!!! “SLAVES IN THE TOMB WHEN ITS SEALED OFF!!!” DUH!

-the 1930’s are an example of this……………… you may want gold or silver coins/jewels in a can in the back yard!!!!

Don’t believe me then do the research yourself and see!!!!!!!!!!!!!!!!!!!!

It’s amazing how disparate personal and commercial bankruptcy is up until 2005. I think that the previous laws were open to abuse, hence the need to put higher hurdles.

Please remove “bad luck” from the bankruptcy reasons. I honestly thought that was a joke when I began reading. Bad luck is merely the catalyst that exposes your #2 reason (which is the real reason people go bankrupt).

Yes, it is “bad luck” when you fall down the stairs and you’re left unable to work. And yes, it’s “bad luck” when your car is totaled by a drunk driver. But being prepared (i.e. sufficient disability, health, and auto insurance), as you cite in reason #2, would have prevented financial hardship in both cases.

Simply put, “bad luck” is the excuse employed by those that don’t want to admit they spent too much on shoes and too little on insurance. Look at poster #7 (above). Does anybody here, other than her, consider “bad luck” to be the cause, or is it really because her boyfriend was underinsured in at least two areas (auto & health)? Allowing people to cite “bad luck” as a reason only gives them a way out that doesn’t require taking responsibility.

My reason for wanting to go bankrupt is the very reason people either do not talk about about or do not want to admit. Foolish borrowing of high interest loans. Then spending the money on needless things. Now I have payments that I really cannot afford to make. Is this a sickness or just stupidity? I want to think it is a sickness. I don’t realize what kind of situation I get into until I’m actually there. And of course then, it’s too late!

Hey, good blog post. I am a Phoenix bankruptcy attorney and spend a pretty good amount of time blogging. Anyways, I am always impressed when I see a post about bankruptcy that actually has numbers…references! In my experience, you are spot on. Yes, things like divorce and illness (as pointed out by commenter Chris) are can lead to bankruptcy, but you three categories do a good job of encompassing all of those more specific causes into broader categories. Nice work.

I just wanted to relate my experience in the field. I’ve been a bankruptcy attorney in the Morris County Area (NJ) for more than 20 years. I would say about 90 of our cases are a result of either lack of preparation, and/or poor decision making. The average age is also right on cue, with an avg of 35 here at the office. Best cure for debt and getting out of it is to seek free advice before it’s too late.

People go bankrupt because they don’t know how to manage their money properly and wisely. If a person doesn’t have the necessary education and skills in financial management, he or she should hire the services of a financial advisor.

I noticed this blog has a graph from 2005. It would be interesting to see an updated graph for 2012.

As a former fraud investigator I can attest to the number of people who claim fraud but in fact are just living over there means. Also Cathy Moran hit on a very good point that not all bankruptcies are equal. Chapter 11 is the quick fix but if your really want to get your finances back on track then Chapter 13 Bankruptcy is the way to go plus it does not stick around as long as other bankruptcies on your credit report.