People get involved in the stock market with the best of intentions: they do it to make their money start working harder for them. When I first started dabbling in equities right out of school, I really didn’t know much. I remember how at my first job, I received some brochures about my first 401K and an ESPP plan, but I had no idea what I was doing.

Over time, I’ve educated myself about the stock market by studying investment videos, using stock analysis tools and subscribing to stock market educational services such as Morningstar and INO Market Club. These materials along with more conventional investment resources such as books, periodicals and newsletters have helped me to gain a solid understanding of my investments and the markets.

Over the years, I’ve finally learned about a couple of different ways to make money through the markets. Here is a review of those methods. From the Wikipedia:

Technical Analysis

This manner of playing the market assumes that non-random price patterns and trends exist in markets, and that these patterns can be identified and exploited. While many different methods and tools are used, the study of charts of past price and trading action is primary. It maintains that all information is reflected already in the stock price, so fundamental analysis is a waste of time. Trends “are your friend” and sentiment changes predate and predict trend changes. Investors’ emotional responses to price movements lead to recognizable price chart patterns. Technical analysis does not care what the “value” of a stock is. Their price predictions are only extrapolations from historical price patterns.

Fundamental Analysis

This type of analysis of a business involves analyzing its financial statements and health, its management and competitive advantages, and its competitors and markets. The analysis is performed on historical and present data, but with the goal to make financial projections. There are several possible objectives:

- to calculate a company’s credit risk,

- to make projection on its business performance,

- to evaluate its management and make internal business decisions,

- to make the company’s stock valuation and predict its probable price evolution.

Prediction of how the stock will move, normally for the longer term, is based on the company’s fundamentals and valuation.

For fun, I thought to share my impressions of these different financial schools of thought. You can certainly make money using techniques rooted in any one or even both of these paradigms, but take note that patience, experience and in some cases, skill, play a large part in your success when participating in the markets.

So I’ve made some comparisons of these strategies that people employ when playing the stock market. On the left hand column are images that to me, appear to closely reflect technical analysis; while the right hand column invokes images that reference fundamental analysis. Of course, these are just my casual notions about these two divergent investing methodologies. These differences aren’t meant to be mutually exclusive nor comprehensive. But feel free to pick them apart.

Technical Analysis |

Fundamental Analysis |

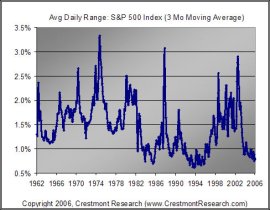

Stock Market Volatility is your friend |

Versus |

The Power of Compounding is your friend |

Day Trading |

Versus |

Longer term investing with mutual fund managers like Peter Lynch or John Bogle |

Make money out of movement from the market, with each movement often measured in pennies |

Versus |

Make money out of your stake in companies and how their products or services sell |

How investors see traders |

Versus |

How traders see investors |

This may yield a get rich quickly scheme, when you work on your own terms, using rapid reflexes and lightning fingers, but when you can go broke just as quickly if you don’t know what you’re doing. Market timing rules your methods.

|

Versus |

This is the path taken to grow rich more slowly, relatively speaking, but depending on how your portfolio is set up, it can actually be quicker than you think. It often involves buy and hold and longer term investing strategies.

|

I hope you enjoyed our little lesson on the various ways to analyze the market. What’s important is that you know yourself well enough to figure out what you’re comfortable with. I don’t believe that there are any wrong investment approaches in the absolute sense, just dangerous ones. A strategy becomes dangerous if you decide to apply it without sufficient planning, knowledge or study, causing you to make reckless moves or generate heavy losses. So the key is to go with what works for you, realizing your limitations while capitalizing on your strengths.

As for us, we’ve always been fundamental investors and after hearing the stories of our day trader friends, we’re convinced we’re doing the right thing for ourselves.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 19 comments… read them below or add one }

Peter Lynch had the best advice. Invest in what you know. Peter followed his own children to the mall one day and saw that they, and all their friends liked this new neat store. It was the Gap. Peter invested and made a fortune. Don’t rely on what others say or write. You have to invest in what you know, see and feel.

True! I agree. Knowing what you invest in is the first step, though it doesn’t stop there. I tried “knowing” my single stock investments prior to making purchases, but it STILL did not make me a good stock picker, unfortunately. I lost money on investments I thought I knew well…. Timing is a factor here since you’ll do well by buying an undiscovered stock of a company on the rise; but an overvalued stock in an industry that is still producing great products and services may not pad your pockets in the way you expect.

Having lost a fortune on tech stocks during the bubble, I’ve now come to follow the value approach when investing my money.

Its interesting to see how the web tries to help people succeed more in their stock investments. Socialpicks.com tries to find good trades by combining people portfolio’s, Gstock.com’s virtual supercomputer calculates billions of algorithms to find better investment strategies and Digstock.com has a digg like community news site. Add social analysis and power computing analysis to technical and fundamental analysis 🙂

@drh

and let us not forget fool.com and stockalicious.com

The information that everyone else already has is already built into stock prices. So even if it’s correct, you can’t profit from it. That, in a nutshell, is the efficient market hypothesis and it’s maddeningly correct.

You have really explained in details the difference between the technical analysis and fundamental analysis for doing stock trading. Also you have effectively pictured the trader’s and investor’s images, it gives a impression for a newbies before entering in the stock market that he wants to become a trader or wants to become a investor.

Doing a discounted cash flow valuation isn’t much more sound than any other method from my perspective. You still have to speculate on what the growth rate of the company will be. 1 or 2 percent makes all the difference.

I think the difference here is not what its heading suggests… It is not technical analysis vs fundamental analysis. In fact, it is Intraday traders vs mid-long term traders.

@Mukesh Udasi

Nice way to look at it, actually. You are right! Nobody ever holds forever, after all. I guess you can consider me a long term trader 😉 . Probably a very long term trader….

It would be a mistake to confuse technical analysis with day trading. Technical analysis is a science in itself which can help pick short as well as long term picks.

Interesting post! The guy who said, “It would be a mistake to confuse technical analysis with day trading.” has no idea what he’s talking about. That’s how you get the best whole sale entries, he probably doesn’t trade anymore with that logic.

How about combining fundamental analysis with technical analysis?

A simple way to do this is to pick up a copy of Investors Business Daily and scan the stock tables for those companies that have an EPS rating greater than 90.

This means that those companies are performing better than 90% of all the companies on the market.

Then you apply technical trading patterns to those companies. This will tend to keep you out of trouble.

IMHO technical analysis is enough to trade succesfully….foundamentals are for a long view, and not so usefull for daytrade!!!

Hi,

This is a great article on technical analysis vs fundamental analysis. Being a forex trader for years, it has not been too easy due to market conditions, but technical analysis and price action is a must to master in forex trading.

Regards,

Dan

I think technical analysis, if done effectively, is simply another form of long term investing. For those who are day traders, isn’t it your goal to make a consistent income over time? This is the same goal that buy and holders have. Simply a difference of approach. Obviously, using technical analysis to make many trades in one day is a a more active role, but doing technical analysis will also yield information on long term trends. I think both types of analysis are necessary, but I also think you did put it in perspective very well. A clear cut picture of two schools of thought. Well done.

For all who are interested in picking low valued stocks it is worth to read Benjamin Graham: Hearing to a U.S. Senate Committee for a Stock Market Study (1955). It’s one of the best and shortest introductions in value investing.

Also worth reading is Bruce Greenwald’s ‘Value Investing: From Graham to Buffett and Beyond’.

Excellent fundamental stock screeners on internet are rare and only offering real value if fundamental history and company valuation techniques are incorporated. A site offering this is ValueExplorer.com.

Debate, debate, debate. There’s nothing like shadowing a successful day trader to learn what works.

I loved the way you explained things. I’m working as an Internee at some brokerage house. I know the concept, but the pictures depicted to elaborate upon the topic are awesome!

Cheers 🙂