I just caught wind of a new Problogger.net writing project and decided to participate. It’s been a while since I’ve joined such a fun event so I’m glad for the chance to meet new bloggers in this process.

Coincidentally, this post was spawned because I got tagged by Super Saver from My Wealth Builder to reveal my top obsessions. I find that word “obsessions” kind of a bit extreme and I’d prefer to say that what I’m suffering from are simply just opportunities of focused interest.

I’d like to try to give the impression of having a “well-rounded persona” so I’m exposing a wide variety of interests here and not stick to any one specific subject. If you’re going to be obsessed, why not practice equal opportunity and maintain some balance? So well beyond the usual suspects of family and kids, I’ll give it a shot with these, which I will tie, in some form, to my finances:

#1 Reality TV

I’m not ashamed to admit that I spend some of my spare time Tivo-ing and watching reality television shows. I am a pop culture fanatic but I especially enjoy television shows where anonymous people vie for huge gobs of money while going through the ringer for it. I mean, it’s amazing what people will do on national tv for competition or money or fame and publicity. I love the process and some of the compelling characters that come out of these shows, so much so that I even started a whole blog on this very subject. Except now, the blog is dead as I have run out of time to maintain it (but never say never)! With this admission, I’m sure I just flunked some bloggers’ “what-not-to-do-if-you-want-to-improve-your-life” benchmarks. Hey, it’s my only vice, if you could call it that!

Wallet Factor: Positive, as it is a relatively inexpensive form of entertainment and form of distraction that keeps me from doing other things that could damage my budget! (I do realize that some will see this as a negative due to to the effects of television advertising and such: but thanks to Tivo, we don’t notice commercials nor product placements.)

#2 My Garden

I don’t have a view nor a pool in my home, unless you call it a garden view. The one neat amenity I can be proud of though, is this lovely garden that I have carved out a budget for in order to retain in a pristine condition. It’s my solace, a place I find quite therapeutic to walk around in as well as to view from within my home. But yeah cheesiness aside, it’s the one luxury I will always cherish. [The photo was taken from my yard.]

Wallet Factor: Not so good. This is the only interest in this list that actually has a financial cost. But the value to me is well worth the cost.

#3 Home Design Catalogs

On the same vein, I have this thing for those “House and Home” magazines and catalogs, as represented by the above random catalog picture. It must be something to do with the nesting instinct I’ve been developing at my age and stage in life. I’m glad I got into blogging so that I could change focus and curb the spending on those “nesting requirements”.

Wallet Factor: Neutral. It could be a negative thing if I get tempted into buying up what catalogs have to offer. But it’s a good thing if the merchandise adds to a home’s “curb appeal“.

#4 The Web

Embarking on the internet will cost you the price of the needed equipment and DSL connection fees but the entertainment and education you receive online is endless. Just like TV, you need to use it responsibly — a matter that’s found a place in many family debates everywhere (including my own).

Wallet Factor: Positive. Again, this is another form of time spent that has been a plus for my pocket. I’ve made a little money through blogging and have become quite financially efficient by using online services!

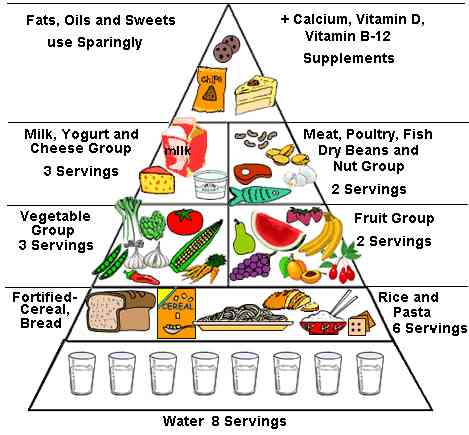

#5 Everyone’s Health

I’m a bit of a hypochondriac to begin with, but at my age, I’m focusing harder on how to keep fit, healthy and stress free. Prevention (of anything bad) is always MUCH cheaper than dealing with the consequences of an ongoing problem. So germs aside, I’m spending quite a bit on preventive tactics on the health front (such as a nutritional program and supplementation) to stave off potential conditions that can arise. And before you say it could be overkill, I’ll just say that we all have our genetic and lifestyle predispositions. As for the big picture, I’ve been known to worry over scenarios surrounding the next big pandemic.

Wallet Factor: Positive. By having more awareness of health issues, I feel that I am being proactive about avoiding medical problems later although I am paying some kind of premium for prevention.

Eclectic honorable mentions (other stuff I like) as well as strong interests of years past include:

Learning to speak Chinese, Hong Kong, horses, academics, my spouse’s previous start up, weird and wacky stuff, horror fiction, true crime, tasteful macabre, choice message forums, dragonflies.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 1 comment… read it below or add one }

Prevention (of anything bad) is always MUCH cheaper than dealing with the consequences of an ongoing problem.