Here are our basic wealth building strategies.

Time for another snap quiz! Can you answer these questions off the top of your head?

- How much is in your investment and high interest savings accounts?

- What’s your mortgage loan balance?

- Know how much you owe on your credit cards?

- What’s your salary?

- If you own a house, how much home equity have you built? If not, how much have you saved towards a home down payment?

- And lastly, what are you doing to “get rich” (slowly or otherwise)?

Well okay, some of these questions are probably easy to answer, but if you can respond to all of these with relative ease and without having to dig them out from under piles of paper, then you must either be:

(1) a Quicken Head

(2) a bit of a control freak

(3) on top of your personal finance game

(4) a money blogger

(5) most of the above

Most of the figures you come up with are but components of that bigger number also known as Net Worth, which is calculated via the ubiquitous Assets minus Liabilities formula. Net Worth, as a subject, has been all the rage among the financial blogging community, just take a look at all the analysis, debates, challenges and revelations that are done in the name of this all encompassing number.

Even if it’s a simple, basic calculation with some limitations, it has its merits; in particular it does well as a useful starting point for determining overall financial health. And the goal of everyone I know is try to get that Net Worth number to go as high as it possibly can. Now what I find interesting is the question of what comprises net worth — since this reality varies for everyone. Maybe by taking a look at what you attribute to your net worth: your wealth if it’s a positive number, or your debt if it’s a negative number, you may get to see where you can make some tweaks and improvements in order to make that net worth number move higher.

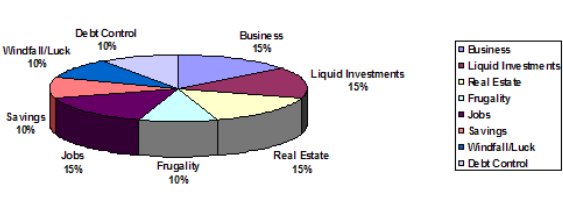

For that big picture, I look at our net worth number in this more general, even simplistic manner to see how we stand today. To what do we owe our net worth? What do I see as responsible for building our assets or adding to our liabilities? Is there any one thing that I can thank…or perhaps even blame for the progress we’ve had so far in our wealth accumulation endeavors? What I like about this picture is that it shows me right away what things we’ve done to build our net worth, and whether we’re addressing all available opportunities to improve our financial state. It makes me appreciate the stuff that’s gotten us to where we are now.

Our Basic Wealth Building Strategies

| Source Of Net Worth | % Of Net Worth Attribution |

|---|---|

| Debt Control | 10% |

| Business or Entrepreneurial Endeavors (Start ups and Home Based) | 15% |

| Liquid Investments | 15% |

| Real Estate (Primary Residence and Investments) | 15% |

| Frugality | 10% |

| Jobs | 15% |

| Savings | 10% |

| Windfall | 10% |

Please note that there is no scientific basis for this diagram; it’s merely an invention I came up with. As you can see, our wheel looks fairly well represented. This is a quick look at our wealth building strategies and how I would measure the contribution of each to our overall net worth. Our approach is to grow our assets through various means. We’ve been doing “a little bit of this, a little bit of that” to try to keep us on track financially.

But following suit, how would your wheel look like? Note also, that there may not be any correlation between how “wealthy” one is and how “diversified” their wheel happens to be, because it is often the case that many people have become successful based on just one or two financial strategies they’ve implemented. For example, there are those who have made it big due to significant returns from real estate, while others have scored from purely business related ventures. All this does is give you a different look at what’s responsible for your finances, and whether there’s anything additional you can do to grow your assets. So if there’s any other potential wealth building component that I’ve overlooked, let me know. We’d be glad to hear about what’s been responsible for your success.

What I like about this view is that it helps me acknowledge the work we’ve done so far. In a way, it gives us some assurance that we’re doing quite a bit to reach our financial goals.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 18 comments… read them below or add one }

Well, I can answer all six of the questions if you allow a margin for error in my salary (which fluctuates from month to month) and that the value of some investments involves and element of judgement (e.g. the value of real estate).

I guesss this means that I am:

(3) on top of my personal finance game

(4) a money blogger

(6) married

I have not done a break down like your wheel but know that my job is the biggest contributor to my finances.

The great thing about a well balanced wheel is that you are diversified.

I earn minimum wage. I have $300 in the bank and no investment accounts. I have a ton of student loan debt and some credit card debt from a failed business startup. I’ll probably never be able to buy a house so I’ll probably end up homeless when rents outpace my income (local rents are projected to rise 8.5 percent this year and an additional 6 percent next year). Retirement will never be an option and I’ll end up destitute when I am no longer able to work.

traineeinvestor,

Nice to meet a fellow finance blogger! It seems like most people do have their jobs as their biggest source of income, no surprise there. I’d say our jobs have contributed quite a lot to our net worth, though I would say that their importance to our overall worth is %15. I guess that’s what I meant by giving them a “%15 score”.

@Minimum Wage,

I hope you have met with debt counselors and maybe looked into debt consolidation programs. I can see how this situation can happen to people, especially if ill health, bad luck or even just age creeps up on them. It’s hard to get back on your feet when many things are weighing you down. But you’ll need to make that income somehow. There is no other way to dig oneself out of debt and financial difficulty other than to earn. The income is key. Out of curiosity, how many hours a day do you work and do you have multiple jobs?

Minimum Wage sounds like a troll to me.

I could answer the questions, and gladly confess to being a Quicken Head.

I find it interesting that you break down things like debt control, savings, and job in the same list. I tend to separate expenses/liabilities (e.g., debt, frugality) and income/assets (e.g., job, investment gains), and things like savings and debt control is where the two meet–it’s easier for me to think about things that way.

Factors I might say are missing in your list are the (not so) indirect ones:

– Getting (and staying) married

– Kids

– Education

Another category I might throw in there is managing risk. By that I mean both taking measured risks, and not taking on too much risk. I think a lot of people don’t think enough about risk, don’t understand how it affects their finances, and as a consequence suffer greatly from either not taking enough risk, or taking on too much.

Otherwise, our “wheel” would look a lot like yours–each of your categories has contributed to our net worth. On the income side, jobs would be the biggest contributor by far. On the expense side it’s more evenly split, but I’d say frugality (which I would probably combine with debt control) is probably the winner since without that, savings and investment would be nonexistent.

Mike,

Heh, I noticed quite a bit of exaggeration on MW’s part, but I give him the benefit of the doubt.

Thanks for your thoughts on your own strategies. I agree that risk management falls by the wayside for many. A lot of co-workers I’ve had in the last decade have frittered away their savings due to crazy stock market habits. To this day, they still do it. Too many people mistake investing for trading.

I also believe that frugality becomes less prominent when other wealth building strategies become successful. I guess the point of this post was to show how there are “many ways to skin a cat” when it comes to building wealth.

Mostly jobs and frugality for me, with an emergency fund 5% savings account and some liquid investments.

But a big student loan pulls me down to a net of just about exactly zero. Luckily it’s a very low interest rate and interest is tax deductible.

Great article. Your blog is one of my favorite reads!

SVB,

Currenlty, I would assign 100% of my Net Worth to my job. Without income from my job, there would be no source of money to save, invest or buy real estate. While savings,investments and real estate have grown independently from my job, the original money came from my job.

In the future, it will likely switch to 100% from investment. Perhaps some will even come from a start up business 😉

Our financial strategy has been like this, which has worked out well so far:

when we were younger (before kids ;)) our jobs and saving habits helped us build a certain amount of net worth from which we were able to purchase a house. The house value appreciated well in California, thereby allowing us to “buy up” once we had kids. In conjunction to jobs and savings, my spouse had worked in a startup in the 1990’s which yielded some modest (not huge though) rewards, enabling us to branch out and take more risk in other business ventures today. So we’re at the point where we’re even more ready to take the leap into other opportunities. None of us at this point are fond of corporate jobs since we’d like to spend more time with our family or at least have more flexibility to do so. It’s a bit nerve-wracking as the nicely built liquid cushion we have is gradually being spent towards an entrepreneurial effort today that we’re still crossing our fingers over. If it pans out, it could change our lives literally. We’ll see….. 😉 We’re hoping our net worth wheel is diversified enough to help us control the risks inherent in this venture.

I have one 40-hour job. I also have about 15-20 hours of (daytime, weekday) medical time, which gets in the way of a 9-5 job. (Obviously my job is not M-F 9-5.) I don’t have a car so I’m limited to whatever jobs I can get to by public transit or walking – a second job would be difficult considering the medical and transportation constraints.

I’m looking for some sort of business I can do (e.g. online) at home on my own time. If I can set my own hours and don’t have to travel, it is definitely doable.

My credit went into the tank several years ago with an extended illness during which I was unable to work for a year. All my active open accounts were closed and charged off with tons of fees added. My aggregate debt is twice my annual income and even BK won’t help much because a lot of it is in nondischargeable student loan debt. I can pay the rent on time and keep food on the table but I’m not making a big dent in the debt. I have two credit issues which won’t drop off my report unless resolved but I can’t resolve them on my income, so my credit remains in the tank and I don’t think I can consolidate.

Great post. I believe I am on top of my personal finances and I am (4)a money blogger and (1)a Semi-Quickenhead (I’ve created my own budgeting templates with excel).

This is my first time reading your blog. I enjoy it.

1. $121 is in my bank account

2. I can’t get a mortgage

3. $6220

4. minimum wage

5. No hope of owning a house

6. Not a darn thing

Great break down. I’ll have to link to your blog and this post. I think have a mentality that you can get ahead and do better is the key to it all.

Great idea, that wealth-building wheel! It would be interesting to think through the details some more, to see if you can massage it into a more accurate representation. That 10 percent windfall/luck chunk looks pretty impressive…where are you getting all the winning lottery tickets?

In my case, wealth-building comes partly from the day job, where 7% goes into a 403(b) and is matched by my soon-to-be-former employer and partly from side jobs, plus a set monthly amount from my paycheck that’s automatically deposited into savings. Almost all my after-tax side-job income goes straight to savings. Sometimes I have to spend part of it on an emergency or large house-related project that has to be done.

I have to respond to Minimum Wage’s comments. From reading your comments its seems like you have an absolute feeling of helplessness. This may seem cliche’, but it’s always darkest before the dawn. I know how you feel. Despite my degree in finance and working in banking for years I had a massed debt over $60,000, which the majority of was credit card debt. I was left paying all of this after a divorce and made $40,000 a year at the time. Although, it took me a few years I paid off every penny and eventually established a credit score over 800. It may be hard to hear, but maintaining a positive and a “I can do it” attitude goes a long way. I know if I can get out from a financial fiasco anybody can. Keep working on it and one day you will pay it all off and one day own a home if you really want to.

I have not done a break down like your wheel but know that my job is the biggest contributor to my finances.

I am hoping to begin blogging for money soon. This is upon many others’ recommendations that I write a BOOK! Not ready for prime-time yet so thought I would start small and work up. I am married, almost 22 years to a very successful man who has not so recently abandoned me and thrown me to the financial wolves.

Besides a bleeding ulcer, I stupidly allowed this to happen through ignorance. No longer. At the brink of my early 50’s I have worked and been successful; but, for the last 22 years I have been only working here and there as a stay at home mother. My personal credit sucks. I want to clear it up and make my own money again regardless of my marital status. I am clearly not qualified to be an economic blogger!

My question is this? Is it possible to clear up my credit even though it is somewhat intertwined with his, which is not perfect? Also, because he allowed me to sink without telling me, would this be an acceptable reason to a credit card company? I could pay bit by bit to anyone I owe. I am on a fixed allowance. Slave trading you might say is going on here. I am the slave and trade work for a pittance. I am going to counseling. Thought you may ask that question. I would.

I have looked for suitable employment as of late to no avail. I am working on a children’s book along with a million other writers in the state.

What would you do if you were dumb enough to let yourself get into this boat? And, before the boat becomes a floating piece of timber and I am simply shark bait…what can I do without affecting our joint economic status? Thanks!