It’s no surprise that subprime loans are causing a lot of foreclosures. However, I’m perplexed by our current property market situation in California. Given the huge rise in foreclosures, you’d think the contagion would spread and everything would be in the dumps. Yet it appears that despite the subprime mortgage mess, I’m finding that homes around here are still barely affordable. More specficially, we’re seeing something more contradictory here to what is going on in the rest of the nation: it looks like the slump is affecting cheaper, smaller homes while luxury homes are selling well and even perhaps breaking sales records.

Modest year-over-year gains in the second quarter of 2007 increased luxury home values to highs in Los Angeles, San Diego and San Francisco, according to the First Republic Prestige Home Index(TM) by First Republic Bank, a leading provider of private banking, private business banking and wealth management services.

In the second quarter ended June 30, 2007, the Index indicated the following:

- Los Angeles values rose 1.1% from the first quarter of 2007 and 4.5% from the second quarter of 2006. The average luxury home in Los Angeles is now a record $2.46 million.

- San Diego values increased 1% from the first quarter of 2007 and 2.4% from the second quarter of 2006. The average luxury home in San Diego is now a record $2.19 million.

- San Francisco Bay Area values increased 2.8% from the first quarter of 2007 and 2.3% from the second quarter of 2006. The average luxury home in San Francisco exceeded $3 million for the first time.

The property market has developed a split personality. On the one hand, we have Zillow.com announcing that the larger, higher end homes aren’t selling as well as the smaller homes.

And here’s more evidence: according to Zillow.com, this was the performance of housing prices across the nation within the last year:

| Home Size / Type | Square Footage | Drop In Value |

|---|---|---|

| Small House | < 1,200 Square Feet | 1% |

| Mid-Sized House | 1,200 to 1,900 Square Feet | 3.1% |

| Large House | > 1,900 Square Feet | 2.8% |

| Condominium Unit | N/A | 5.2% |

These statistics show us how the national property market is faring: “small” homes (less than 1,200 square feet) showed the smallest declines in home value. But in California and in other high-valued property markets, the market seems to be split in a different way.

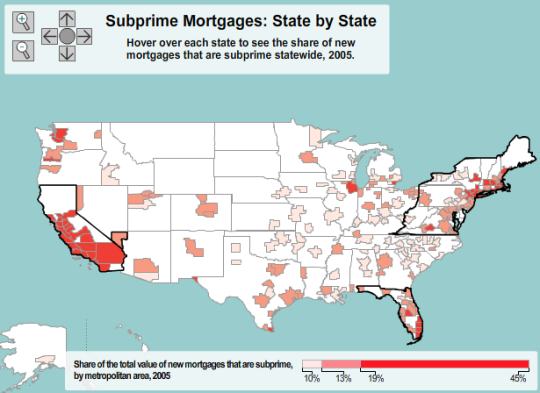

Let’s first check out this state-by-state map of the subprime mortgage crisis that I encountered after reading a post over at All Financial Matters (and found on CNN Money), where it appears that California is heavily mired in subprime loans.

Some quick regional facts from this interactive tool: the stats are from 2005. The tool (but not this image) shows that the share of new supbrime loans in 2005 throughout California (25%) is not as widespread as in Texas (29%), Mississippi (33%) or Florida (30%). But the share of the TOTAL VALUE of suprime loans per state is seen via the colors on the map: just check out that sea of orange on California.

I thought it strange that this wasn’t my observation seven years ago while shopping for homes then. The Bay Area property market was entirely affected with larger homes receiving the biggest price haircuts after the tragedy of 9/11. So is it different this time?

I have asked a relative who works in the financial sector about this and his response was that a catastrophic event, as in the case of 9/11, normally affects all markets simultaneously since it forces everyone to be more conservative about their money. With the subprime situation, we’re talking about a more isolated case, with problems in particular sectors and asset classes such as property, mortgage and hedge funds all stemming from tighter credit. In this case, those at the lowest rung of the risk pyramid have suffered the most and born the brunt of the crisis. Where subprime does not exist, life goes on as normal hence giving the impression of a segmented market.

Still, I keep hearing that it’s just all a matter of time though and that eventually, the property market bust will affect housing prices everywhere. But when talking about California (or places like Manhattan) and its crazy property prices, I simply wonder how long I’ll be holding my breath wondering if we’ll ever get an “equal opportunity market”.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 16 comments… read them below or add one }

Wow, I didn’t realize Chicago had such a high percentage of subprime loans. Like your market in California, I haven’t seen any effect on the luxury or even the McMansions (my definition being homes $500,000-$1,000,000 or so).

The inventory of homes for sale is certainly larger, but it doesn’t seem THAT much worse. Maybe it will take some time before the true effects of the subprime fallout will be seen.

I’m in Albuquerque, and things seem pretty strong here to. There is the sense that things are slowing, but there haven’t been price drops. There are some new cookie-cutter type housing developments that do have a lot of for sale signs, so maybe those new houses are dropping in price, but older houses near downtown or the university are keeping value just fine.

Manhattan, NYC and the metropolitan NYC area where I live continues to thunder forward. I think that the coastal areas, in particular, are simply never going to go back. Growth may slow, but there will never be a time now when all of the sudden you can get a two bedroom in a decent part of Manhattan for $600,000. That boat has sailed. The only hope for most coastal buyers now will be bizarre unsafe mortgages, horrible levels of debt, the lottery or moving inland.

Honestly, I’m sure California is the same in areas but I just don’t know who lives in New York anymore. When I moved to NYC I made less than 100K but was able to afford a decent big two-bedroom place in a hip neighborhood (Chelsea) with a roommate. The same place now would be so far out of my league, even with my salary roughly double what it was, that it’s not funny. The idea of buying a two-bedroom in Manhattan is only reasonable when I’ve had a martini or two.

I cynically and opportunistically hope for a crash but I think whoever you’re listening to is engaging in wishful thinking. It’s just going to get harder and harder to afford a nice place in a desirable location.

(and before anyone jumps on that, to ME New York is desirable, I’m sure other cities in the US have appeal to other people, just not so much to me)

It’s “Web 2.0”! One of the managers in my company said, “there is still too many rich people here!” Though I think that it is good that the smaller homes are slumping here, because that’s all I want. A bigger home costs more energy anyway, and is harder to clean. It’s about time the smaller homes are dropping in prices too, because whenever I see a 700 sqft shack here in San Mateo selling for 600k I want to barf.

Unfortunately, statistics seldom tell the whole story. The luxury market has been affected in San Diego. What these stats don’t tell you is that a) the increase in median price in this niche is because last years $3 mil home is now $2.5 mil, ) a 48 million dollar sale and a 35 million dollar sale (both sales blew away the previous record sale of $25 million), which skew the numbers as well, and c)the number of short sales I’m seeing in the 7 figure figure market is scary.

I think the desired international locations like coastal CA, high end NYC, etc are now going to be buffeted by the new world rich, i.e. Chinese, Indian, Russians, UK, other European rich whose pricing power is improving as the dollar improves. While it costs us $30 to buy soup/salad in UK, people are literally flying (middle class people) into NYC just to shop for the weekend and then fly back. So just imagine for those doing ‘well’ how ‘cheap’ our real estate is for them – I expect half of Miami to be foreign owned in 10 years the way things are going. Now this is not inner suburbs or ‘average’ property but I am talking the top 10-15% of property in these areas.

Again, we are selling away our country with this debtor nation status of ours. Piece by piece. Middle class Americans cannot afford homes but ‘upper class’ people from other countries will be able to. Ironic. Sad but ironic. Keep spending people – keep spending…

Hey! I was really surprised that Chicago has such a high percentage of sub prime loans.Thanks for providing the information.

The “equal opportunity market” as regards housing, is coming, but not until next year ~ 2008, which will see the real effects of the “Panic of 2007” and the mortgage-lending bubble burst. What is not being reported is that this really isn’t a “subprime crisis” insomuch as a mortgage-loan securities crisis.

The U.S. housing market has always been healthy. The pain now being felt is because of the many crimes of those who think that they can “control” the lives of millions of Americans by “hedging” the futures of families against the greedy needs of international bankers, and their minions.

A HISTORY:

What happened was that after the dot-com bubble burst in 2000/2001 the international banks, and investors needed a place to put their money, and something to bet it on.

Open the curtain ~ and here comes U.S. real estate. Housing starts were already on the rise since the mid-1990s, and as one generation aged, and another moved into its place (Baby Boomers) many houses that have been in families for generations rose in price as titles changed hands.

With the busting of the technology market and the NASDAQ in 2000/2001 ~ the obvious place to put money was in housing. The new Bush administration’s tax cuts freed up lots of money ~ money that was being hawked by investment banks to put into real estate.

Fed by the media, realtors, and speculators, the normal rising rates of housing in the United States took off like a rocket. Suddenly, there was liquidity everywhere, and housing was being sold and traded like stock.

The traditional “sunbelt” states like California, Nevada, and Florida, were the first states to become involved as “hot” places to buy and sell real estate. Speculators flooded into these markets first, and it spread outward from there into other states.

Comapanies, seeing the speculation in real estate, created new mortgage units, and companies, to find more people to sell “no interest loans” to as the swelling real estate market demanded more buyers.

These companies rose quickly. A mortgage officer and his crew could make as much as $13,ooo a pop on one approved mortgage application. Soon, call centers were employed to find ever more “buyers” ~ as the market demanded more and more loans.

Subprime became the new buzz word as realtors hawked neighborhoods the country over convincing homeowners to think about selling their houses in a hot market where their houses were rising in value.

Meanwhile, more companies were advertising the fact that homeowners could “refinance” their current mortgages because their homes were already rising fast in value. Take out another loan ~ refinance ~ here, take some cash back, get that plasma screen TV, finance your next European vacation, buy a new car.

Need even more money? No problem. Refinance again, and again. Use that house of yours just like a credit card. This housing market will be hot forever. The sky is the limit and the future is yours.

Now that the housing market was “hot” ~ speculators could gamble even more. The market was so “hot,” so much money was being made, and to be made, that corrupt teams of realtors, mortgage-lenders, home-inspectors, bankers, lawyers and their friends throughout the industry decided that “hot” wasn’t “hot enough.” They wanted the market even “hotter” and made sure of this be forging mortgage-loan applications to move properties all over the country. They paid people with no intention of buying a house to complete applications in their own names ~ hiking fees, and raking in hundreds of thousands (and some, millions) of dollars ~ in the process. Since regulation wasn’t happening ~ who would know?

Seeing the speculators rake in the money, investment fund managers decided to bet their the money of their investors on U.S. real estate. Fueled in the early 2000s by Bush tax-cuts, with a new market in mortgage-lending, and with rates driven on the low end (with regulators told to back off) the private finance companies went into the FHA loan business, and took advantage of an area that the government had long been into ~ providing affordable home loans to Americans.

These loans, called “subprime” offered first-time buyers, and those with borderline credit the opportunity to own a home. It’s a business that has been going along for many decades ~ that is ~ until Wall Street saw they could “package” these loans into securities, and hedge fund owners saw $$$$$ in betting on these loans.

The banks took part, seeing they could bet on the housing market too. So, they looked the other way, and approved as many loans as they could so they could be bundled into these securities, and sold on the world market, mainly to European money-market investors.

These investors, and their managers were convinced that these mortgage-loans, stamped Alt-A, gold-standard, cannot fail, securities, would make them rich. They were told the U.S. market was hot, and would remain hot for many years to come.

The hedge fund players waited until particular investment banks took part in these mortgage-securities, investment firms like Bear Sterns heavily invested. So did banks in Germany, France, and England. All looked great, the dollar was stable, and housing starts in the U.S. remained on the up and up.

But, when the LBOs and CDOs reached peak levels, the hedge owners called in the “bet” ~ that is, they bet AGAINST the housing market in 2006 and fled with huge amounts of cash somewhere in the billions of dollars. It is reported that some of their hedge-fund players (they know who they are) made off with hundreds of millions of dollars in late 2005, early 2006.

This is where the crash comes in and the resulting “Panic of 2007” and credit crunch of spring, summer and fall 2007.

Now, the housing market is on the decline ~ in a BIG WAY ~ and with record foreclosures, what is happening is that the victims are being blamed for the crisis.

My question is ~ where’s the money from the billions lost in the housing market? Where did it go?

I’m not talking about “refinancing” money. I’m talking about the huge amount of securitized mortgage-loans that were bundled into packages sold on the markets, played with, and bet on by hedge fund owners.

You want to know who is responsible for the Panic of 2007?

Follow the MONEY.

Theodore,

Truly interesting analysis. What I’m intrigued about here is your ominous prediction for the market in 2008 and beyond. We’re waiting in the wings for a big opportunity in 2008 or 2009 to snatch some real estate positions, whether it be in REITs or real property.

Everyone else: you echo what is scary about the economy and real estate market right now.

Another question here is how is the stock market going to react in the next couple of years in light of what may be in store for real estate… I wonder whether it’ll hold its value.

Thanks for the intriguing article. However, I am hoping for a better outcome in 2008 than what you are predicting.

Good information, I hope that the market improves going forward in 2008!

Thanks for the info, I own a home in San Diego and know that this market will come back. I do a lot of locksmith work for local real estate agents and the ones that seem to be busy right now are the ones selling bank owned real estate.

Myrtle Beach is in the same boat. A very high percentage of subprime loans on investment properties. Thus, a very a high level of foreclosures and short sales for real estate brokerages.

Thank you for the article you’ve posted. It adds information for my future investment in real estate.

New York is holding up in 2009, 2010. I know this is an older post, but it is relevant, again. @San Diego Locksmith “I do a lot of locksmith work for local real estate agents and the ones that seem to be busy right now are the ones selling bank owned real estate” I think this is true in any real estate market.

I totally agree with you Mikel! Your statement is definitely true, based on my experience..