It’s been around 5 months since I’ve last checked our investment portfolio. We’re some of those people who really don’t spend that much time checking the details of our investments; we like how things are more or less in auto-pilot. I get some vague idea how we’re doing whenever I receive our account statements. But it’s when I do these reviews around twice or three times a year, that I see our net worth details and our full financial picture. I figure that’s good enough — the less I look at the numbers, the less chance I’ll do something impulsive!

At this time, I have mixed feelings about how things are going. Two reasons why:

- The stock market is experiencing a lot of volatility in the last few months, and despite that, it currently maintains a gain of 9% for the year. It seems like it can’t make up its mind where it wants to go even after the last few rate cuts.

- We’ve been partially living off our savings this past year which accounted for a decrease of 2% off our overall portfolio totals. This is telling me that it doesn’t seem like an impossibility to “retire early” based solely on the strength of our portfolio growth. Quite a tempting thought.

Since my last check in May, 2007, it appears that our investment portfolio and total liquid assets (from all sources, including our cash and emergency funds) have been flat to up 4% in the last 5 months depending on when a portfolio check was made. Still, the portfolio has logged almost a 15% increase for 2007 so far. For the time being, it looks like we’re beating the U.S. Total Stock Market, which has a year-to-date return of 9%. To what do I account this growth?

- Heavier international equity weightings have certainly pulled up our overall rate of return.

- We bought into the trough of the recent market correction, which is a contrarian approach we often use when there are dips. We used this time to rebalance our portfolio, again, shifting and adding funds into international holdings.

- Our individual stock holdings have done surprisingly well in this time period, so it was time to lighten up from 5% to 2% of the total portfolio. I am not big on individual stocks but sometimes take a few positions with well-known companies.

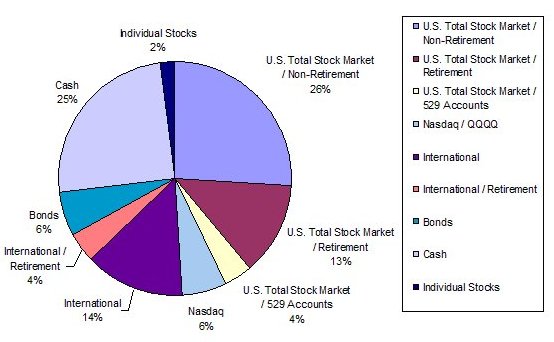

Here are the details of our allocation.

Asset Allocation for October, 2007

And for easier reading, here are the numbers from which the chart is based on. On the table, I keep a column here for our target allocations, which represent the % numbers I’d like this portfolio to have, down the road. I am slowly rebalancing our portfolio allocations to reflect these numbers. Unfortunately, with the way the markets are behaving, the numbers get skewed ever so slightly here and there such that the target numbers are not met exactly. But overall, I am fairly satisfied by how things have turned out so far. [Rows in gray show the departure between our allocation percentage and the target allocation, no matter how small the difference.]

| Asset Class | October 2007 % | Target Allocations |

|---|---|---|

| U.S. Total Stock Market / Non-Retirement | 26% | 25% |

| U.S. Total Stock Market / Retirement | 13% | 15% |

| U.S. Total Stock Market / 529 Accounts | 4% | 4% |

| Nasdaq / QQQQ | 6% | 6% |

| International Equity / Non-Retirement | 14% | 14% |

| International Equity / Retirement | 4% | 6% |

| REITs / Other Real Estate Investments | 0% | 10% |

| Individual Stocks | 2% | 0% |

| Bonds | 6% | 10% |

| Cash | 25% | 10% |

| Total | 100% | 100% |

Our Investment Portfolio Highlights

We rebalanced our portfolio to some degree during the summer market correction. On May 2007, we used to have a weighting of 55% in US equities, 11% in International equities, 2% in Bonds and finally 32% in Cash. Today, we are 51% in US equities, 18% in International equities, 6% in Bonds and 25% in Cash.

We actually used up 2% of our cash savings to cover our expenses thus far in 2007 due to our current cash flow situation. I am the only one currently bringing in a stable income this year, but the great news is that our alternative income through some consulting efforts and small business endeavors have added 18% to our household income, such that the effect is like getting an 18% raise. For the record, our current income for this year is 27% of what it used to be when my spouse was working, so any form of alternative income is helpful to the bottom line.

Our biggest planned portfolio move: Going forward, we are waiting in the wings, looking into how the real estate market correction will play itself out, as we plan to diversify into the property market in the next several months to a couple of years. Do we dare leverage ourselves into the property market and go into rentals? Do we put some money into REITs? I believe we’re eventually going to try both strategies at some point, but we’ll have to proceed cautiously and monitor this housing market since at this time, the bottom is still not in sight.

One last note: at some point in the past, I had mused over possibly buying into currencies and precious metals. For some reason, I’ve never really felt entirely comfortable getting into gold, given that I recall the 1990s when some family members used to gnash their teeth over the poor returns of their gold investment. Their negative experience seems to haunt my thoughts on this subject. So even as gold has run up in value and padded some pockets out there, we’re out of that play, especially now that the easy money appears to have been made. Now what about currencies? I’ve griped over the weak dollar a while back and discussed some good ways to hedge against it. Well, after some debate, we’ve decided not to put our money into foreign currency accounts and instead have simply added to our international fund weightings, which we expect should act as our hedge against the falling U.S. dollar. So far, we’ve been satisfied with this strategy. Going forward, we may increase our international allocation even further.

We’ll see how things go by the end of the year when I plan to do another check up. Hopefully that 15% jump in “net worth” holds! But you never know in this crazy market…

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 10 comments… read them below or add one }

I usually check net worth and portfolio once a month. Anything more frequent causes me to make bad decisions as I react to day to day moves. Anything less frequent and I don’t get to respond to real market changes.

Gal

That is really nice and in-depth. I might of misunderstood about the level of activity, which I concluded to be very little if any, but great 15% return while barely even touching it.

I’d love to share more details and real numbers, but unfortunately, my spouse wouldn’t appreciate it if I did… 🙂 What I can offer, however, are our money reports covering our strategies and relative performance. And lots of percentages.

Can you pleas clarify why you break out asset positions into investment vs. retirement? Shouldn’t you simply have an international position and a domestic position across all your accounts?

On the real estate side, we prefer a REIT Index (Vanguard’s VGSIX). In our opinion this is superior to rental properties because of the liquid and diversified nature of the investment.

Shadox,

Great question — I have to apologize for the possibly unusual way I have broken down my asset allocation wheel. The reason is because I actually track my finances on a custom spreadsheet I’ve developed in the last 10 years and I’m really still functioning in the “dinosaur era” when it comes to financial tracking. So the answer to your question is that it’s just my “custom way” of breaking things down. Going forward, I can make it simpler and just coalesce the allocations without specifying retirement vs non-retirement accounts. I thought that the detail may be helpful but if it adds to the clutter, I’ll simplify it.

Also, I appreciate you mentioning the REIT approach to real estate investing. I’d love to stay simple as well and will most likely get started in investing in this manner (vs landlordship). I have so many friends really falling for the landlording option and I wonder if they’ll enjoy it in the long term as much as they did when they were simply fantasizing about the opportunities.

I’m jealous! 🙂 15% is very nice! Congrats! Do you have a financial advisor that helped you with the allocation or did you somehow come up with this allocation yourself?

Very nice job! My Net Worth’s actually up over 50% this year, but some of that’s because I’m in college, and it’s very easy to double your net worth when it’s still in the low five figures :).

Congratulations on increasing your net worth by so much in 2007. This year’s been an extremely tough year both for shares and property and I think this uncertainty will probably continue into 2008 and 2009.

I’ve still got a few long-term core holdings but I’ve got a lot of cash on the sidelines waiting patiently to be reinvested.

I actually doubled my networth this year too but it’s all because of super frugal and savings so it’s not like my stocks did really well or something!

After further review of our portfolio, we’ve decided to tweak it further. I’m going to do reveal further details of our target portfolio soon in a follow up post, then execute some of the actual changes in the near future. There’s quite some fascinating theory behind trying to get the “right” portfolio mix for you!