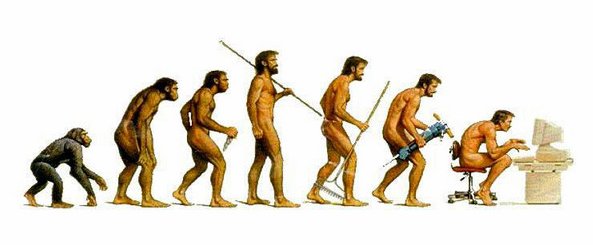

The evolution and education of a long-term investor.

I often hear about horror stories regarding people who’ve made big mistakes trying to invest their hard earned money. These horror stories happen because of the lack of familiarity people have about the investment world. We may have been there before as well — a typical scenario is this: the uninitiated start off being uncomfortable or unfamiliar with the investment world, so they are distrustful about where to put their money, until a well-meaning friend or family member comes along to persuade them to invest in either a personal project, business or fund that eventually goes nowhere. Such an experience then sours the would-be investor from taking any further risks with their money. And an unhealthy relationship with money commences.

This brings to my mind how things were for me when I first started learning how to handle my finances. A lot of the education I’ve received not only came from mistakes I’ve made myself, but also from hearing about practices done by others, which yielded subpar results for them down the road. Interestingly, I’ve found that many of us perform these money moves repeatedly, living up to the saying that old habits die hard.

So what have I got here? A list of common financial habits that we often perform, whether or not its in our best interest to do so, especially when we’re still at the cusp of beginning our financial education.

Questionable Money Moves Made By New Investors

Keeping most money in cash.

I have a few friends who are deathly afraid of volatility and the stock market and think it’s synonymous to gambling. But they’re trading the risk of volatility with facing the risk of inflation since money in cash is just not going to keep up with rising prices in the long term.

Using a professional broker to provide financial advice.

There’s nothing inherently wrong about seeking professional advice and money management assistance. However I’ve also seen first-hand how a broker had ripped off my own parents at one point in their lives. From that lesson alone, I vowed never to trust anyone but myself with direct management of my finances. Instead, I house my funds in a few highly regarded online brokers. I’ve considered working only with well-awarded discount brokers such as TradeKing and ETrade.

Entering into business with friends and family.

Nothing inherently wrong about this either, except that there’s a way to approach such ventures. I often see deals and agreements sealed with handshakes and many times, it’s a cultural thing, but I’m just not the type who’ll take chances. No contract, no deal.

Giving one’s business to friends and family without due diligence.

When you’re close to people, they expect you to give them their loyalty automatically and indiscriminately. So what happens when they ask you to give them your business? In my own circle, we’ve got lots of agents and brokers running around wanting us to sign up with their financial service, whether it be based on real estate, insurance, investment, etc. What do you do then? It can be a dicey situation if you aren’t necessarily comfortable with the services they’re offering.

Asking around for tips on the next big investment.

One of the most popular questions I get is: where should I put my money? With people expecting a simple straight up answer. I cannot count the number of times someone’s asked me about where they can get a quick 25% return in a few months. It seems difficult to accept that a reasonable rate of return for a diversified portfolio with controlled risk is only around 9% – 12% a year. Somehow, this just doesn’t sound good enough for the impatient, so they opt to trade stocks on their own to beat this market average or enter into more “exciting” but risky ventures.

Following investment fads.

It’s human nature to want to capitalize on the “in thing” of the moment. Unfortunately, what’s “in” one day becomes “out” the next day. Just ask the subprime mortgage holders out there.

But as time goes on, such mistakes hopefully turn into valuable lessons learned, and become for us, a form of tuition. My own investing education evolved from a lot of trial and error and experimentation, especially since I started investing at a young age (age: 23), a time when I took to heart the common financial advice that you should go “all out” with your money when you’re young and capable of making up for any losses you incur. Here’s a look at how my investing habits have developed throughout the years.

The Evolution of My Investing Habits

Like many, I started out being much more adventurous…

- I tried shorting, options, and considered margin investing.

- I traded single stocks.

- I followed stock tips on message boards.

- I shifted allocations often.

- I checked my net worth and portfolio numbers daily (compulsions).

Today I’ve steered away from these actions. After 18 years of investing, new habits have arisen (here I shift from “I” to “We”, having settled down within the last decade):

- We review and carefully evaluate our portfolio 2 or 3 times a year though when there is market volatility, I do tend to watch the market more carefully.

- We shift allocations and rebalance our funds based on how much our allocated percentages are off mark in our portfolio (and not based on emotion).

- We buy mostly during dips or on weakness. There’s a time we do start to get excited and that’s when there’s some volatility in the markets. It is a good idea to equate volatility with opportunity — seeing the silver lining in storm clouds that swirl around.

- We limit our account transactions.

- We keep our individual stock allocation to 5% of our overall portfolio. Our individual stock allocation is very small and involve stocks of companies we work for.

- We have a large emergency fund.

- Our core portfolio is in index funds and ETFs. The only “sector” we invest in is the Nasdaq through QQQQs. We’re not big on sector investing since we noticed this did not make too much of a dent on our overall portfolio.

- We never trade.

- We reinvest all dividends and practice dollar cost averaging diligently.

- We keep a tax efficient portfolio and focus on keeping our fund costs and fees low. We only purchase no load funds.

The point here is that I look back at our investing track record and realize that the education of an investor follows its own life cycle. In my case, I started out brash, aggressive, and eager to do anything to make our money grow as fast as it could. As time flew by, I tempered my attitude towards investing and moved away from “active” investing and almost obsessive monitoring of our portfolio. Today, I’d consider ourselves “old fogeys” when it comes to investing — we prefer to be as simple and as passive about investing as we can possible be, yet ensuring the healthy growth of our net worth. In other words, my investment profile changed throughout the years. But I guess, that shouldn’t be all too surprising, don’t you think?

It’s true that today, we’d consider ourselves the most boring investors around. Though I believe we started out as much more exciting and “passionate” about investing when we first started, we found that as time goes on, just like an adolescent turns into an adult, we’ve pretty much settled down and mellowed out as investors. We figure, we’ve already sowed our wild oats when it comes to playing with our money and we’ve moved away from wilder investing methods to take on a more relaxed investment approach that allows us to just leave our investments alone to do their own thing. Is it age that does this? Experience? Is it just a matter of “novelty wearing off” or are we just being boring? 😉

How has your own attitude towards investing and financial management evolved throughout the years?

Image Credit: Google Images — it’s everywhere in the internet.

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 18 comments… read them below or add one }

Just like you, I jumped in with two feet.

Not really educating myself. I just wanted money and I wanted it fast.

Now I take baby steps. I check my growth 2 times a year (maybe more)

I diversify and invest in no load and index funds?ETFs with low ratios

Good advice! Yes most definitely stay away from doing business with family…family and business truly don’t mix, particularly if there’s a history of personality conflicts or social competition.

Keeping your money in cash form isn’t the best idea either. Investing it or putting it in a high yield savings account is smarter.

-Raymond

What an excellent post about the pitfalls but also rewards of investing in the stock market. I guess I’ve been lucky enough to have other people make their mistakes for me and teach me along the way. But I have many years of stock market investing ahead of me. I hope I can minimize my mistakes by continuing to do a lot of what you’ve outlined here.

Perhaps also not using financial message boards? At least with blogs, you can get a better feel for where the person is coming from, etc. Message boards seem even more anonymous.

I started off not knowing anything about funds. I invested in some shares that in a set and forget strategy – they didn’t pay off returning approximately 0% over 2 years. I was essentially gambling/writing off the investment money.

Then I read about index funds, understood and loved the concept and invested in them. Still doing that now.

Investing is a learning process. It takes time to evolve a winning strategy that you will stick with no matter what the market masses are doing. Understanding behavioral finance is crucial to sticking to your guns WRT your financial plan.

I wrote a similar post today about my journey that began with value investing, took a big detour into momentum trading and now back to value investing. LOL

http://thefinancialengineer.blogspot.com/2007/12/value-investing-seldom-popular-always.html

I think reading and educating yourself are the keys to successful investing. Investment books, financial planning, retirement, budgeting books…they are all worth reading. And of course blogs too.

Mike

Looks like you have just written about my investing history.

I have been there and done that.

Like you said, I have mellowed down am a lot less adventurous and more disciplined.

Perhaps the title of this post should have been “The Investment history of Fathersez.”

It is good to be able to read an unbiased opinion of my own wrongs and be made to think.

Thank you

you always find the best picture to put in your post

Isn’t it interesting how our overall attitude and tendencies change just after a couple of tries in the stock market wherein we get burned? Anyway, it’s happened to me. I realized that it’s not just age that may make us change the way we invest and it’s not just our view of the markets. Other factors that affect our investment behavior that seem to have a speedy effect are “education” and “experience”. The more we have of those, the more we alter our ways — those ways that that didn’t yield us the results we wanted.

One other factor I didn’t mention that could affect how we invest is the amount of wealth we have. That’s something I’d like to explore further sometime.

@Plonkee – I went down the path you took as well. Went from single stocks to sector funds to actively managed mutual funds and then upon discovery of index funds, kept with it.

@Kris – thanks for sharing! I love to hear the personal stories that others have made.

@TheWild1 – lol. Thanks for the compliment! 🙂

I agree with the majority of the questionable moves you’ve listed. The worst being following fads. However, I wouldn’t rush to recommend avoid using the services of a professional broker just because you had a poor experience with one. You need to understand quite a bit before investing by yourselves. We use professionals in every aspect of our lives and should also seek professional advice when it comes to investing.

I’m looking more into real estate investing (the rental side) and I do individual stocks in a Roth IRA. I prefer to actively manage my own things.

I don’t really see myself “mellowing” into the index fund thing, but who knows. I’m not really looking for something to stick with. Things are always changing and I’m looking to move with things as they do.

I’ve started to put a good portion of my money into index funds while investing in individual stocks at the same time. I find that this keeps me sane at times when stocks go down. So far it’s been good but I’m always leaning against putting more percentage of my portfolio into index funds just so I don’t have to worry about my money all the time.

> Giving one’s business to friends and family

> without due diligence

This one is true in more than just investing. Some of the worse experiences I’ve had is when I hired friends and family do work for me.

Great read! I plan to include your article in my weekly carnival review this Friday.

Best Wishes,

D4L

It takes a lot of time to become a good investor and this is why we shoud start with small steps and with small investments; we have to practice a lot and we have to have patience.

I must say this is a great article I enjoyed reading it keep the good work. Good replies.

Great article.

I had the opposite experience, where I spent the first 20 years completely in no-load mutual funds. My very wise parents recommended it.

Now, I have about half in mutual funds and half in stocks. The stocks have been fun and I have learned a lot. But, it’s definitely a lot bumpier ride than my mutual funds.

I always recommend some stability to any aspiring investor. Then, you can have some risk capital, if you have the tolerance.

Long term investment will definitely make money in long run. but even intraday trading done with discipline will make good money, in my opinion.