Develop a home buying budget and find out what kind of property is right for you.

A lot of the problems we are seeing right now in the real estate market are due to homeowners who’ve overstretched their budgets to afford the house they wanted. In order to avoid such a predicament, we should be approaching this process more systematically. Here are some steps to ensure we don’t buy too much house:

How To Buy The Right House For Your Budget

#1 Start off conservatively.

We used to live in a much smaller home several years ago, but when it was time to “move up”, mainly to accommodate new members in our family, we started our house-hunting process by thinking we’d buy a house not much different from what we already had, but just slightly bigger. From the beginning of the process, we already placed a cap on our budget, thus establishing the maximum budget we’d like to have.

#2 Do a wish list.

Have some idea what kind of features you’d like to have for your “target” house. We used magazines, design catalogs, drives around the neighborhoods we wanted to settle in, to give us some basic idea about what to look for.

#3 Prioritize the features.

After compiling the list of home features that are important to you, prioritize them. This will allow you to be able to make tradeoffs later on, if necessary, once you’ve established your budget. Also, this information would be quite valuable for any real estate agent or broker whom you hire to help you with your house hunting endeavors.

#4 Peg your down payment.

You can start out by asking a few questions: how much cash do you have available for a down payment? And how much do you anticipate closing costs to be? Knowing the answer can help you determine what types of loans you can get. Typically, down payments range from 5% to 20% of a home’s purchase price.

You may have saved earnestly to fund your house. In our case, we decided that we could also earmark some or all of the proceeds of our original home’s sale to be our new house budget. We were comfortable about planning a rollover of our previous home’s equity into our new home. And being financially conservative, we generally prefer making a larger than usual down payment in order to reduce our debt exposure.

#5 Do some math.

The standard rule for monthly mortgage payments is that it should be between 25 to 33 percent of your monthly gross income. More specifically, here is the 20/28/36 rule, a useful rule for mortgage affordability:

- Use a down payment of 20%.

- No more than 28% of your gross annual income should go to mortgage, insurance, homeowner’s fees and real estate taxes.

- No more than 36% of your gross annual income should go to mortgage, home and other debt expenses such as credit card debt, car and school loans, etc.

Note that the last two numbers (in this case, 28 and 36) represent debt-to-income ratios, which help you determine your maximum monthly mortgage payment. It’s a big part of the mortgage lender’s concern. Following is the Debt-to-Income Ratio explained. There are two calculations used to determine this number:

The Front-End Ratio: This calculation determines how much of your pretax income will go towards your monthly mortgage payment. The mortgage payment figure includes interest, principle, taxes, and insurance and typically should not go over 28% of your gross monthly income.

Annual Salary x 0.28 / 12 (months of the year) = Maximum Housing Expense

The Back-End Ratio: This calculation determines the amount of your total gross income that will go to pay all of your other obligations, including the mortgage, other loans, child support, credit card bills, and any other monthly debts. The figure should not exceed more than 36% of your gross income.

Annual Salary x 0.36 / 12 (months of the year) = Maximum Allowable Debt-to-income Ratio

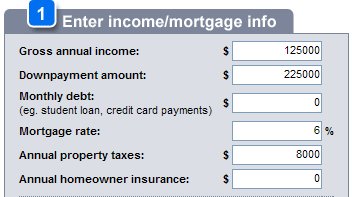

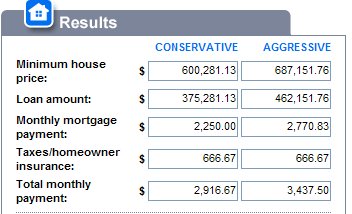

Let’s go through a local example: the following illustration demonstrates the kind of house your typical Bay Area engineer can comfortably afford, and what price limits s/he needs to adhere to. See the results from this CNN Money Home Affordability Calculator:

|

||

|

Assumptions made by CNN Money: To arrive at an “affordable” home price, we followed the guidelines of most lenders. We’ve allowed a total debt-to-income ratio of no more than 36 percent. And we have assumed a housing payment-to -income ratio of 28% for our conservative estimate, and 33 percent for the aggressive one. Before buying, however, you should also factor in other savings needs, including retirement and college. |

To evaluate this example, let’s check out some assumptions: the current median price for a Bay Area abode is around $625,000. [Note: I’ve seen various reports showing slightly different numbers but this should do.]

Yikes. These days, it looks like you’d have to save a LOT of money for a down payment before you can buy the average house in San Francisco. Let’s take a look at those numbers I entered: I’d consider $100,000 to $125,000 to be very good pay for an engineer around here. I also surmised that typical property taxes are $6,500 to $8,000 a year and assumed that the hypothetical down payment is at $225,000, a truly large down payment if I ever saw one!

What this shows is that by playing within some hard financial rules — see the assumptions for how the calculations were made above — at an interest rate of 6%, you’d need a $225,000 down payment just to be able to snag that average Bay Area house given the $125,000 income (though the down payment in this example is a high 36% of $625,000, note the other factors that were considered for this budget). This also implies that with a higher income, you may be able to get by with a lower down payment for the same priced house.

As I’ve mentioned, this is but one example of how to determine the range for your home budget. [Though it’s an extreme case that pretty much demonstrates home UN-affordability in California.] Whether or not you find this a realistic representation of your situation, it’s still a good starting point for developing a budget.

#6 Get prequalified for a loan.

This will give you a great opportunity to review your finances with a loan professional and truly determine if your house buying plan is feasible. This process doesn’t cost anything and should give you some idea how well your standing is as a homebuyer in this current market since the lender will be carefully evaluating your finances for that prequalification.

#7 Talk to friends and family.

Augment your neighborhood and home search with discussions with your family who may be able to offer you some opinions, input or even advice on the matter. At the very least, they can be a sounding board for any ideas you may have. This is just another way to get a different perspective on things, especially with regards to the huge decision that’s facing you.

#8 Look around and check comps.

Armed with your prioritized wish list and your budget numbers, you may want to pound the payment and check around to see what is available out there. It’s time for the process of finding out whether the neighborhoods and homes you had in mind are a fit for your budget. See if there’s a match!

#9 Make tradeoffs and focus on a market.

You may be lucky and find homes that will fall easily within your budget range and which sport all or most features you have on your wish list. But if that’s not the case, your ordered list should help you rationalize which features you may be able to live without or not. We found that by viewing several houses, we solidified the things that were important to us and what we couldn’t compromise on, such as the number of rooms, location and size. And ultimately, we found a home that we just couldn’t pass on, even though it “slightly” broke our budget. So yes, I have to confess that we went over our budget a bit but it was so worth it since there would be no way we could afford our house if we tried to buy it today!

#10 Find and consult with a good realtor.

Look for the ideal real estate agent since they will no doubt have some suggestions on how to match you up with just the right house for your budget. When we first started our house-hunting expedition, our realtor saw how we insisted on keeping with our strict budget. He then reviewed our accounts, income and taste in homes and gently persuaded us to look into listed houses that were above our price range, assuring us that we’d be able to afford it and we would be happier about things in the long run. We went for a 40% increase in space (40% more than what we had originally wanted) for a 25% increase in budget. It turns out that our initial budget was indeed too conservative (see #1) and that we had room to pick up more house for a bit more money, and it was indeed the right choice in the end!

So good luck with finding the right house for your wallet. Now that the property market is easing, homes will move further within our grasp and be riper for the picking!

Copyright © 2007 The Digerati Life. All Rights Reserved.

{ 19 comments… read them below or add one }

Since I can’t afford a whole house, can I just buy one-quarter of a house?

Remind me not to move to CA anytime soon!

I’m probably on the very conservative side of things. The 40% increase for 25% price increase sounds good. As long as we’d have time to clean or mow it and goods to furnish it. It’s sad sometimes to see big houses which look awkward because they aren’t fully furnished…not even in a cool zen-minimalist way.

These are some great points to consider – my wife and I are in the very, very early planning stages of looking for a house to buy (we have some debts to whittle away first). I used to want to stretch to buy a bigger home, but now I’m convinced I want to buy extremely conservatively and maximize other savings and investements.

Another facet to concider is quality of life.

If you enjoy better cars, dining out, etc. go less than you can to preserve that lifestyle. as you are not a candidate to be “House-Poor.”

If you really are a home-oriented person, this is where you are going to spend most of your time, not a big shopper or vacation taker, I personally think you can stretch te numbers, a bit, as real estate as a whole (present market excluded) is a good investment.

I went about things a bit differently for my first (and only) house.

1. Start saving for a house.

2. Assume I can afford my current rent plus my current savings rate.

3. Get pre-approved for a loan. I only looked at fixed-rate 30-year mortgages, but you should look at 15-year mortgages, too, because you probably get slightly better interest, and the payments aren’t that much higher. You will be given a maximum loan amount and an interest rate for which you are approved.

4. Calculate how much house I can buy with that interest rate and the monthly payment I can afford. I did include taxes and insurance in my calculation but forgot to include repairs. Oops. If the lender wouldn’t lend me as much as I wanted to borrow, I’d have to wait and keep saving. If the lender would lend me a lot more than I wanted to spend, then they were crazy.

5. Contact a real estate agent and see if there are any properties in the price range I think I can afford. (Note: never say how much you are approved for if it is more than you want to pay. Agents tend to find things only at the top of your range or above it.) I suspected there wouldn’t be anything I could afford yet, but I called an agent who claimed one could buy for the price of renting. She was almost right, if I had been renting a two-bedroom apartment instead of a one-bedroom one.

6. Create list of wants. I decided I wanted something a) totally affordable to me, b) walking distance or on a bus route to my employer, c) having a solid foundation, d) having a big living room, and e) in a non-scary neighborhood. I felt very poor, felt this would be just a starter house, and had low expectations. If I couldn’t find anything with all of these qualities, I would keep saving.

My plan only works if your current living arrangements are just fine and so you are in no hurry to buy.

Minimum Wage, you could buy a condo, which is sort of like buying one part of a house. I decided against this because I didn’t like how you have to keep paying condo fees even after your mortgage is paid off.

Debbie, condo fees cover stuff like cutting grass, snow removal, garbage removal, roof, siding, pool if there is one. This is the type of things you get to pay for the house as well. If a condo is one-level, not a townhouse, common charges often include heat/hot water. Additionally, they aren’t that big. My common charges for a two-bedroom/two and a half bath townhouse are $250 a month. This is pretty average. The only problem is that with a house you get to decide if you want to replace siding or wait. With condos the majority rules. If the majority decides to replace siding, for example, you may be stuck with an assessment. So the choice between a condo and a house really depends on if you want to have your own backyard and the responsibility that goes with it. I am a single woman, so there is no way I could maintain a house. Also, I’d be scared being in a house alone.

There are also co-ops that are usually much cheaper than condos. The maintenance on co-ops is usually higher than on condos because it includes mortgage on the whole complex but it includes property taxes as well, so often it comes out similar. The co-op is only a step above renting though – you don’t own property, you own shares that allow you to rent it. More rules on resale, often renting out is difficult and new buyer requires board approval. But the price is often less than half of condos of similar size.

Condos are way overpticed and I don’t understand the attraction some people have to them.

Condos are going up all over town, and some new condos just went up in my neighborhood. They start at “only” $95,000 for a 375-sq ft studio while nearby you can rent a studio for less than $500.

Where’s the sense in buying an overpriced condo?

Besides, all I can afford is %500 and I’ve never seen a condo with a $500 payment.

This is a great list. I printed it to give to my boyfriend since it shows everything I have been telling him. I have been saving for a house for a while but he is less determined than me. I actually used to work as an agent so know how it is but he thinks things are easier and cheaper than they really are. This list won’t work perfectly for us as we will never have 20% down (Tiny houses and condos here in NJ are 300K and we make a combined low 80K). On top of that condos here have a fee of about $600 bucks here so they are much more costly than a house. But still great article, I’ve read many and this covers everything.

One thing I’d like to mention as to #10. Yes having a good realtor is important, but don’t ignore properties sold by owner. Browse the local papers – in our area we have a little magazine called the “Pennysaver” that routinely lists properties for sale. As the owner doesn’t pay the real estate fee, he/she may be inclined to go lower. Additionally, what many people don’t realize is that the realtor reads the “by owner” ads too. Occasionally, the realtor may show you the property that is sold by owner. In this case, the owner will have to pay half the fee to the realtor, so you’ll be at a disadvantage compared to potential buyers who just call the same owner.

I bought my two last condos by owner including the one I currently live in; I also sold one of them “by owner”. I did have a realtor, but got better deal (and better properties) by just calling the owner. I also had a case when the realtor tried to take me to a condo sold “by owner” – I’d seen it already – (I called her up on it, it was indeed the same place). When I was selling, a realtor called me and asked to bring her clients. So, yes, it is important to have a good realtor, but it is also important to look yourself.

“On top of that condos here have a fee of about $600 bucks here so they are much more costly than a house.”

Wow. I live in Westchester county, NY, which is much more expensive than NJ – a tiny house here is over 600K, and our common charges are much less. I pay $250 a month in common charges for townhouse-style condo that is currently worth around 420K. There are several other complexes in the area – some a little bit cheaper, some more expensive, but most have similar common charges (less if there is no pool). $600 sounds more like a co-op maintenance than a condo or like taxes+common charges, but you have to pay taxes on a house as well. Are you sure the amount you mention doesn’t include taxes and/or you aren’t talking about co-ops? Have you looked at all complexes in the area? $600 for common charges sounds excessive unless the place has indoor/outdoor pool, gym, etc.

A very good blog about home loan. These useful really will help to other while they buy house for them. If I get a chance to buy another house, then i will defiantly go for either a bungalow or a row house. However, it is very important that one should not take risks while buying a house.

This is one of the best articles on this topic that I’ve seen. Thanks for sharing it.

I like the CNN Money calculator, I agree it may miss some things but I think it gives a general idea of payments. It is risky to buy a house and you never really know how much it will all work out to unti you are in the house.

Yah… when the wife and I started calculating, we didn’t account for insurance, taxes, etc…. that put owning a non-torn up home out of our range (some are pretty torn up here in the sacramento area) We’d be wiping ourselves almost clean had we bought a home, and would have no money for repairs, etc, which were a given for the price range we were looking at. We decided to wait a year, commit to saving and paying down debt…. the market will still be pretty good in the year… I don’t see it rebounding that quickly.

I find it interesting that your real estate agent encouraged you to spend more on a home than you’d originally planned, and that it worked out well for you. It says a lot about working with–and shopping for–a good Realtor.

Great tips. After calculating using the CNN calculator, I found the price range of the house I can afford. Thanks =)

Another facet to consider is quality of life.

If you enjoy better cars, dining out, etc. go less than you can to preserve that lifestyle. As you are not a candidate to be “House-Poor.”

If you really are a home-oriented person, this is where you are going to spend most of your time, not a big shopper or vacation taker, I personally think you can stretch the numbers, a bit, as real estate as a whole (present market excluded) is a good investment.

Great article and explanation of front end and back end DTI. Other factors of course include credit and LTV…

Some really good tips. Some more material on trying to estimate your home budget. I have seen friends who have houses beyond their means but regret later as they are struggling to make payments.

We liked the article and are including a summary of the article here.

Let me know your thoughts of the summary.