When there’s smoke, there’s fire.

The latest unemployment numbers are finally pointing to something we’ve been suspecting all along: that we’re now in the midst of a recession. But for those folks out there who aren’t thoroughly convinced, or who would like to become acquainted with the topic of recessions — after all, this is something that may have some influence on our spending and saving habits in the near term — I’d like to present this FAQ on recessions. So let’s get to know our personal finance’s public enemy #1… 😉

Signs and Predictors of a Recession

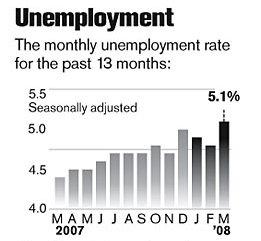

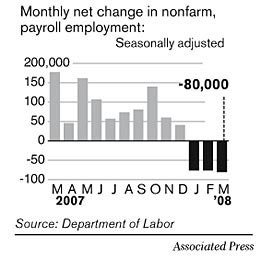

What are the symptoms of a recession? Here are some of the signs that the recession is finally here:

- three sequential months of job losses

- the largest number of job losses in 5 years occurred in March 2008

- the national unemployment rate rose from 4.8 percent to 5.1 percent

- increase in mortgage defaults due to subprime loans

- financial institutions are in near collapse (Bear Stearns?)

- foreclosure spikes nation-wide

- stock market down from previous highs

|

|

Definition of a Recession

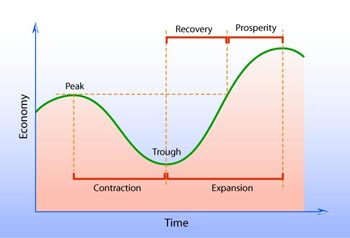

Though it may sound like the end is nigh when the media starts to freely promote the notion that we’re finally in the thick of an economic storm (but really just the trough of an economic cycle), you may want to put things in perspective. A recession is part of a normal economic cycle and is defined as follows:

According to the National Bureau of Economic Research, or NBER, a recession can be defined as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP (gross domestic product), real income, employment, industrial production and wholesale-retail sales.”

While other sources officially describe it as “a decline in a country’s gross domestic product (GDP), or negative real economic growth, for two or more successive quarters for a year.”

The determination of a recession is typically delayed, and identified only after some months have past where weakness has been tracked and recognized on various economic fronts and in market indicators.

It may not be so bad when you know it’s just temporary. Or when you realize it’s already happening way after it’s already started. Or maybe it’s not so bad because you happen to be lucky enough to live and work in a recession-proof locale. Or we could just be lulled into a false sense of security since the last couple of recessions we’ve had haven’t been painful enough to be truly memorable.

It is worth noting though, that recessions have been shorter and shallower than they’ve typically been way back in history. Following are some interesting tables and charts depicting the history of recessions in the United States.

History of Recessions

This table from CNBC shows us a history of recessions:

|

Recessions of the 20th Century

|

| Date | Duration (in Months) |

| Sept. 1902-Aug. 1904 | 23 |

| May 1907-June 1908 | 13 |

| Jan. 1910-Jan. 1912 | 24 |

| Jan. 1913-Dec. 1914 | 23 |

| Aug. 1918-March 1919 | 7 |

| Jan. 1920-July 1921 | 18 |

| May 1923-July 1924 | 14 |

| Oct. 1926-Nov. 1927 | 13 |

| Aug. 1929-March 1933 | 43 |

| May 1937-June 1938 | 13 |

| Feb. 1945-Oct. 1945 | 8 |

| Nov. 1948-Oct. 1949 | 11 |

| July 1953-May 1954 | 10 |

| Aug. 1957-April 1958 | 8 |

| April 1960-Feb. 1961 | 10 |

| Dec. 1969-Nov. 1970 | 11 |

| Nov. 1973-March 1975 | 16 |

| Jan. 1980-July 1980 | 6 |

| July 1981-Nov. 1982 | 16 |

| July 1990-March 1991 | 8 |

| March 2001-Nov. 2001 | 8 |

| December 2007 – June 2009 | 18 |

|

source: NBER

|

As you’ll see, the last couple of decades have yielded some pretty tame recessions that have lasted us only 8 months each. Will this current one be any different? Many say we’re due to return to “normal or average recession standards”. For clarity, this is how recessions are classified or characterized:

A “mild” recession is one whose duration is less than 10 months and which results in small declines in jobs, retail sales, output and real GDP.

An “average” recession typically persists for 11 months with more moderate declines in the jobs, sales, output, real GDP and interest rates.

While a “severe” recession is known to last for 16 months, with economic indicators experiencing more dramatic drops.

Should we then expect a longer down period? Given the causes and triggers of this downtrend, and the general difficult financial landscape our nation is facing, it may not be surprising to see a more protracted contraction this time around.

How The Economic Cycle and The Stock Market Are Linked

All this recession talk is of course, fascinating, but as investors, I’m sure you’d be more interested in finding out how recessions affect the stock market and consequently, your portfolios. Well, looking back through history (from the 1950’s) and at how the stock market has behaved during some of these periods, I can see that the 16 month recession triggered by the global oil crisis in the early 1970’s as relatively being the harshest and having the most devastating effect on the average investment portfolio.

Here are some statistics from Vanguard showing how the S&P index has performed during economic slumps:

| Recession | Nominal S&P 500 Return | Real S&P 500 Return* |

|---|---|---|

| July 1953–May 1954 | 23.63% | 23.10% |

| August 1957–April 1958 | –1.31% | –3.64% |

| April 1960–February 1961 | 20.04% | 19.02% |

| December 1969–November 1970 | –1.92% | –6.96% |

| November 1973–March 1975 | –7.79% | –22.82% |

| January–July 1980 | 9.53% | 3.64% |

| July 1981–November 1982 | 14.22% | 7.11% |

| July 1990–March 1991 | 7.89% | 4.59% |

| March–November 2001 | –0.90% | –1.70% |

* Adjusted for inflation using the Consumer Price Index. Data sources: Vanguard and the National Bureau of Economic Research. While business commentary typically defines a recession as two consecutive quarters of negative real growth gross domestic product, the National Bureau of Economic Research (NBER) is the recognized arbiter of U.S. recession dates. The NBER has identified nine recessions in the U.S. since 1953, with an average duration of 11 months.

These numbers can give you some perspective on how your portfolio may behave during recessionary conditions. Despite the grim mood that recessions can evoke, the positive takeaway here is that the general long-term stock market trend is UP.

Other insightful words about the relationship between economic cycles and the stock market come from Joseph Davis, Ph.D. (a principal and economist for Vanguard’s Investment Counseling & Research (IC&R) and Fixed Income Groups):

Just as recessions haven’t always heralded a bear market for stocks, periods of economic growth haven’t always been accompanied by major gains on Wall Street. Vanguard IC&R research has found that the average monthly return on the S&P 500 has been higher during economic expansions than during recessions (1.05% versus 0.76%), but the difference is not statistically significant statistical noise,” Mr. Davis suggested. Perhaps less surprising, stock market volatility has been significantly higher during recessions, as risk premiums rise during periods of economic uncertainty.

“The primary reason there hasn’t been a strong relationship between recessions and stock market returns comes down to timing,” Mr. Davis said. “It’s inherently difficult for equity investors to ‘time the economy’ by getting out of—or back into—the stock market at just the right moment.”

Sounds to me that this is just one more argument for avoiding drastic changes to your investment strategy or portfolio as a knee-jerk response to economic tidal shifts.

Ack! We’re In A Slump! So What Can I Do?

Even with the existing coverage I’ve done on this subject, plus the healthy list of stock investing tips I’ve gathered in earlier posts such as the following:

- How To Invest Defensively In Down Markets

- Survive A Recession: Think Long Term

- Shrug Off A Stock Market Slide! How To Reduce Market Anxiety

- Down Year Ahead? How It Can Be Good For Your Investments

I don’t feel I’ve quite wrung everything I can about this topic just yet, so I’m sure I’ll have much more to say about this later on. For now I’m hoping this compilation helps you a little.

I’ll close by saying that recessions are part of the natural scheme of things, just like bad hair days, ant infestations and ugly weather. But if you’ve braced yourself for it, are flexible enough to go with the flow and think far enough ahead, you’ll realize just how quickly even unfavorable times fly by.

Image Credit: Recession History

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 17 comments… read them below or add one }

This probable current recession is nothing more than a buying opportunity. Impossible to time getting out and back in correctly. So you are better off continuing to dollar cost averaging throughout and if possible, increasing your investments. Unemployment is still very low, so that means there are still lots of us who are working and making a decent living. They should be taking this opportunity to invest in the beaten down markets, whether it be real estate or stock. Moving to bonds is not really a good option for the long term investor, only if you need to preserve capital for the short term.

We won’t know for sure if this is technically a recession until it is over, but it doesn’t really matter what label is applied. The important thing is the future direction of the marker which looks to be up. Recessions have been shorter, largely due to the Fed’s actions to stimulate the economy by lowering rates. This is good news for stocks and the long term investor, not so good for fixed income and safer investors.

Whether with the recession or other worrying things in life, I keep just reminding myself that I’m only 22. There’s a heck of a lot more years left. If this turns into a bad one, then I’m young and can keep working my way through it. And if not, then it’ll probably barely be a blip on my radar. I do wish food prices would go down, however. That part stresses me a bit.

Great write-up. This has been the central theme at every workshop I’ve done lately. Everyone wants to talk about the “R” word.

Awesome post! I have been feeling that someone was pushing a self fulfilling profecy for the last 6 or 8 months. If you talk about recession people get nervous, hold off on replacing that dishwasher or car, companies tighten belts, slow down commences and hits the news causing a vicious cycle. One person gets laid off and several hundred people hear about it and suddenly “a lot of people are laid off now”. One good thing I heard is that the flow of illegal aliens has slowed or reversed across the Mexican border. It’s nice that we have a neighbor that can absorb some of that unemployment. 🙂

It’s interesting to see how the past recessions compare to this one. I don’t think it’s a self-fulfilling prophecy because it’s mostly fueled by real estate losses, but I think people are starting to panic some. This recession is unusual in that the steep job losses aren’t really accompanying the steep decline in home values (as is typical). However, if this is what we need to get Americans to take a serious look at their debt and focus on making wiser spending choices, then maybe a small recession is a good thing.

If you ignore the 1973-1975 recession, the stock market has actually held up pretty well during the other recessions.

Great writeup. Although I also expect this little downturn (possible recession?) to pass quickly, the fall elections could play a big role. With many politicians promising to control more of the economy and to confiscate more wealth in the name of fairness, D.C. could do a lot of harm, dragging out a recession for years like the federal government did with the Great Depression.

Nice in-depth article on the recession. The housing market is also continuing in it’s downturn cycle. Existing home sales and year over year home values continue to decrease while lending requirements get tougher. Liquidity has been added to the home lending market, but investors are still hesitant to be exposed to the risk of further declines in home values. It was reported yesterday that New Home Sales have plunged to the lowest levels in 16.5 years and the year over year price declines are the worst in 38 years. I’m still looking for signs of a bottom and hope it comes soon.

Great article and thanks for reminding us what a recession really is (and not just what the media wants to call it). However, some parts of the country (especially those with high taxes and low innovation) have not been able to pull out of their economic slump– no matter how well the rest of the nation is doing.

Thanks for the article and reminder that a recession is normal and natural and there is no need to run around saying the sky is falling…

This recession is very different than the previous ones though

The average income of the blue colar population is remaining stagnant

Our budget deficit is astronomical

The feds cannot reduce interest rate anymore down to .5 %

banks will need a signifiant amout of bail out moneys to be able to start lending again since many of them do not have 50 % reserve anymore since their equity did decrease in value

The average working person is in too much debt

The bail out in my opinion is too little too late.

Solution:

Allow all bad banks, and insurance companies to go bankrupt

Give seed money to individual to start new banks and new insurances companies and start from basics.

(No Mortgage default swaps and other financial derivatives that are soo often misunderstood….)

David

We are on our way to a serious depression…Read about this on my blog.

This is just my second recession since graduating and I can tell that it is quite different from the one in 2001. I don’t have much experience but this one is a big one… Good research.

Now’s the perfect time to invest if you can. All the banks which received TARP funds are now posting record profits. Whether you think it’s fair or not that they are profiting off our dollar, over the next 10 years we’re going to start seeing serious innovation in conservative finance.

It’s not just that recessions affect stock returns. Stock returns also affect recessions. When people lose large percentages of the accumulated wealth of a lifetime, they become afraid to spend for many years. When people become afraid to spend, businesses fail and many people lose their jobs. The root problem here is the insane stock prices of the late 1990s, which made a huge price crash (and the recession/depression that always follows from an out-of-control bull) an inevitability.

There are only four times in U.S. history when we got to a P/E10 value above 25. On the first three occasions, we went to price levels 50 percent below where we are today. It is not certain, but the strong likelihood is that we have another huge price crash ahead of us.

I believe that humans can only take in so much bad news at one time. We took in all we could in September 2008 and it is now going to take another year or two or three before we will be able to fully admit how much long-term damage we did to ourselves by permitting prices to get so out of control in the 1990s.

There will come a day when prices will go back up. But I question how many of those who have been following the conventional advice will be able to hold on to their stocks through another 50 percent price drop. The bottom line is that I believe that further drops in stock prices (caused by the bull of the 1990s) will cause this recession/depression to go on for a good long time yet.

My hope is that we will learn something from this experience and begin considering more realistic ways to invest. I believe that all investors should be taking price into consideration when setting their stock allocation. That would make out-of-control bulls and the recessions/depressions that follow from them impossible.

Rob

This was a great visual. Thanks!

If you look at the earlier comments on this thread, they were more optimistic (it’s just a bump in the road). But those comments go back to April of 2008 when recession was still being debated.

Rob, you took a bold step adding the D word to the thread. But what ever we’re in, it’s really important that people stop thinking that it’s only temporary and that the good times will roll again in a quarter or two. This is a time to reassess, rearrange and retool more than anything else. It’s a time for neither optimists or pessimists, but for realists.