How do international stocks affect your stock portfolio?

The U.S. stock market hasn’t been doing too well of late. It’s hovering at its lowest point of the year, although it appears to be a reflection of all the bad news we’re seeing in the economic front recently. High gas prices, high food prices, high prices everywhere. Spending is up, savings and investments are down. The only other thing down in the dumps along with the markets and the economy is our collective mood about our whole financial situation.

But it’s times like these that you may want to review your portfolio’s allocation. The weightings on your portfolio may have shifted over time and now that it’s the middle of the year, it could be a good time to revisit your investment set up.

This is also an opportunity to decide whether you’d like to keep with the same allocation you’ve always had.

For the record, we’re currently between 25% to 30% invested in foreign stocks at the moment.

Yet my spouse is eager to do more to hedge our investments and go further into foreign holdings. He’s asked about possibly raising our international allocation to match the representation of foreign equities in the global market, which is around 50%. I’ve also known some people who have dumped their domestic holdings completely in favor of foreign equities. With the dollar in the dumps and everyone wanting a piece of America for cheap, I can see why folks are eager to take flight into international funds.

Not sure I’m convinced about following suit to this same extent. 50% in non-U.S. stocks seems very aggressive to me. I’m no longer single, young and carefree… and no longer as comfortable with this type of investment risk. But to lend credence to my concerns, I researched this topic further and reevaluated our foreign allocation strategy.

Thoughts On International Diversification

It’s worth reviewing why we buy foreign stocks. Here are some interesting points on this issue:

- International equities belong in our portfolios for the added diversification. With added diversification, you can lower the risk of your overall portfolio.

- When different economies behave similarly to each other, they are described as “well correlated”. The less correlated your investment asset classes are, the more diversified your portfolio, in theory.

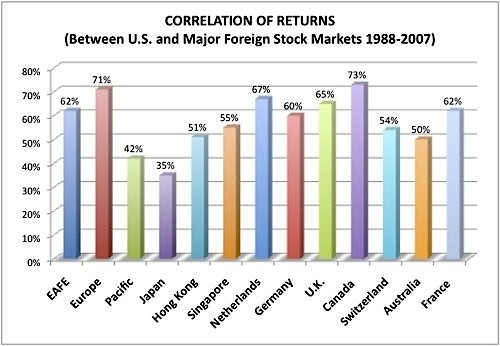

- On this note, market correlations between the U.S. and other countries vary widely, a good thing! You can see those relationships in this graph from T. Rowe Price:

- Developing countries, emerging markets, those countries with growing local markets or those less dependent on the U.S. economy are less correlated to the U.S. market. They may trend differently from the U.S. market.

- No country is completely immune to economic contagion. Even with low correlations between markets, any stock exchange can still be impacted by severe financial trends in other parts of the world.

- International stocks have higher average returns than U.S. stocks and come with higher volatility. But the combination of U.S. AND international stocks in a global portfolio lowers average volatility while producing higher risk-adjusted returns (e.g. higher returns for the associated risk).

A correlation of 100% means that a country’s equity market and the U.S. market move in lockstep. A correlation of 0 means that there’s no relationship between a foreign market and the U.S. market.

Check out this chart that shows this phenomenon. International stocks are represented by MSCI World Index excluding the USA. The global portfolio includes international and U.S. stocks (MSCI World Index). Stats for portfolios below are for 1970 to 2005.

| Total Return | Total Return Volatility | Return / Volatility | |

|---|---|---|---|

| International Stocks | 11.19 | 16.69 | 0.67 |

| U.S. Stocks | 10.72 | 15.36 | 0.70 |

| Global Equity Portfolio | 10.55 | 14.38 | 0.73 |

Returns are based on U.S. dollars.

Is There A “Perfect” Foreign Stock Allocation?

The short answer is YES. Apparently there is! According to this comprehensive Vanguard report on international equities, which includes some detailed analysis of risk, return, volatility and other considerations covering investment portfolio mixes, they’ve come up with a few recommendations:

A good starting point for any investment portfolio is an allocation of 20% in international stocks.

Allocation is one thing while the type of foreign equity you buy is another. Personally, I’d buy an overseas index fund or ETF that tracks an index for the highest diversification I can achieve. But some investors may prefer to focus on those stocks that are the least correlated to the U.S.

Consider an upper limit for your foreign stock allocation of 50%.

This is based on the proportion of the global market that foreign stocks currently represent. In fact, studies show that the effects of currency risk, progressively higher correlations (e.g. diminishing diversification), foreign taxes and costs outweigh any benefits of higher foreign stock allocations. Here’s what Vanguard specifically says about this:

While adding an allocation of 20% to 40% has historically been beneficial, adding too much can increase portfolio risks without the commensurate benefits. International allocations exceeding 40% benefit a portfolio incrementally less, particularly as costs are accounted for.

The suggested allocation range for foreign stocks is between 20% to 40% of your stock portfolio.

Although no absolute answer exists for all investors, it should be clear that an allocation range of 20% to 40% is reasonable given the historical benefits of diversification. Allocations closer to 40% may be suitable for those investors less concerned with the potential risks and higher costs of international equities. Allocations closer to 20% may be viewed as offering a greater balance among the benefits of diversification, the risks of currency volatility and higher correlations, investor preferences, and costs.

But 30% is the magic number!

Ah but wait! If you’re really looking for the foreign stock allocation sweet spot, finance theory points to 30% as the magic percentage. It’s the perfect overseas equity allocation to achieve the best balance between diversification (and therefore risk management and volatility reduction) and return.

With 20% international exposure, an investor would have captured 50% of the maximum diversification benefit. An investor with 30% allocation to international stocks has captured 70% of the max diversification benefit. Anything above an allocation of 30% shows that you don’t get significant volatility reduction and can in fact increase your volatility during some time periods such as from 1992 – 1999.

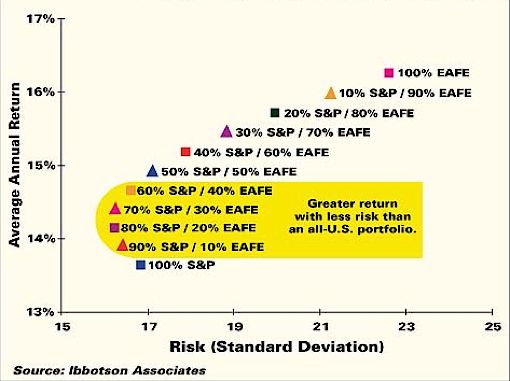

I found a few graphs that illustrate this conclusion, courtesy of ICMA-RC. These graphs were plotted using data covering different time periods. EAFE stands for the Europe, Australasia and Far East Index, which tracks overseas markets.

A Global Portfolio’s Risk vs Return, November, 1971 – November 1995

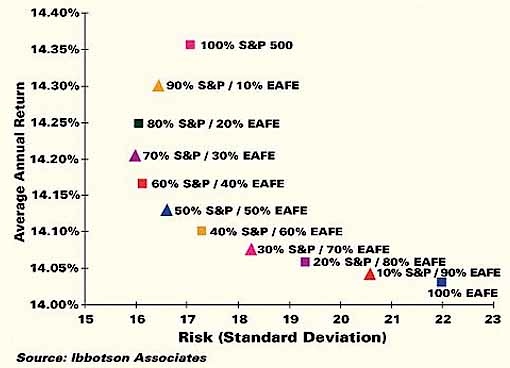

When covering a different time period, something interesting happens. The graph goes in reverse.

A Global Portfolio’s Risk vs Return, November 1973 – November 1997

Note that standard deviation is a measure of volatility. Funny how these two charts reflect different time periods but still produce similar results, with elliptical plots pointing to the same conclusion (albeit in reverse): that a 20% – 40% foreign stock allocation provides the best mixes that yield optimal risk-adjusted returns. The 70/30 split between U.S. and foreign stocks achieves the lowest risk and provides the best diversification benefit.

The main difference between these charts comes from which asset class had better returns during a given time range: in one time period, the EAFE-heavy portfolio yielded the higher returns, while in the later period, the pure U.S. stock heavy portfolio dominated.

These charts support what the Vanguard report states and also coincide with this chart from My Money Blog (lifted from A Random Walk Down Wall Street), as well as the revelations in this news article.

How Much Are You Allocating To Foreign Stocks?

A lot of folks gravitate to the 70/30 domestic vs international split, but lots more have it set up differently. Here is a look at how others have invested in non-U.S. stocks:

- DoughRoller’s allocation is 35%.

- Lazy Man’s allocation is 50%.

- Jonathan’s allocation is 40%.

- Pinyo’s allocation is 28%.

- G Blogmaster is comfortable with 20% to 30% in non-U.S. stocks (according to conventional wisdom), though he wonders about this Wharton professor’s recommendation.

- Morningstar Forum members have it all over the map.

How about you… what’s your allocation?

Now all these findings, coupled with this guide on how to incorporate foreign stocks into our long term investment strategy, has made me stick to our current allocation. For added foreign diversification, we may look into non-U.S. bonds or CDs instead. But that’s something we’re still mulling over.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 15 comments… read them below or add one }

Great article (as always). One interesting note is that Vanguard’s new Total World Stock Index Fund (VTWSX) allocates just 41% of its assets to U.S. firms. I’m not prepared to move 59% of my investments overseas, but it does underscore the movement of capital from the U.S. to other developing and developed countres.

I see what you are saying, but there’s something that’s missing from this argument. All of this data is historical. Globalization was just getting started at the very end of the date ranges of the charts.

Think of where the Internet was just 10 years ago vs. today. The world is changing so rapidly that the past should have nothing to do with the present.

Think about it if you lived in Europe… would you still put 70% of your money in the US, 10% in your home country, and 20% in other parts of the world?

Also think about it from the point of view of people who invest in their own company’s stock. We are the first to say that’s not a smart plan, because if your company goes bankrupt, you are out of a job and your investments are zero. If your money is in the US and the US economy tanks, you could be out of your job and your investments.

I’m sorry if this sounds un-American. I’m really one of the most patriotic people that you’ll meet, but I’m just trying to think logically and from a neutral viewpoint.

I have a bunch of money in Vanguard’s FTSE all world ex-US fund. It just recently removed its purchase fee. I think I’m also 25% in international funds. I also have vanguard global equity and Janus overseas in my retirement accounts.

I actually have 100% of my allocation of my IRA in foreign markets and have a return between 40-44% for the last five years. I’ve thrown around the idea of starting a mutual fund with a friend who educated me with this method of investing. Comparing to the Dodge & Cox International Stock, which is in Kiplinger’s top 25 funds to own, it can only bring a 25% return for the same period.

I think a lot of the investing advice floating around there in the mainstream media isn’t worth a hill of beans. Keep it simple.

Thank you for this; I love it.

I’ve heard a similar thing about stock/bond allocations. I can’t exactly remember, but I think it’s this: Owning 10% bonds gives you a higher expected return than 100% stocks with lower volatility. Owning 30% bonds gives you the same returns with even lower volatility (I think). And 20% had minimum volatility (I think).

One thing about weighting your stocks to your own country: you have less volatility due to changes in the exchange rate between your unit of money and that of other countries. Similarly, if you weight stocks slightly to your own company, then you are more likely to be invested in something you understand. (Of course, sometimes what you understand about your company is that you need to have as little stock as possible in that company!)

Great article and I enjoyed the indepth analysis. Having lived overseas for a long time I can definetly recommend the investment in foreign companies/countries. For those living in the US I like your approach “I’d buy an overseas index fund or ETF that tracks an index for the highest diversification I can achieve”. I have recently written about global investing and for now Vanguard international funds are my preferred choice. I am looking at other ETF’s as well given recent falls which present good buying opportunities.

Really great post!

I wonder if Foriegn currency counts in the magic 30% number, or if that would be considered seperate.

Thanks!

Excellent research! Your article prompted me to dig through some of my old notes from my college investment classes. I found a reference to foreign allocation being around 5-10% max! I guess that is a bit out dated.

If I am reading the charts above correctly it suggests that you put 30% of the funds in foreign funds and rotate those funds between Pacific rim investments when U.S. economy is tanking and move it to European based funds when the economy is flying high.

Thanks for the thoughtful and informative post. I have been considering doing some investing in foreign markets for some time. My mother does a little bit of dabbling with it, but nothing major. Now would probably be a good time for it…

Excellent well thought-out and researched post! I am currently at 9.9%, but am working my way to 20%. I will then reevaluate my long-term position.

Best Wishes!

D4K

very interesting.

there’s been some talk that foreign markets are no longer decoupled from the US – if the US tanks so will the rest of the world. we’ve seen this happen this year in the returns of foreign stocks in some countries.

that being said, i’d rather put my money in a globally diversified fund (I haven’t but I should)

I’ve been putting 50% of my assets in foreign stocks/currencies.

I’m currently at 30% but Lazy Man brings up a good point. The question is, is he right? It’s tempting to say that we’re in a “new kind of market” but those who say that seem to always get burned.

Great post! I’m about to do a major rebalance/reallocation and this is something to consider since I am exiting most of my international funds from a old 401k I had to liquidate and buying BRKB shares instead. But I still have to look at my current 401k and figure out what the heck to do there.

It is incorrect to say that “International stocks have higher average returns than U.S. stocks .”

It all depends on what time period you are looking at. For example, during the 1990s the MSCI-EAFE Index had an annual return of only 7.33% (w/ a std dev of 16.93), while the US return was an annual 19.01% (w/ a std dev of 14.39), according to Jeremy Siegel’s Stocks for the Long Run (4th edition) p. 164.