Here’s why we should teach money management and personal finance in schools.

I don’t think it’s a stretch to say that most people would be happy to see personal finance being taught in schools. I’ve wondered if the bottom-line is ironically….money. Perhaps schools don’t have enough money in their budget to teach it. I’ve noticed that even private schools don’t offer it. Being a mom who’s become aware of what goes on a little behind classroom (or school office) doors, I’m offering a few reasons why this could be the case:

Why Don’t Schools Teach Personal Finance?

#1 School budgets are already limited. In California, the issue of public school budgets is as sticky as they come. Parents, teachers and school administrators alike have all their eyes on our governor to quickly pass his mandates for school funding; any delays throw huge monkey wrenches in our schools’ planning and budgeting processes. If many existing, standard classes (such as art, music, P.E. or even science(!)) sometimes get axed because of limited resources, then wouldn’t it be much harder for unconventional subjects like personal finance to make headway in school curriculums?

#2 Money management or personal finance topics may already have some coverage in schools, just not in the way you’d expect. The topic of money is often threaded into other subjects: for instance — currency may be discussed in history or the social sciences, or money problems introduced with mathematics. The subject of finance doesn’t get its own focused class, but may be taught in bits and pieces across various subjects.

#3 Schools don’t have personal finance advocates on board. Who knows what goes on within a school’s chambers? Our schools have many other things to worry about (*cough*politics*cough*) such that the issue of accommodating a new subject may be too much trouble or may just not get enough priority. Unfortunately, inertia rules.

Yes it could be all about politics or money. Just like everything else in the world, we’re not getting lessons in money management in schools because there’s not enough support for it, or because we can’t afford it.

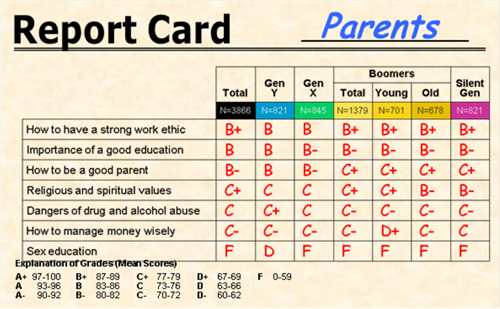

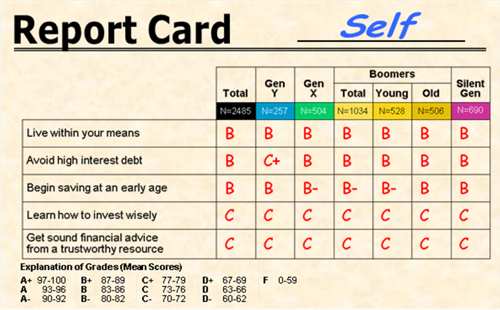

Well, with nobody but ourselves to teach our families about finance, here’s what a survey from Schwab reveals about the public’s report cards on the subject of money. The results aren’t too bad but they aren’t excellent either, and there are definitely huge gaps in the average family’s lesson plan on finance.

Personal Finance Report Cards

The Schwab survey participants included people from the following age groups:

- The Silent Generation, retired people (ages 63 to 83);

- Baby Boomers, the next generation of retirees (ages 44 to 62);

- Generation X (ages 32 to 43); and

- Generation Y (ages 21 to 31).

These participants were then asked how they would grade themselves as personal finance teachers to their own children and how well they were taught at home about money.

Money Management Survey Findings, Across The Generations

• Parents were given poor grades for talking to their kids about money. The subject of money management ranks only 2nd to sex and drugs as the least discussed matters in the home.

• Parents across generations are instilling decent lessons in children when it comes to the principles of living within one’s means, avoiding high interest debt and beginning to save early. But parents haven’t supplied as much guidance on how to invest wisely.

• Only 4% think they have a high level of expertise around money management and personal finance matters. While almost half (49%) say they know “a little” about these topics.

• Most respondents (78%) acquired their financial management skills on their own.

• Survey respondents gave their parents high grades (B+) for teaching them to have a strong work ethic, but a “C-” for teaching them to manage money wisely.

• The older generations emphasize different matters of finance than do younger generations:

- The Silent Generation said the most important lessons parents could teach their children about saving and investing are: (1) live within your means (74%) and (2) begin saving at an early age (64%).

- Generation Y believes more than any other generation that learning to invest wisely is the most important lesson and, indeed, is more likely to believe that investing wisely will be extremely important to achieving financial security in their retirement. The Silent Generation believes this the least.

• More than half of parents surveyed (57%) don’t teach their children about saving and investing because they don’t believe they have enough knowledge to do so.

• A majority of people (78%) say their parents don’t know enough about saving and investing to teach them. 61% said the biggest barrier to teaching children about saving and investing is that children have no interest in learning about the topic from them.

• 95% of those surveyed believe financial management should be taught in school.

Some great insights can be picked up from these results. They may hint at why the average person in the U.S. carries so much debt, why our national debt is currently where it stands and why most investors don’t make money in the stock market. It may explain some of the reasons for the subprime mortgage crisis, why so many are going into foreclosure and are working past retirement. Could it be that we’re spending ourselves to oblivion, not only because we can’t help it but also because we just don’t realize we’re compromising our financial futures by doing so? The lack of awareness and education in the area of money is what’s keeping many of us broke. What should we blame for the subprime lending crisis and the dreams turned American nightmares? Our lack of knowledge in money matters. If we can’t get these basic lessons taught in our schools, then we’ll have to step up and fill that vacuum at home, even if we have to take the crash course on money ourselves!

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 27 comments… read them below or add one }

What I find interesting is that everyone’s parents were well above average (B/B+ grade) at teaching their kids to work hard but were really terrible (F grade) at teaching them about sex. But if everyone was that way, wouldn’t that make them all average (C grade)?

I guess it depends on how the grading works, but Schwab definitely wasn’t using the Bell Curve.

The report cards show that grades were based on “mean scores”. I am presuming that the grades were given out by the survey participants themselves and so there wouldn’t be a bell curve involved. Just people measuring themselves and their parents using a numerical system (and number ranges) that map to letter grades.

I am not waiting for the school to teach my kids about personal finance. I’m letting Dave Ramsey do that for my high school age kids.

Anyone that pushes self restraint – pay with cash, no credit cards, no debt – I’ll fully support.

The debt cycle starts early and continues throughout life and in the end; you cannot retire since you have nothing left.

I’m a father of ten and debt-free except for my house. It can be done, so get on a budget and stick to it.

I agree with you that there would be huge problems teaching financial management to kids in grade or high school. Another problem with teaching such habits is that, without practical experience, no amount of theory or examples will convince kids not to go out out a credit card shopping spree as soon as they can get loans.

Some things only bad experience can teach to people, and financial management may be one of them. Instead of just teaching how to spend/save money, maybe more time should be spent on critical thinking skills. Someone who can read and think about a contract may not be so willing to go ahead with a $0 down, no income, no assets, no job mortgage for a $500k house.

My father has always said that if there were one thing he wishes I would learn, it would be how to leverage the money I have in order to make money without working twelve hours a day for fifty years. And yet, my parents never spoke to me about our family finances while I was living in their home. I think that they avoided the topic because they didn’t want me to spend my time being worried out money, and I thank them for providing for me in such a way that I never had to. Nevertheless, parents do their children a disservice when they do not give them at least a cursory education in how to manage wealth.

Personally I don’t think personal money management can really kick in until the kids are either 1) older or 2) go out on their own.

For example, I considered myself pretty financially sound compared to others growing up; however, as I grew older I begin paying for my own stuff it finally clicked in my head out much I took money for granted. Now I question whether I should buy those pair of shoes when before I would wonder why wouldn’t I?

So no matter WHO teaches it, unless the kids are actually given REAL life experience it probably won’t effect anybody.

Perhaps it should be rolled into a “life skills” class that should include some basic life skills and how to interview for a job, interact with people, etc. Money management (and the consequences of not doing it) needs to be taught in school because parents aren’t teaching it at home.

Money it’s one of necessary thing to led a life.Most of the parents were well above average (B/B+ grade) at teaching their kids to work hard but were really terrible (F grade) at teaching them about sex.The report cards show that grades were based on “mean scores”.Perhaps it should be rolled into a “life skills” class that should include some basic life skills and how to interview for a job, interact with people, etc.So no matter WHO teaches it, unless the kids are actually given REAL life experience it probably won’t effect anybody.

Unfortunately at this point I don’t think we can rely on parents to teach money skills to their kids because many of these parents themselves and neck high in credit card debt.

At the least we should have some classes in high school that talk about the basics of personal finances and interest. There should also be a few classes on the step by step process of how people get overloaded with debt.

I’ve seen numerous surveys such as this over the years and all of them are based on three concepts. The first: Identify the need. Second: Create a feeling of inadequacy and incompetence. Third: Develop a strategy to make money from this insufficiency.

If personal finance were a static subject as History, Math, and English (classes that teach concepts to move forward with) this would be an easy task. But it is not. If it were, there would be no business channels, no need to report what new financial product has been developed to promise shareholder profits (under the guise of doing you, the consumer some good), and certainly no discussion about whether our kids should learn finances at summer camp. Really.

Once we begin grading ourselves on our own child-rearing performance, we risk the face-to-face appraisal of how good we are and how much to blame we will eventually be if, for some reason one of our kids fails to take our advice and decides that being an artist is what they want to do, even if they will starve (without parental subsidies) or another decides work with the less fortunate in our society (also a noble undertaking that requires a few bucks from Mom and Dad here and there).

Are we supposed to teach our children to go forth and earn as much money as possible, therefore easing the burden of their own personal finance or allow them to become what they will, advise them as you might and let their own personalities take its course?

At the heart of personal finance is the word personal. This is concept of uniqueness, a state of mind that is formed after years of trial and error, advice taken and not, and with any luck, some unexpected good fortune.

Most of us blunder through the world of finance hoping to grab something, some tidbit we can use. What we can do is show our children, when they are old enough, the finances are difficult with no real answer to every question.

We can hope that our children understand what it is like to struggle with the day-to-day, paycheck-to-paycheck existence that many of us have and even fewer admit to.

Show vulnerability when they are old enough to understand. Don’t let averages, mean, median or otherwise guide you in your daily life. Each personal finance story is different and we should let schools (which in almost every instance do a horrible job at managing their own cash flow) teach the rigors of study and not the nuances of life.

I learned all the skills I needed in school. They taught quite a bit of math–it’s hard to get out of there not knowing that a small number minus a big number equals a negative number.

I learned to read, and credit card companies, etc. have to disclose their terms in writing, so that works out.

I learned some economics and some history, so I know that economic things change over time (yes, we studied the Great Depression) and can be different for different people (we studied slavery and the Civil Rights movement).

The problem really is that some people don’t learn to actually think about their finances and to apply the skills they have to their own finances. It reminds me of one time that one of my friends realized he could apply his brain power to his personal relationships. Yes, you can. Instead, many people get themselves into habits without even thinking about it.

I think that it is important to start teaching kids when they are young at least the value of a dollar. It doesn’t take a financial guru to instill basic financial principles. Even a basic understanding of money is a start, and like PersonalBudgetTraining said: find someone else to help if you need it.

Sometimes the things I see and hear with regards to money just blow my mind, and the only way I can get a release is to write about it on my company’s blog. A month or so ago was just such a situation and it pertained to this exact topic:

http://letsblogmoney.com/2008/06/17/start-teaching-your-kids-early-to-build-a-strong-financial-foundation/

I think a lot of people just don’t care and part of the blame goes to the school system, but a lot of it is a personal choice.

I know a few people who have a decent amount of debt, and I see the same attitudes in my personal dealings with them that caused them to be in debt.

I think part of the blame should certainly go towards the school system and parents, but a lot of it really is personal choice.

Looks like a Malaysian survey would show about the same results.

Our schools are failing in even teaching the 3 R’s so, let’s not talk about pf or other life skills.

My wife and I are now trying to teach the kids pf ourselves. (And we would rate a C- or even a D. At least we now have experience.)

I don’t know if it is really necessary to teach personal finance in schools. However, I do feel like parents should be doing this all along.

“If personal finance were a static subject as History, Math, and English (classes that teach concepts to move forward with) this would be an easy task. But it is not. If it were, there would be no business channels, no need to report what new financial product has been developed to promise shareholder profits (under the guise of doing you, the consumer some good”

I agree that schools should not be teaching students about the latest financial products or what to invest in. But schools could teach the basics about how to maintain a budget. Also I dont think schools should be telling people not to become artists. But whether someones budget is 1,000 a month or 20,000 if someone knows how to maintain a monthly budget and anticipate expenses they will be in better shape.

That’s a very interesting point about the majority of parents not having sufficient knowledge to teach their kids about money.

I never really thought about that but with so many of these same people struggling with loans credit cards, mortgages, etc, I guess it makes sense.

While I agree that the heart of personal finance is personal, as Paul and some others have stated, the personal side of finance cannot be put into play if you do not understand how the various transactions in the financial world work. Even with the base skills of math and reading, this still doesn’t explain stuff like the difference between a fully amortized loan versus a daily rate, two cycle billing, how a car loan and home equity loan differ from credit cards with interest (hint: car loans and home equity loans do not add the interest to the principal), how to compare different interest rates (APR v APY), how the stock market works, how indexes are formed, how a mutual fund works, etc. Without the knowledge on how these debt/investment tools work, it is hard to make the “personal” choice in regards to risk tolerance, lifestyle, etc.

The basics should be known and easy to follow: live within your means, work hard, build a career, save for retirement. And while it seems so simple that one should not buy a house they cannot afford, what exactly does that phrase mean? 15 year, 30 year, ARM, interest only, negative amortization, PMI/MMI, prepayment penalties, CLTV, Debt-to-Income ratio, FICO…these are all things that play a part in buying a home, and kids need to at least know the terms so that they can truly know what they can afford. This all depends on risk tolerance, assets owned, down payment, net income. These are the tools that one can make that personal decision.

While it may be simple to just tell someone “You can afford a house at 25% of your net income”, it doesn’t factor in many other pieces of the puzzle. If kids have the tools early on, they can make those personal decisions easier down the road.

I had this professor in High School who was always trying to teach us about finances, unfortunately none of it stuck because I wasn’t aware of finances in my home life. Now, over a decade later, I find myself wishing I could remember some of what he said. Which is why I read this blog among many others!

Here’s why I think personal finance is not taught in school: no one is tested on it, no one receives funding based on it, and colleges don’t admit based on it…

Here’s a lesson I learned as a business person: if something is not measured, it rarely happens…

The metrics you set and the tests that you decide upon to measure your performace, set the way you perform. Schools aren’t measured on their students’ financial literacy – hence, student are taught financial literacy…

boring

Kids should start learning this stuff while still young to instill in their minds the importance of saving and correct money management. In the long run, it will be beneficial both for them and their parents as well. When will this be realize? This is the big question.

The insights are great. We do need to take the advice of those who have learned through experience how important learning and teaching some of these issues are.

I was not taught the importance of knowing and managing finances, and neither was my husband, and it has been a hard lesson. We have tried to teach our children to be wise with their money in real-life, not just out of a textbook, and hopefully they will have an easier time than we have had!

It is very difficult for me to mentally compute money in head because I mess up when adding up the money in my head without using my calculators. I used to get coin values all mixed up. It took me a while to get the coins straight.

I was unable to distinguish between coins.

Basically finance is not taught in schools because they see it as not important, but it is very basic to our society. But that is the way of schools, I took many courses in college (required) that were not relevant to my chosen career path. It’s just not deemed relevant by the powers that be, but it should be corrected.

Financial education should be taught in public schools.