Saving for your child’s college education is slipping in priority, according to a Upromise survey.

Saving for college is one of our bigger long-term savings and investment goals, second only to funding our retirement. Given that I was born and raised outside of the United States, the biggest gifts my parents have granted me and my siblings were the opportunities to study abroad — in particular, we received the chance to pursue our higher education in the United States as foreign students. Unlike the way things are structured and handled in the U.S., my parents saved for our college education the old-fashioned way and did not have the benefit of using 529 plans or UTMAs to shelter those savings.

That need to save for college is universal.

Lately though, parents everywhere are feeling the pressure from this current economic climate, and many are putting the financial goal of saving for college lower in their priority list. We’re seeing some indication of this through a survey that Upromise just put together, which showed some concerning results:

Out of 1,000 parents who were involved in the survey,

- 80% didn’t believe they were saving enough for college.

- 58% attributed their lack of savings to escalating gas prices, groceries and utilites.

- Greater than 75% thought that the government should do more to make college more affordable.

- 67% admitted that this issue (and the positions of our presidential candidates on this matter) will influence the way the survey participants will vote this November.

- 82% are concerned with the growing cost of college.

- 88% believe that a college education is needed to compete in a global economy.

- 79% think that the U.S. is falling behind other countries in terms of quality of education.

- 67% think that the U.S. is falling behind in terms of access to education.

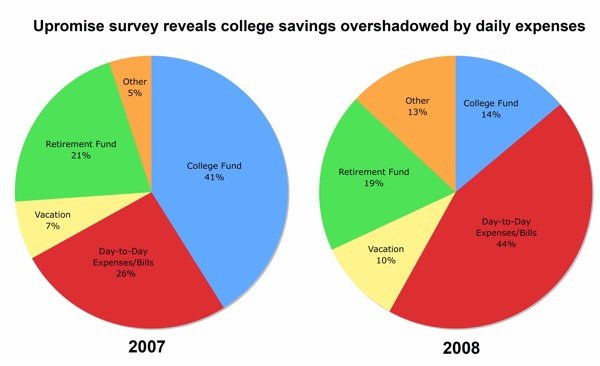

And more telling points — check out the following table that demonstrates the comparison between financial situations faced by parents in 2007 vs 2008. Survey takers were asked a few questions:

| Economic Scenario / Question | 2007 | 2008 |

|---|---|---|

| What would you do with a $10,000 windfall? | 41% said they would apply the windfall to a college savings fund. | 14% said they would apply the windfall to a college savings fund. |

| How much does the average family spend on back-to-school expenses? | $563.49 | $594.24 |

Interestingly, back-to-school purchases have increased over the last year, for the average family. So people aren’t necessarily cutting back on spending for the near term, they’re just not saving as much for the long term.

In addition, this Upromise survey graphic shows just how parents intended to save a windfall for various financial goals. A quick look at how the typical savings plan (for new savings) has evolved over the last year reveals a shift in financial resources from longer term financial goals (like retirement and college savings programs) towards shorter term financial goals and obligations such as bill payments and saving for vacations. That is, if people received a boost in their savings, the charts below show how they planned to use it.

These changes may be a response to our present economic conditions rather than a true shift in priorities. But what do you think? Do you think the economy is to blame for why Americans are saving less for college and retirement? I see the economy being the usual scapegoat for all the negative financial stresses and events that people are experiencing today. But are people just making excuses to justify the drop in their household savings rate?

Copyright © 2008 The Digerati Life. All Rights Reserved.

This is so true. With rising utility costs, the credit and housing messes, and simply the general public’s inability to save it is becoming increasingly more difficult to properly fund a college education. I personally love Upromise. There is no real interruption in my regualr routine in order to get the contributions, and there are so many ways to save with the program, I can’t imagine why more people don’t take advantage. It’s essentially free money! I even wrote about it in order to get the word out and hopefully help people in my blog post entitled

Worried about the rising cost of a college education? Discover Upromise.

Savings is simply the easiest to cut when your financial situation worsens. This is somewhat like asking whether healthcare spending went up because of an epidemic or if the epidemic is simply a scapegoat.

Look back in five years and you’ll see how habits have changed (if at all). Right now, you’re just seeing everybody trying to maintain their comfortable budgets with a ‘short term’ cut to savings. Long term, it’ll be a balance of fear of dog food in retirement vs. comfort today.

I also find it quite interesting that while retirement savings has decreased just a bit, “other” has almost tripled. I think you’re seeing a bigger shift in perception among parents with upcoming college expenses than an actual shift away from college savings more than other savings. After all, there’s no way the average American was saving 40% of their salary toward college funds in the first place!

@Eric,

Upromise is one of those things I immediately signed up for when I heard about it. Great idea for those families who want to boost their college savings painlessly. 🙂 Now I’ve wondered how the savings I do get from my Upromise’s credit cards compare with those cash back / rewards cards I’ve been researching recently. I’ll see if I can report back what I find out, at some point.

@Deamiter

You make great points. From your statement: “there’s no way the average American was saving 40% of their salary toward college funds in the first place!” I realized that I had to qualify what I wrote in my post. It does seem at first glance that people are supposedly applying 41% of their disposable income towards college savings. What I understood the survey data to show was that those savings really refer to a windfall.

The question was asked parents: what would you do with a $10,000 windfall? And they responded according to what those savings charts show.

So your take is that the changes can be attributed to parents with upcoming college expenses reorienting their savings goals? I’m surprised that a change like that would occur literally “overnight” though — the data comparisons were for surveys one year apart, so I’m not too sure the demographics of their survey recipients would account for those shifts.

This shows more how quickly people’s attitudes change than real change. People constantly talk about how the economy effects their decisions (to buy more, save… whatever). Rarely does the explanation have merit. I worked for the federal government for years. None of the employees’ personal finances were effected much by changes in the economy. Yet they voiced the same reasoning.

Those people that lose their jobs, yes, their spending is affected. And some may increase savings due to believing a greater likelihood of losing their job. Some may see their income decline and therefor adjust (tips, commissions, small business profit…). But in general I find these survey more like surveys of commentators for why a certain stock when up $4 today. And now why down $3 today? And now why up $2 today? etc. They just make up stuff that seems like it is reasonable based upon what others think.

The proper financial moves rarely have much to do with the economy that month or year.

@Curious Cat,

I gather from what you’re saying is that these are just short-term blips in people’s savings plans, and upon reflection, I suppose what we’re seeing here isn’t surprising at all. There’s a hiccup in the stock market and everyone readjusts for a while then when things start getting rosy again, plans are once more reset to the way they were.

What this survey echoes is what I would expect all along: if prices are higher and you’ve got a fixed amount of money, your disposable income will shrink. That disposable income is what pretty much goes to your various savings buckets.

This was a very interesting post. The graphs and data were also great. I think the cost of college is a huge issue in the US that is further seperating the middle class from the Upperclass. I was lucky to grow up in an upperclass family that paid all of my college expenses. Many of my friends had to foot the bill for college though.

College debt just places the poorer middle class further back. It is difficult for the average american to save for retirement and a college fund (especially when college costs rise 3% per year). Also, if that middle class person is forced to pay back their own student loans they are even further behind.

The shift away from college savings during this economic downturn is as expected. People prioritize spending at all times. In hard times needs are prioritized over wants. Paying rent and buying groceries are wants. Saving for retirement and college education are wants.

Additionally, parents are being advised to focus on retirement over children’s college education as you have less time to save for retirement compared to the time your kids have to pay off student loans. I firmly believe that if you work hard, you can gain access to a college education. I chose the route of an expensive college education over a state school and had to take on student loans as a result. The difference in my starting salary compared to my friends who went to the state school more then compensated for the student loans within two years of graduation.

Skimping on college savings is not such a terrible option for parents. I’m personally interested in seeing the government try to help children earlier on with education rather then see them help children through college.

This is the first I have heard of Upromise, but it seems as though it is a very unique way to save. Very interesting post!

@Matt:

I’m not quite sure of the intent behind your comment on the middle class being required to repay student loans. All people who borrow money are required to repay such loans, not just the middle class.

Going to college is not always the financially burdensome task that it is made out to be. If the only goal is to further one’s education and be set up to achieve greater things via attaining a degree, then a local school would be more than enough, especially taking into consideration the fact that there is no need to pay for housing, or meal plans (the largest costs of higher education). The matriculation fees are significantly reduced for in-state residents, and with the advent of such sites as textbookx.com, and amazon.com textbooks can be found at significantly lower prices than campus bookstores. Plus, if planned for properly, there are scholarships, as well as federal, state and school-sponsored grant programs. And, almost all schools offer night-classes for those that need to work during the day, and who still desire to improve themselves by furthering their education.

It kind of makes me think if we should send everyone to college. I know that in the job that I currently have a college education is totally unnecessary (I work a normal office type job). However, it did require a college degree. Education should be about more than getting a rubber stamp on your resume to get a job – it should be about specialized training and the advancement of communal and personal knowledge.

I’ve got 3 daughters under 4…I’m 29 years old, and truly have trouble figuring out where to start with the whole college saving thing. My first step was some cash value life insurance. Cash growth plus death benefit just in case, seemed like a good idea.

I’m making a sound financial investment in contraceptives instead right now : )

Vacation went UP?

Sounds like more than few people are sticking their heads in the sand.

I’m with the majority on everything listed except when it comes to government interference and how the candidates think. Government only makes the problem worse. Never better.

The shift from 2007 to 2008 in living expenses is only going to get worse next year unless something is done to lower fuel prices. Have to agree with Steward about college. For the most part, it is just a rubber stamp on your resume, unless you are in a very specific field that absolutely requires specialized knowledge.

Wow 41% down to 14% in one year. Just another way we are sticking it to the next generation. Well, my kids are 2 and 6 months so I have some time. The question is whether the dollar will hold up before they start school.

What’s going on in Vacation and Other? It seems like priorities are shifting…

Thanks for contributing this wonderful article to the Carnival of Family Life, hosted this week at Write from Karen! Be sure to visit Karen’s site on Monday, August 25, 2008, and check out this week’s other excellent submissions!

We don’t have kids yet, but my husband had his schooling paid for by his parents and we’ve still got the better part of a decade to pay mine off. Mind you, I got a 3% interest rate, but it still is hard to be paying student loan bills when you’re just starting out. The plan is to save and invest in a way that will create the extra income needed to pay for our kids educations.

I think that the savings rate was kind of bad over the last few years and got worse recently with the downturn in the economy. While I agree to some degree with people who think college is just a rubber stamp, it’s still a very important rubber stamp that can have a big effect on salary in the first few years. And the college one attends can also have a big effect on earnings in a particular field. When I graduated, a few companies I interviewed with not only wanted a college degree but where only interested in graduates from a selected group of colleges.

Great post and just a quick note to let you know it was included in the 28th edition of the money hacks carnival (Careers/Education section), which I hosted this week.

I think it’s sad how we monetize institutions that should be a right to everyone. We need to stop making education a business, and instead make it a priority.

Comments on this entry are closed.