Tired of your old shoebox? Here’s a simple system to keep financial records in order.

Like many small business owners out there, I’m always much more enthusiastic about the actual service I provide than in the back-end, record-keeping tasks I have to do to keep my business humming along smoothly. But over time, I learned how necessary it was to take the time to set up a system to keep track of my business finances, because as I found out — if you wait until tax season, it can really be a nightmare!

Note that along with the simple system I’m about to describe, I also use business financial software to manage my finances. Some notable software products that are popular among small business owners include Quickbooks Premier and Quicken Home and Office.

A Really Simple System For Keeping Financial Records

People will tell you to “save everything” that has to do with your business, particularly receipts. My first year in business, I had a box on the floor under my desk. I would literally throw every receipt, invoice, and business document that I wasn’t sure what to do with into that box. When it came time to file my income taxes, I had to go through every sheet of paper in the box, and it was quite a hairy experience to sift through! Plus, whenever I needed to find any receipt, form or other documentation at any time, I had to dig through the pile each time and hope I could find what I needed. Not the best system!

So I had to make changes or face mounting frustration with my paperwork. Here’s a better idea for an uncomplicated storage process for receipts:

Materials Needed:

- 3-Ring Binder

- Large manila envelopes (about 10)

- 3-Hole Punch

- Pen

Step One: Assemble the Binder.

The idea is to attach the envelopes into the binder. With the flaps of the envelopes facing up, flaps open, and the opening towards you, 3-hole punch along the left edge of the manila envelopes so that they will fit centered inside the binder.

Step Two: Create Categories and Label the Envelopes.

On the top flap of each of the envelopes, write a business category. These will vary based on the type of business you do, but for me, as a freelance writer, some of my categories include:

- Office Supplies

- Telephone

- Internet

- Subcontractor Payments

- Travel

- Home Utilities (I work from a home office)

Step Three: Record and Add Your Receipts.

Whenever you buy something for the business or make a payment on behalf of the business, write the date and amount on the outside of the manila envelope, and slide the receipt into the appropriate envelope. You can prepare a list of items on the outside of each envelope that can easily be referred to throughout the year if needed, which will then make tax season so much easier. (And help you make the most of possible business deductions).

This system has worked really well for me. Now you may say — why not pick up an accordion folder or “expanding file” to do the job? I say why not? Go with whatever works and what you’re happy with. My customized system which you can construct on your own will do the trick, as will many other organizational systems. I just happen to like the use of a binder to carry my papers.

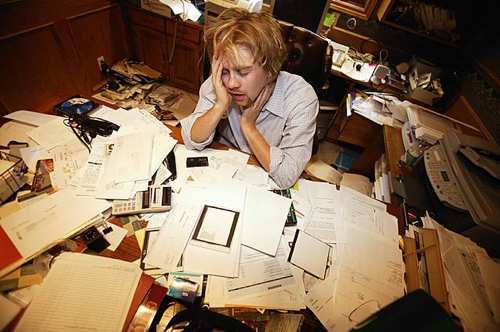

So if you’re tired of feeling and looking like this, particularly during tax time 😉 :

Photo from Hitchcock Realty

And would rather have your place of work look like this instead, no matter what time of the year it is,

Photo by Jorgeq

Then take a look at one of the steps I’ve taken to assure that I retain my sanity when it comes to my business records.

If you’ve got some quick tips for organizing your business (and personal) records that make life ten million times easier for you come tax time, please pass them along! I’d be interested to know how others manage their paper trail. Interestingly enough, many of my entrepreneurial friends still insist on using a shoebox, out of habit. 😉

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 17 comments… read them below or add one }

For personal finances, if you use software for tracking income and paying your bills, the shoe box is just fine (and is what I use) for every piece of paper except documents you know you will need at tax time. Those can all fit in a single folder.

For a small business, to be honest by the time you do all of the organizing and filing you describe, you could scan the stuff, archive it with a couple of keywords and be done with it. You can always find it later using a search engine like Google Desktop. Normally you won’t need to find it if you use a decent accounting package. Paper is the enemy.

Mr. ToughMoneyLove,

You must be doing this a while! I’m new at being an entrepreneur, so I haven’t worked on a well-organized system yet myself. I agree that there are a lot of people out there still doing the shoebox method. I have talked to various tax professionals who tell me that a lot of their self-employed clients still use boxes. Some have built very complicated processes around these boxes 😉 and are content with using those.

I’d like to go past the box stage myself and am interested to hear how people organize their documents. So thank you for your suggestions and for sharing your system with us!

Being in real estate, I find that record keeping can be a real pain, but an absolute necessity. I have been using an expanding file folder to categorize receipts and mileage forms, but I like your idea better.

I throw all my business papers in a basket and file everything in accordion folders at the end of each month. For credit card receipts (95% of our expenses are charged), I enter/categorize in QuickBooks and throw in a folder. Once the statement arrives, I match all the receipts to the credit card statement, staple and file it. I hate filing daily so doing it monthly works for me.

The 1st picture on the site looks just like my desk. I’m going tomorrow to get me a 3-ring binder, 3-hole punch, the rest of the items I have. I’m going to make my desk the most organized place ever. Thanks so much for the information and it is so simple, don’t know why I did not think of it.

I too work from home as a REALTOR in Metro Atlanta. So as you can see, your organizational tips are useful on the east coast as well. Tax time is always so frustrating.

I try to put as many expenses as possible on one credit card. That way I can easily track my expenses by month and by year.

I agree with Austin Real Estate Guy. I like your idea better, too.

SVB,

It’s been said that a cluttered desk is the sign of a cluttered mind. Therefore, an empty would be the sign of an ….

I think I’ll keep my cluttered desk 🙂

I like the idea, I’ve used envelopes in a box but it hasn’t been overly effective. Thankfully I haven’t needed to be too organized about it. I think finding a system that works for you isn’t going to be what someone else suggests – I think you need to find what works for you.

One user suggested scanning the documents – great but what do you do with the originals? Depending on your business you might need to keep those as proof and a scanned version might not hold up. The point is look at examples like your very good one and adjust to see if it fits for you.

I really like the idea of your manila folders in a binder. It just seems like it would look and feel good to me.

I can also see how scanning things like ToughMoneyLove suggested could be a really useful way to keep your records, but I think I could get lost in it quickly (*not that tech savy*). I think it will be a manila envelope for me.

One important thing to have is a “snatch file,” something with all your most important documents so you can grab them in the event of a fire, flood, whatever. Ours is bright red accordion folder so you can’t miss it.

This system is interesting and looks really useful.

I work from home as a web designer in Metro Atlanta and while tax time is always so frustrating, your organizational tips will help me out quite a bit. Thank you for this post!

I gotta say, my book keeping sucks big time and I am too lazy to do it. As a result I have a panic at the end of each year to do my tax return.

I found the easiest way was to hire someone once a month to come in for a couple of hours and do it for me.

Basically I have 4 trays: Receipts, Invoices, Bills, Other. The guy comes in and empties the trays and fills in the spread sheets for me 🙂 $100 a month… well worth it 🙂

At the company I work, I often sort receipts chronologically and then tag them according to the month we received them. It helped us in a big way, especially at the end of the financial year when we prepare our tax returns.

I don’t know if you’ve ever heard of this, but I recently picked up a handheld scanner and the “NeatReceipts” software. It’s awesome. Basically, when I get to the office I just run my receipts through it, and it stores them digitally, categorizes them, and tallies the totals for tax time.

Just to add to your brilliant system. Use sheets of paper (old docs no longer in use) and write the month on it. Staple the slips for a particular month (eg. Jan, Feb, Mar, etc.) to that sheet of paper marked for that month and put that into the envelope. That way you will have a monthly record.