With the economy making headline news, what do you think of the way the media is handling the financial crisis? Is it just me or does it smack of drama and hyperbole?

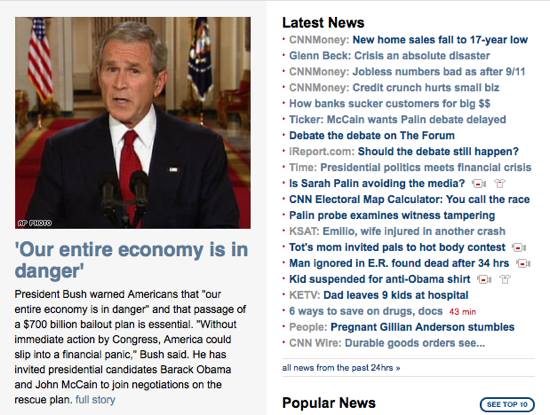

Financial panic. Distressing scenarios. The market is not functioning properly. Widespread loss of confidence. We cannot risk an economic catastrophe. Long and painful recession. Our entire economy is in danger.

Disturbing words from Dubya and it all sounds critical and precarious.

Tell us again how we’re this close to financial collapse unless we succumb to a bailout. How we’re on the verge of ruin.

Times like these, I want to put my head in the sand, or fingers in my ears while I sing “Lalala, I can’t hear you”. No, I’m not going nuts here just yet, but I’m beginning to approach “financial crisis overload” from the stuff I’ve been reading and hearing about lately. As I digest each day’s financial events, I’m not sure what to make of all the media madness trumpeting how everything is falling apart in our economy.

How much of this should I believe in? How much should I take with a grain of salt? Is it all overplayed or overhyped? I know it’s “bad” but I wonder just how bad. Should I be so afraid that I become motivated to take out all my money and hide it in my kid’s toy chest in the closet? (Of course that’s just a hyperbole 😉 ).

So I frequent the CNN Business section and all I’m seeing there right now are gratuitous expressions of gloom and doom, news to frighten us out of our britches and stoke us into panic. Yet so far, my empirical observations aren’t in line with what I’m reading as I haven’t personally felt the consequences of this economic malaise, except perhaps when I look upon my somewhat ravaged long-term stock portfolio. It makes me uncomfortable some, but occasional slumps in my portfolio are nothing new to me, and for the most part, I’ve (wisely?) shrugged off these occurrences each time.

The Financial Crisis: Do You Feel It?

So is this financial slide any different? How the media has jumped on the story of our economy, making it constant front page news complete with “financial crisis timeline”, makes it sure seem like it is. But depending on where you’re perched, you may not see evidence of the real estate market contraction; for instance, with prime real estate in the Bay Area still selling for ridiculous amounts (something I’ve reported earlier) and business as usual everywhere else, my only window into this crisis is through what’s offered by media outlets and my favorite news channels.

I wonder now whether I’m miscalculating the severity of our financial situation, as implied by these bailout talks and Fed’s threats of recession. In the midst of all the ruckus and rumblings of economic carnage, here I am still conducting myself in the same way I’ve always been, except now, I’m wondering how much more worried I should be.

Certainly, the foreclosures are vividly real and painful for those in the thick of these predicaments. Bankruptcies have spiked, job losses abound, and more riches-to-rags stories are unfolding everyday. The pain of losing your money in a failed bank when your savings are over FDIC limits is also very real. But what I’m seeing is a financial tempest that’s behaving like some kind of nasty twister (to use a weather term) or a bad flu epidemic (to use a medical analogy) wherein some people get hit, while most others are spared.

To some degree, I don’t really like how this economic crisis is playing out — not only because it’s temporarily wrecking my net worth (which is to be expected) — but also for the offbeat reason that I believe it makes us personal finance bloggers look bad. How? Well, the news changes week to week, and developments happen day to day such that whatever we write one day may no longer be so up to date or even completely accurate the next. I don’t like how this crisis is compelling me to keep bringing it up — who wants to keep bringing up negativity anyway? But I’ve noticed that this seems to be what readers are hungry to digest, since I’m noticing a surge of visits from those readers interested in knowing more about the economy and the crappy markets.

I continue to mandate that we shouldn’t panic and that we should avoid emotional decisions involving our money. After all, when blood is in the streets, that’s when we should pump up our courage and think about buying low. But this media, the talking heads and our political leaders haven’t been too encouraging.

Any thoughts on the financial crisis talk? How much is spin and how much is the real deal? I don’t want to understate the gravity of the situation if we’re really on the brink of something big.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 24 comments… read them below or add one }

Fear not. Over the next 3 to 5 years, taxpayers will be handsomely rewarded for saving the financial system. My guess is — all in — the taxpayers will have gained $100 to $200 billion from this bailout; which is clearly against the conventional wisdom prevailing in the media. But a bet against the short to medium-term viability of the US economy is a sucker’s bet. Even our bipartisian leaders who cannot agree on anything, do come together in times of crisis. No doubt this will be a key chapter in the our financial history, but one that shall pass like all the others before it.

The crisis is not overhyped except to the extent that Wall Street is receiving most of the blame. If fact, the goverment was the catalyst for this crisis when, beginning in the 1990’s, it openly campaigned for home ownership for every working adult that could fog a mirror. It backed up that campaign with initiatives to encourage no money down lending and by threatening banks who did not provide subprime loans to certain “communities.” So the banks did what they were told, home ownership rates increased 6%, and here we are.

I would say that when everything looks so bad that you want to cash out your retirement accounts and sell all your stocks and put everything under your mattress, then you should start buying.

For everyone else that has a sound financial investment plan, it should be business as usual.

Hmm, I’d have to say yes and no. Are we facing financial troubles right now? Without a doubt. But the media is playing a huge role in fanning the flames and making things worse than they really are.

I’ve been fielding calls all week from people who are saying they keep hearing people talk about this as being the next great depression and acting irrationally because the media is throwing around careless words and comparisons.

Now, this isn’t an apples to apples comparison since the downturns have been created by completely different mechanisms, but let’s go back just a few years to 2000-2003. From Mid 2000 to early 2003, the S&P 500 dropped around 50%. 50% over the course of 3 years. Let’s at the past 12 months. The S&P is down somewhere around 22%.

If you look at the first year after the market came crashing down in late 2000, the S&P was down below 1,000 and lost nearly 35%. It continued to drop for another 18 months.

Was that the end of the world? Did all of the gloom and doom come true? Now, I realize that we’re talking about a “crisis” that is rocking our financial foundation and it isn’t just overvalued companies finally coming back to earth, but whatever the root cause, we’re barely in a bear market (no pun intended) as it stands right now, yet people are suddenly bailing out of banks and hiding their money under the mattress as if it’s the next 1929 market crash.

We still have relatively low unemployment, we’re still seeing growth in the economy, even if it’s as a result of increased exports fueled by the weak dollar, and most of the country isn’t experiencing the devastating real estate collapse that we keep hearing about in some of the major metro areas.

That’s not to say times aren’t a bit tougher now than they were a few years ago, and there are clearly banks in trouble, and people being squeezed by the situation, but the media has taken this and really ran with it creating more panic than is probably warranted.

Either way, hey, whatever you want to do with your money is fine with me. If you want to be a sheep and listen to the talking heads and act irrationally, more power to you. But I’ll take my chances with the likes of Warren Buffett and continue to stay the course, and even stock up a bit while everyone else buries their money in the back yard and finds out they have to work until they die. I’ll be enjoying my early retirement on the golf course and try to refrain from saying “I told you so.” 😉

Hi Digerati, I smiled when I saw your blog post. I’m from the media and I have been covering the business beat since the 1997 financial crisis. I know the temptation among media people to crank up the hyperbole and make things dramatic enough to be interesting. Being a blogger, I’m sure you know the creative side of writing. But really good media people have to report what really happened and the carnage lately was bad on all accounts. However, reporting has to be balanced and some people who have been in the financial markets too long have likely forgotten what it is like to be working in the agriculture sector, for example. I guess what I’m saying is, you can ascribe the shrillness in the media to either overexcitement or getting carried away by the moment. I have been reporting about it too last week over at my blog because AIG has a huge consumer base in the Philippines and tried to calm things a little bit, because the figures showed that there is reason to be calm 🙂

The unemployment rate right now is about 6%, in the Great Depression it was 25%. With this bailout the fiscal deficit will reach around 10%, that’s higher than it has been in recent times.

For a brief period last week, the T-Bills had reached a point where their yield had become zero. That doesn’t happen very often.

Japan’s economy has contracted for a second consecutive quarter. Mexico has revised its GDP growth estimate downwards and India is struggling with high inflation and high deficit.

The situation is bad, maybe not as bad as the Great Depression. But I really don’t think the financial system has the strength to come out of this on their own. Without help, I think we may be seeing unemployment rates of about 10% in about 8 – 10 months. Then that will be really bad.

I appreciate your reasoned point of view on this, as opposed to the finger-pointing that seems to be happening on other PF blogs right now.

I think the government and the media are invested in working taxpayers into a panic right now, so that a decision can be rushed. But I believe if you look at the situation rationally, you see that the FDIC/RTC is working as it should.

As someone who believes that the blame in this whole mess lies primarily with lending insiders, I believe that bailing out the banks will simply allow them to return to their pattern of predatory lending, continuing to hoard profits and pass expenses on to taxpayers.

I also worry that the $700 billion that is proposed is also going to give the government – no matter who’s in office next year – power to say, “Oh, we can’t afford that, we just spent $700 billion, remember?” to cut out services we need more desperately.

I don’t think that the economic crisis is over-hyped. I also prefer to call it a fiat money crisis, because that is what it is in its core. Bailing out irresponsible banks won’t solve the debt problems both public and private; it will just prolong the pain.

Contrary to what the main stream media says, wall street as a whole (capitalism) should not be blamed for the actions and policies set forth by OUR congress. There are, in fact, corrupt men in wall street who partnered with corrupt men in government to engineer a win-win situation at the expense of the taxpayer. Capitalism (and our nation or any nation) will only survive when the good and virtuous people are running it. Which means, come this November, you must vote for good men and women who stand by principle and uphold our constitution and not just give lip service to causes that seem noble and just.

“The unemployment rate right now is about 6%, in the Great Depression it was 25%. ”

I think the idea is not that we are in the Great Depression, but that we might be there if nothing is done to stave it off. First, there are likely to be more bank failures, so the unemployment is likely to increase. Second, there are companies that deal with these banks e.g. sell them software or equipment that are likely to hurt. Third, and most important, the difficulty with getting credit is hurting many businesses worldwide even if we don’t see it immediately. This credit tightening got a lot worse in the last two weeks so not all businesses have yet felt it, which is why everywhere it seems like “business as usual”.

@John@Canadian Banks – the idea of the bailout, at least as we can surmise from the media, is not to help bad banks but to unfreeze the credit markets that are threatening businesses that have nothing to do with finances and Wall Street but that need credit for day-to-day operations.

When Buffett starts worrying, I start worrying…And he’s worrying about what would happen without a bailout…

I kind of feel like the ‘crisis’ is either worse than we think it is or it isn’t as bad as they say it is. I’m wary of all the doom and gloom that the bush administration panders because it seems that they are fear-mongers with the press. However, I do think that there are some definite financial proplems with the economy right now — I just (not being invested in anything) don’t have a good idea of how bad/good they are. *grin* but that’s why I read blogs like yours, right?

Ed: Yes, please keep on reading! 🙂 Good points you make!

just stop reading the CNN business garbage. They are so biased, and they want Americans thinking the economy is going to crumble as they walk into the voting booth. Pundits on television have admitted that it would help Obama if people felt that the economy is failing.

I just don’t like CNN and I think there are much better alternative media sources for business information. Wall Street Journal is usually very fair about their assessment of what is going on.

@Erik,

Yes, I agree, CNN isn’t your best example of news. But I guess it’s force of habit for me. The New York Times and WSJ instead?

I am not sure if a bailout is necessary. It should only be done if the whole financial infrastructure was at risk – not just to make the stock market go up.

Most of the more responsible media I’ve seen have mentioned that there is no danger of a 30’s depression – because in modern times the government is so involved in the markets.

Instead, they think the worst that may happen is comparable to the late 70’s / early 80’s.

The government should not be concerned with what the stock market does – instead, they should just be concerned with the integrity of the financial markets.

I think that the Federal Reserve and Treasury are already doing a good job with the interventions they did so far – like take over AIG and encourage the purchases of Bear Stearns and Merril Lynch.

Ultimately, I think the cause was probably too much liquidity by the Federal Reserve. They lowered interest rates and pumped in money to ease the dot com bust, and that fueled an even bigger stock market bubble.

By all means this economic “crisis” was over-hyped from day 1. Have you heard the latest news that CEOs will not accept the bailout because they don’t want salary restrictions. Amazing how once the CEOs money is at risk we’re no longer in trouble.

Not only would the bailout not help the credit crisis (which is not an economic crisis, some Americans, myself included do not rely on credit to live…yes shocking and alien-like I know), but it would worsen it by extending credit to businesses that are on the verge of failure. In other words, we’re trying to fix an economy that took credit risks by taking a giant credit risk on those who took the giant credit risks that got us into trouble in the first place. It baffles the mind how such a move is supposed to help.

Worst of all, it does not help homeowners. If we wanted to fix this problem, a plan similar to my recommendation of trickle up economics via a “Home Bucks” would have a vastly better positive impact on the entire economy. In my plan, homeowners get cash to pay for mortgages and home improvements, which helps remove the bad debts from the banks books, and adds taxpaying properties and reduces our energy consumption (via the home improvements).

Instead we get a bill for $700 billion and little to show for it.

I’m glad to find others questioning the majority. I took my questioning to the max! I asked myself “Who would I be without money?” It really wasn’t that bad!

I challenge others to do the same.

Don’t panic. Stay calm. Even in hard times.

Great article.

Thanx for posting.

Not going to be easy! Lets hope it wont be long…

As I’m putting on my site 4 Hurting Christians that all this was obviously known about, yet allowed to happen.

Can only be two reasons, first not to panic everyone, so keep quiet, hope it goes away.

Secondly as I’m researching and a believer in the last days, obvious that the Global elite want more control over us.

Create, or least allow a crisis and then pretend to be solving it and do that by introducing more measures.

Terrorism did this, now this is doing the same, we go along with it because of fear and we have no choice.

Those that were in debt to the banks are no in debt to the government with loans that eventually have to be paid back, with the tax payers money.

Don’t say I’m alright, I’m in a building society as my site provided links and proof it will affect you too.

Anyone and everyone will suffer, as they reclaim it one way or another, whether through tax on cars again, or petrol, or tax on the pay packet, or cuts in services, or council tax rises, they will get it back.

I predict worse to come, and I’m not expert or prophet, but unlike Peter Jones of Dragons Den, saying things are now on the up, anyone can see what is coming, due to all the factors put together, credit card debt, 10p tax scrapped, house prices falling, people behind in mortgages and unemployment and, list is endless and spirals out of control, unless action is taken, trouble is, that action takes away more of our freedoms, and masses go along with it, because the delusion is that it’s doing some good, getting rid of the fat cats etc.

But it comes down to control, if you are in debt, then someone owns you.

@Lee,

Have you ever gone back in time? If you did, you’ll see this sort of stuff regurgitated every several years. Every decade even. It’s nothing new. I don’t see any period of time as “the end” — could be the end of an era, sure, but that’s to be expected as change always happens after an event of some magnitude that’s affected our lives.

My point here is, we can whine and rant about “bad times” all we want, but the truth is — it’s nothing unique. We function on an economic cycle which expands and contracts. It so happens we’re due for a bear market / recession / crisis / whatever you name it after 6 or 7 years of a boom (housing, in this case).

Take note of the pattern — there’s nothing unique / unusual / special about it: it’s the same story, with different players.

Is the United States better off today than it was in 1932? I keep thinking of this once that the news started to spread about the financial crisis that is suffering by United States. On the year 1932 Franklin Delano Roosevelt was first elected president, and the country was spiraling into a severe recession. FDR’s “New Deal” economic policies radically restructured the way the U.S. economy worked.

Essentially, the government’s role in the economy expanded to a degree America had never seen. In the short term, Roosevelt’s policies provided the country with a needed lift, but it can be argued that they caused significant long-term damage. In this Wall Street Journal article, Paul Rubin suggests that while the current state of the U.S. economy is not in the state it was in 1932, many of the same indicating factors are there: stock market in a tailspin, credit markets locking down and a popular Democratic presidential candidate — Barack Obama — is the economy. An Obama presidency, coupled with what could be a 60-seat, filibuster- running on a platform that will inject increased government regulations into problem areas like proof majority in the Senate, would bring the country as close to a pure liberalist agenda as it has ever been. Proponents of a free market economy are concerned that Obama’s governmental “hands-on” policies will not provide the American economy with the long-term direction it needs.

Those who support the ideals of capitalism won’t say that we’re better off today than in 1932. They’re likely to tell you that we’re in for more of the same — a “New, New Deal.” But even though US is experiencing financial crisis, I must agree that leaders should find alternatives to survive on the crisis.

Ed: Sorry but no keywords allowed in comments. Thanks.

Not to brag but I called this economic crisis in 2000. I was one of very few people who knew this was coming. I positioned myself accordingly and invested properly, selling my home with the maximum 500K per couple and rented a brand new home with an ocean view. Bought gold and silver and non-hedged mining company stocks in 2000 and more when I got my proceeds from the sale of my house.

As I told my new neighbors when I moved in, this is not about houses. It is about debt. This is not a simple cycle like some claim. If it is a cycle, it is a much longer cycle than the usual ones we are used to.

If you follow those who got it right, they would disagree with almost everyone that has made comments here. I am talking about the economists who got it right. Most economists totally missed this i.e. Alan Greenspan, Helicopter Ben, etc.

The issues we face are not going away easily. This is much bigger than most of you think and if you do not hope for the best but prepare for the worst, you will not be real happy.

Although the media is obviously full of hype, they also have no clue how bad things really are. No one is talking about the size of this issue in the mainstream. They cannot as people don’t even comprehend the numbers associated with this disaster. You will not see the lifestyle return to the days of yesteryear.

I was speaking to my Schwab VP who is supposed to have some knowledge. When I told him the numbers, because of course he had no clue. He laughed at me. When I told him where my information came from, and sent him the link to the numbers, he shut up and has never returned my calls or e-mails since. The numbers are available to the public and if you are concerned, want to be educated and prepared, I suggest you educate yourselves on this issue quickly.

If you are unaware, we have become a “services economy” i.e. that is what we manufacture. Specifically financial services. Who in gods name would buy these from the very same crooks who cause this mess? What I ask are we going to “rebound” to? Manufacturing?

US Hegemony is ending. Power and money are moving to South East Asia. If you are unaware of this, you will lose much more than you already have.

Good Luck!

It could be true that the crisis is being blown out of proportion by the media, but something about this whole crisis stinks of fraud. Now I see a similar situation that could be brewing in Thailand. I’ve observed a number of major development projects throughout the country. New houses seem to be springing up everywhere in the suburban areas of Bangkok and other cities. I don’t know what is going on behind the scenes of it all, but I’ve seen a lot of people with questionable qualifications given loans for houses or condos, when their salaries often don’t seem to justify the size of the loans which they’re receiving. Some Thailand lawyers have referenced the Thai banks as a key contributing factor to the onset of the 1997 Asian Economic Crisis. However, that doesn’t mean we can assume that lenders or other banking institutions are entirely responsible for financial meltdowns of markets.