Was this the inevitable? WaMu gets its emergency bailout with a buyout from J.P. Morgan.

What do you know? The virtual ink has barely dried off my post about the WaMu free checking account rate increase when the other shoe finally dropped. In fact, as soon as WaMu increased their rates…it seems that their ratings were downgraded, and finally, a buyout(!) — all in a span of a few days. Things are really becoming volatile in the financial front with WaMu getting absorbed by J. P. Morgan. If you’re curious about “what happens now”, then I’ve offered some thoughts on this subject when I wrote about the case of having savings accounts in problem banks.

This may be the best case scenario for WaMu, but its employees and stockholders are experiencing the brunt of its downfall. Here’s what’s in store for you if you’ve got WaMu connections. I found this information from the Seattle Times:

What happens if I’m a WaMu …

Depositor: Your new bank is JPMorgan Chase, and your money is safe. Savings account rates and account numbers might change, but these adjustments could take months. Banks typically give plenty of notice about such changes.

Borrower: Your new lender is JPMorgan Chase. Continue to make payments as usual.

Stockholder: JPMorgan Chase bought WaMu from the FDIC, not from its shareholders. When a bank fails, shareholders are the last to be paid; they will receive nothing.

Employee: Branch employees could be the safest, because there is so little overlap between the banks’ branches. Headquarters employees are not as secure, because JPMorgan already has many of those functions. It’s too soon to know how many of those jobs will be lost.

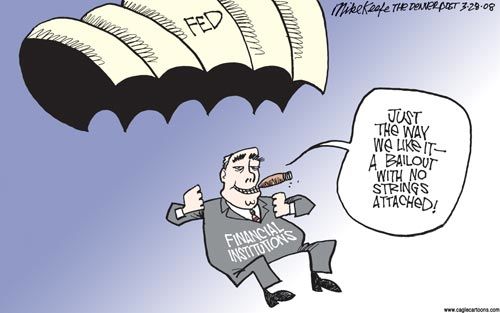

Image by Mike Keefe, the Denver Post

How this event bodes for the rest of the financial industry and the economy, remains to be seen.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 20 comments… read them below or add one }

With the recent article about how some “house flippers” ripped off Wamu for millions, I can’t say that I am surprised by this at all.

I do have accounts with Chase and can say that they have always been pretty good. I assume the 4.0 rate won’t be lasting for long though!

Yes, I expect that when things stabilize for the reincarnated WaMu (JP Morgan), the lofty rate may evaporate. But they’ll take some time to sort that out, I presume? Or they may want to maintain their rates to build customer confidence. I remain curious to see how this unfolds.

The last couple of weeks have been some of the craziest I’ve seen while I’ve started pf blogging, and while it gives me stuff to write about, I’d much rather have things get back to normal. I doubt this wish will be fulfilled anytime soon though.

What about if you’re an affiliate? I had the WaMu links, but didn’t want to promote because I knew it was likely that WaMu would tank. You’re working their affiliate program, too. I’d be curious to know if you get paid, or if your commissions are in the “unsecured creditor” realm.

Hi Erica,

I don’t see any indication that there’s been any changes in their programs, at least so far. If you click on the WaMu links, you are still sent to their application page and there are no announcements or updates on the free checking application page at all. I am also not seeing any indication that you’d be an “unsecured creditor” as an affiliate. Again, this is just from my observations at this time.

If you go to the Washington Mutual home page, you’ll see a message that says “WaMu Customers, Welcome to JPMorgan Chase”.

It looks to me from that home page that they continue to offer the WaMu free checking account and other bank products. But who knows how efficient or how well they’ll be able to process new applications and what their customer service will be now that they’ve got organizational changes in the horizon.

I just can’t believe that this happened. I was a long time believer that WAMU was going to make it out of its troubles. I guess I was terribly wrong. Thank goodness I didn’t make any bets on their stock!

@Jack,

Well, a lot of us hoped for the best for WaMu to pull through. True, the losers here are the shareholders and to some extent, employees who may find themselves “redundant” and may therefore have to be laid off. But even as JP Morgan absorbs WaMu’s assets and liabilities, they’ve got this to look forward to (from a JP spokesperson):

“If you just draw a circle of three miles around our branches, Chase branches today cover 25% of U.S. households, and on a combined basis [with WaMu], we now cover 42% of US households.”

that’s a frightening statistic, the companies that do survive this and gobble up the failing banks may come out in dominant positions, when the dust clears.

Well it seems as though if you have an account with WAMU you are fine. There is nothing to be worried about. What I am worried about if how much does the Federal Reserve have left when more banks begin too fail?

I’m sure the CEO was happy he only had to work 3 weeks. He averaged about a Million a day in compensation!

I guess Bernanke and Paulson will not like this, but it will really benefit them as their case for a bail-out is getting stronger by the hour.

Don’t you all find it interesting that the sky was supposed to fall, and that the “crisis” is upon us? The market took this news like nothing happened at all. Food for thought about the immediate necessity of our $700 Billion, no?

Sorry for the innocents at WAMU.

“ink has barely dried off” is rapidly moving into one of those crazy old sayings you have to find some explanation of how it worked in the olden days to understand 🙂 Like dialing a phone.

I love the cartoon!

I was just going to comment on your post re WaMu’s rate increase earlier this week. Funny stuff. Which only goes to show: higher return goes with higher risk. It’s a fact of life.

I’m just glad that the FDIC didn’t have to bail anyone out… that would’ve been *expensive*. While I feel for the shareholders, it’s all part of the game…

Shadox – I agree with you on the “higher return with higher risk,” fortunately the “risk” here was just that WaMu goes under… not that you could lose any money. That’s a good risk to take. 🙂

“Don’t you all find it interesting that the sky was supposed to fall, and that the “crisis” is upon us? The market took this news like nothing happened at all. Food for thought about the immediate necessity of our $700 Billion, no?”

I think the urgency had nothing to do with how the market took the WaMu news – which by the way is hardly a news with WaMu’s failing for some time.

The case for bailout is the ongoing credit freeze that is hurting businesses that need credit for things like paying our salaries…

I get the feeling here that nobody really cares much about WaMu employees, most of whom had NOTHING to do with the failed policies and strategies undertaken by management (who, coincidentally, are long gone, along with significant $$$$).

It’s really a shame that it all had to go down like this. WaMu had been in existence for over 100 years and had made it through a number of financial crises. But I guess it all boils down to the fact that the last one they faced, they lost.

Management really IS to blame for this one. But don’t hate the employees. I’m one of them, in the corporate office, but I’m really just grunt, like most of you. I came to work, I have a family, and I did my best. Time will tell if I stay or go. Same goes for probably 20000 others.

Don’t act like this doesn’t affect people.

By the way, affiliates have been instructed to take down their links. The program has been closed. I don’t know what happens with regard to payments. I assume there is no cash with which to pay.

i’m SO BUMMED! I’ve loved WaMu as my bank ever since I escaped from the fees of BofA in college and now they’re going to be Chase. *sigh* They were a really ‘different’ sort of banking experience and I’ll miss them.

After reading your previous post about WaMu’s 4% interest rate, I was looking into getting an account. The next day, Chase bought them out. Great timing. I currently have an account with Bank of America and like any other bank right now, their interest rates are pretty low. Does anyone know of a FDIC-backed institution that offers interest rates over 2%?

I can’t believe the amount of feedback this topic is getting. I still don’t understand all that the bailout will do. I’m sure us citizens will get a “It Worked!” or “It Failed!” in the history books!

JP Morgan is in the news again, but this time, it’s not good. It’s been reported that since April 2012, JP Morgan Chase lost almost $8 billion performing the same kind of credit related hedging moves that brought about the credit crisis. These plays are designed to inhibit risk, but in this particular case, this big bank ended up at the losing end of the transactions. Seems like these big banks never learn. This doesn’t bode well for private banking esp. in light of the ongoing debt crisis plaguing developed nations.