Savings account rates are down and so is the stock market. People are losing their jobs left and right. How do we cope with hard times? Even if you are in financial trouble, there’s always hope. Maybe these money tips may help!

Almost 20 years ago, I lost my job and had no immediate prospect to find another one. This was in 1987, which was also another period of intense economic crisis. How was I going to pay the mortgage and the monthly family expenses? How was I going to continue paying for the expensive private education for my two daughters? I stayed in bed for about 2 days feeling sorry for myself, until my spouse and a close friend “ganged up” on me and showed me how ridiculous my attitude was.

8 Money Tips For Those In Financial Trouble

1. Be objective, gain perspective.

In 1929 and for the next 2 years, stories of bankers jumping from high buildings were common. What did they accomplish with their foolish gesture? Absolutely nothing. Financial despair is nothing new, but it is certainly much less traumatizing than learning that you have an inoperable brain cancer. And that is the first step you must take if your financial situation looks desperate. Think of the worst possible scenario, which is losing your life before your time has come, and compare it to losing money. An exercise such as this often gives me perspective.

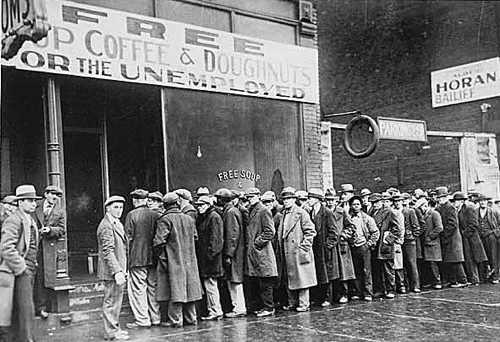

Hard Times

2. Talk to friends and family.

The second step, which was fortunately my situation, is to talk about it to your spouse and to very close confidantes. Talking relieves the anxiety and the pain, and quite often leads to the astounding discovery that there is a way out. There is always a way out!

3. Look into government and private assistance.

We are lucky to live in one of the greatest countries in the world (if I say so myself); one that is quite rich, prosperous, and brimming with countless opportunities. There are some government agencies to turn to, as cited in this article:

GovBenefits.gov should be your first stop. This federal government site has an interactive tool that can help you identify the aid programs you might be eligible for, along with links that can connect you to state resources. Also, try your state human-services agency’s Web site.

You may be eligible for certain services such as unemployment compensation, food stamps, low-income energy assistance, Medicaid, disability or Social Security assistance. Check as well, with your local community organizations and churches, which often have wonderful support for those in need.

4. Raise cash from things you can sell.

Many folks have been able to cash in on clutter, and sometimes, that would be enough. But if you have gotten rid of the clutter and still need extra money to buy yourself some time, you may have to make a list of everything else you can safely sell… or pawn; maybe you have valuables, such as expensive jewelry that you’ve bought for your spouse or yourself. I had to sell a diamond ring that my wife had inherited from her grandmother. She cried because of the sentimental value, not because of the money it represented. But it gave us a little breathing room, enough for me to find a job that paid less; it was enough to help us survive until the economic situation changed.

5. Find out if you should consider declaring bankruptcy.

When you file for bankruptcy, it’s clearly a huge step — the biggest consequence is that it goes on your credit record. So consult a certified financial planner before you make such a radical move. While bankruptcy is a last resort decision, sometimes it can be beneficial. With a Chapter 13 bankruptcy, individuals are able to reorganize all of their debts over a period of time.

6. Focus on your debt and take actionable steps to improve your situation.

For more on how to get yourself out of financial trouble, check out these concrete ideas:

- Review your debts. Take note of what you owe and evaluate debt reduction strategies.

- Eliminate credit card debt.

- Contact your creditors to explain your position about making payments, especially if you’re getting calls from debt collection agencies.

- Cut down on your costs, slash your budget and develop a workable financial plan.

- Use your assets to pay down debts, where it makes sense. Compare your loan interest rates vs your savings’ rates and make the appropriate decision.

- Get credit counseling.

- Consider debt consolidation, but only if your situation calls for it (in some cases, it could be a waste of money and may actually make things worse).

- Watch out for scams! Lots of unscrupulous people come out of the woodwork to take advantage of those who are in financial trouble. Don’t be a victim of these losers.

- Stop being poor with these steps to get off minimum wage.

7. Seek emotional help and try to stay positive.

Hard financial times can be some of the most stressful financial events anyone can face. If you find yourself in such a position, consult a mental health community center to discuss your emotional stress with a qualified counselor.

We must be strong enough to recognize that a lot of the money problems we encounter can actually be more mental than financial. If we keep in mind that every period of crisis can also bring with it potentially great opportunities, and if we’re willing to admit and address our issues head on, we’d be halfway to recovery.

8. Always believe in yourself.

Many times I doubted my own abilities; “if I am in this situation, it’s because I am not good enough,” was my reasoning during my darkest hours. That is a recipe for a situational depression, a mental state from which it is extremely difficult to emerge. Facing the facts also includes assessing your own abilities and potential without bias of any kind. Again, talk to people who know you and ask them for an honest opinion; nine times out of ten they will cheer you up and give you the strength to start again.

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 26 comments… read them below or add one }

Nice work! We have to stay positive!

Pascale

Jacques — thanks for sharing these tips on such a personal note. I know several people who have tried repressing their financial situation, because talking about it might make it more real. It’s one of those realities that are much easier to deny. You’ve given some great tips that focus on the emotional aspect (sometimes underestimated) as well as some changes in habit that can help. On the everyday spending side, I just wanted to add that using cash as much as possible is a good step to eliminating credit card debt. While credit may be appropriate for some purchases, the cash options are growing as they represent a solution in the crisis. The company I’m with, eBillme, offers a buyer protection-oriented cash option on many major online shopping websites. One way to manage spending may be to categorize purchases into types, those where you only spend if you can pay cash, and others where you’re allowed to use credit. Anyhow – just my two cents. Thanks again.

I think being in financial trouble helps you overcome a lot more adversity in the future because you now know how to deal with these problems if you would ever face them in the future.

This article really hits home – I work as a financial professional and people’s reaction to the latest market downturn is concerning. The tips are extremely helpful and clear.

Excellent article. I think a lot of people are going to make this economic crisis personal, and the longer it lasts — the harder it’s going to be to deal with.

I agree that times are tough. Tips given here are very helpful to help us overcome our own financial crisis.

You make some excellent points about financial troubles but for me the area that stands out is “Focus on your debt and take actionable steps to improve your situation.” This is often an area that we can all do something about, by reviewing our finances and putting measures in place to deal with those aspects that our draining away our finances, it’s a cost cutting emphasis but, i think it works smoothly enough if implemented correctly.

Very good article. In Germany, we have the same problems.

Wow, I needed that. I guess most of our week points is managing our finances. When all is good, people usually get themselves in so much debt over things they don’t really need and save nothing for possible rainy days. So when tihs<- hits the fan, you drown quite deep in everything.

I’ve just recently started a financial plan that I’ll follow in 2009. I want to start budgeting in detail like a business, and cut down on my bad spending habits, not apply for any sort of credit, work on settling my current debts and keeping my credit score good, and also save atleast 10% of what I earn per month for future investments or possible rainy days.

Thank you for this great post, I’m inspired by your rise back on your feet, plus I’m glad that your wife and family stood by your side the whole way in full support, now that’s something you hardly find these days.

The first step is admitting there is a problem. For me personally getting a three month payment holiday on my mortgage has given me some breathing space. I’m not naive enough to believe that banks act out of the goodness of their own hearts but they can quite understanding.

great advice on how to handle these turbulent economic times. in times like these, it is important to have a strategic plan. The longer the timeframe until you need the cash, the less change you need to make to a well balanced portfolio. I find that many people panic and make changes they do not need to make.

I can only imagine (from personal experience) that financial stress is one of the top reasons for people to feel alone and overwhelmed. Now with the Holiday season fast approaching and finding employment can be difficult i think this article reminds us to keep an eye on the big picture.

Thank you for a wonderful feedback; Goran has an excellent suggestion, starting and sticking to a financial plan. Amy emphasizes the emotional aspects, a key component in a difficult situation. We have lived a charmed life for the last 20 years and have forgotten how to prepare for stormy days. This experience will make us tougher and more skilled at handling our finances.

Good tips, I put some advice together on how one should prepare for economic downturns back in October of this year, including:

– car advice

– savings goals

– spending

The full article is here.

Vince Scordo

Great article. One caveat is that if you are considering declaring bankruptcy, you should watch out what you do in terms of selling assets. The new rules are a little more restrictive than the old days and if you were to sell your possessions when you knew that you were going to file bankruptcy, I believe that the court can have issues with that since essentially you sold assets from your estate that may have been able to be sold to pay creditors. I read a lot of blogs and forums and I recall one attorney talking about this. I looked for the link, but I couldn’t find it.

The best advice is consult an attorney if you see dire straights coming and make sure whatever your plans are to try and “make it” won’t hurt you should you have to file for bankruptcy later.

Joe

Very nice post relating to the financial position of a business. And you have explained very clearly and it helped me a lot.I find that many people panic and make changes they do not need to make.

When you are out of work or having financial difficulty is really not the time to focus on reducing your debt. Rather, focus on preserving your cash, and reduce your debt payments to the minimum possible in order to maintain your cash reserves.

Once you have a handle on that, reduce your expenses as much as possible and focus on getting some income coming in. Figure out how long you can survive your current living situation without income and formulate a plan and a deadline on which you will radically change it (breaking a lease, getting a roommate, buying a van and living in it) if you unable to pull in adequate income.]

Don’t wait to restructure your life and expenses until you are broke–change things while you still have some cash and options.l

Those are things I would add to your article.

Actually, Philip Brewer at Wisebread wrote something about this topic recently that’s worth checking out, too.

Well, what perfect timing for me to read this. Today is day 5 of unemployment. I unexpectedly lost my job on Monday. I’m impressed you only stayed in bed for 2 days…I stayed in for 4. But today, finally got out..even if it was only to the local Starbucks.

Can I add one other idea? Contact your EAP Program. Outgoing employees are entitled to assistance too – especially in the form of career counseling. I received an excellent kit which I started today. And remember, it’s all confidential so there is no harm in trying.

I understand your wife’s sadness at having to sell the ring she had inherited from her grandmother. Perhaps she would feel better knowing that her grandmother helped her out during a time of crisis. I am sure that somehow her grandmother would feel the same way. Love can transcend time and space.

I wrote about this briefly recently in this article.

But I think one of the most difficult things to do is to accept an alternate lifestyle compared to what you are used. I think this is why financial situations often go from bad to worse. Its sometimes hard to emotionally accept altering your lifestyle because of financial changes.

Great post, I think talking to your friends and family (2) is a great way to put things into perspective (1). We’ve been fortunate that none of our friends have been feeling the pinch, yet, but when that happens, I hope they can lean on us (and vice versa) if need be.

Great tips. It all starts with living within your means and making sure you make the right economic decisions to what your actual situation is.

I just was diagnosed with Parkinson syndrome, my short turn disability looks like a no go; they just keep me jumping through hoops. No money coming in, lousy credit and no help to be found. Thanks for the inspiring words.

Lost&Worried

Rita

Times are very hard these days and they are gonna get harder before they get better; I find myself depressed and full of sadness often. I was in prison for about 10 years straight and I always look back and KNOW that no matter how hard it is right now, it can always be a lot worse!

It’s amazing this post was a year ago, and just like that, everything is rebounding and the job market is brightening as we head into 2010.

Perhaps an update of this post for the new year yeah?

Best,

Sam

I would like to thank the author for these good advices. I’m actually having very hard financial issues and it’s giving me a headache almost everyday. As regards to point 8 it relates so much to me. I’m always blaming myself for not being good enough either in professional or personal aspect, especially how I deal with expenses and my own financial plans.

“When bad things happen, sometimes happen altogether in a same time”.

Cheers.