What things did we uncover about the financial industry during the financial crisis of 2008? Find out how these events affected our personal finances.

What comes to mind when you think about the financial crisis? It was certainly a peculiar time when a lot of negativity permeated the economy and the financial industry. But how bad did it really get? Let’s take a look. Here were the news articles that roiled our world… or at least, got me shaking my head and furrowing my brow during the latter part of the 00’s:

What We Learned About The Financial Industry During The Financial Crisis

1. Money managers behaving badly.

Could Madoff have pulled his fraudulent scheme at any other time in history? Maybe not. It took a lousy economic climate to bring down the big guys and expose the biggest stock investment scam in history. When things are going well, the rising tide lifts all boats, so it’s easier to disguise the crookedness that goes on under the covers. I’ve seen many bad examples of money managers behaving badly.

2. CEOs behaving badly.

Money managers aren’t the only ones behaving badly. You’ve got gambling CEOs (heard of Fry’s CEO who used money taken from kickbacks to fuel a gambling habit?), wasteful CEOs (flying corporate jets while begging for OUR money) and yeah, those CEOs who unfortunately feed the corporate greed stereotype. Did you know that the average salary, bonus and benefits for top bank execs is allegedly $2.6 million?

”Most of us sign on to do jobs and we do them best we can,” said Frank, a Massachusetts Democrat. ”We’re told that some of the most highly paid people in executive positions are different. They need extra money to be motivated!”

I have never seen so many ill-behaved corporate leaders in my life. But maybe stories like this come out of the woodwork much more often when things go south. When things go sour, many more truths are unmasked, and vulnerabilities and imperfections are easily exposed. It’s just too easy to look the other way when things are going well…

3. Corporate excess fueled by taxpayer’s money?

The financial bailouts have been fueling some of these doozies:

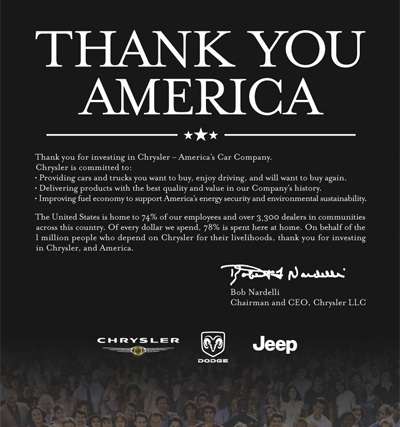

Chrysler takes out a six figure ad to thank taxpayers for their money, after receiving a bailout. Click the image or this link for the full ad.

Here’s what the ad says: “On behalf of the 1 million people who depend on Chrysler for their livelihoods, thank you for investing in Chrysler, and America,” which is signed by Chrysler CEO Bob Nardelli. Some articles have clarified that the “full-page ad in The Wall Street Journal runs between $206,000 and $264,000, and a full-page ad in USA Today runs between $112,000 and $217,000.”

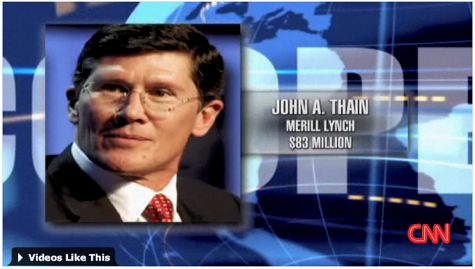

That’s not all. Have you heard about this $37 million Park Avenue apartment that your bailout money has supposedly bought?

4. Bonuses for some, layoffs for most.

Then there’s the stark contrast between those victims of foreclosure and financial loss, of mortgage fraud, of layoffs and of bankruptcy, and the very small percentage who work in the financial industry who continue to revel in massive bonuses and hefty compensation packages. So who’s paying for those bonuses now?

5. Lack of financial accountability.

Do you know where your money is going? The banks who are getting your bailout money aren’t saying much (well, maybe because the media’s been asking). Still, this general lack of transparency seems like yet another corporate subterfuge, just like the fear tactics that the financial industry is heaping upon our government officials and friends in high places to help secure the bucks they need. I’m surprised there’s not more public outcry about this.

6. Continuous requests for bailouts to help the “financially distressed”.

I still can’t get over the irony of the Three Big automakers arriving in posh corporate jets then begging for bailout money. If I wasn’t so peeved, I would have found this ad funny (picked it up from Andrew Sullivan; warning: somewhat strong language).

Can the future be any crazier?

Copyright © 2008 The Digerati Life. All Rights Reserved.

{ 8 comments… read them below or add one }

1.2 Trillion off books in Enron-style accounting over at Citibank …

Good one! If we couldn’t laugh we would all go insane.

I thought a free economy based on supply and demand was supposed to correct itself? Bailouts preclude self correction and reward bad management.

it’s the big wigs begging for bailouts with there cars and jets that really get me!

As much as I agree with most of the above, I don’t think info about bailout money buying an apartment is entirely accurate. The CEO in question had a contract with Merrill Lynch before the bailout was even in the cards, so he’d have gotten the money either way. Additionally, it’s not even clear that Bank of America needed or wanted the bailout money: it was among the first major 8 banks that had no choice about the bailout: if you remember Paulson invited CEOs of several major banks and told them they are taking the money whether they want it or not. Some of them – like the CEO of Wells Fargo – even objected saying they are doing just fine and don’t need the money. I don’t know if Bank of America objected or not or if it would’ve even asked for the bailout — it was still a profitable bank at the time (and still is).

I agree that it’s not fair that the CEO of Merryll gets to retire with millions when most people – including a friend of mine who worked as a computer programmer for Merryll – lose their jobs. But it is still not accurate to say that our money were used to pay Merryll CEO when he’d have gotten the money either way.

I read the list of things you had, and while in a lot of ways I feel sad for the things that have been allowed to go on in our country and the financial markets, I really think a lot of the “public perception” has gotten out of control as well. #1 is cut and dry. Yeah, don’t steal money.

#2 is not about CEOs exclusively. Your fry’s example is about a VP, not CEO. The example of the CEOs from the Big 3 flying in private jets (already paid for, so just fuel and fees to pay to fly) were actually cheaper to fly into DC than a first class plane ticket for the CEOs and their top 3 from each company. 3 flights, 1000 dollars in fuel, and 250 dollars in fees for the planes to land. Hmmm I wonder which is cheaper? That or 4 first class tickets to DC from Detroit.

#3 and #5 are fine. I agree – they should be accountable and use the money appropriately that was given to them. I think the government needs to get some teeth and do something to them.

#4 is not as bad as you make it out to seem. Any company that writes a contract with a new CEO for payment, then they need to live up to it. CEO and many high level people are on CONTRACT basis, and not At-Will as the rest of us peons. While I think that sucks, this is the nature of the business. If they have a contract, it has to be paid off if the company goes under. The Boards of Directors approved the contracts and need to be fired if you want to change anything. That CEO that was at that bank for 3 weeks before it went belly up and still got 30 million. I don’t know how much he knew of how bad his company was doing. CEOs are usually the last ones to find out bad things because people want to keep their jobs.

#6 is fair .. I mean I think they should have let them fend for themselves. Nothing like rats from a sinking ship to figure out how to fix an industry. If a bank defaults, the money that owed on mortgages is to who? The former owner has cashed the checks and you get to keep your houses. It is just “new” money that is not being delivered. Yeah .. you need that to move an economy along, however there are lots of banks that are not in the whole sub-prime mess and have lots of money to give out. They are tightening controls as they won’t make any money on it since interest rates are so low.

So can things get crazier? Heck yeah. It all depends on what changes the new administration bring into office. If we go 180 degrees the other way in an over reaction (just like the patriot act was for 9/11), it will be a lot harder in the future for the vaunted middle class to get ahead.

The financial chaos leapt the boundaries of both country and class. It didn’t care if you were uber-wealthy or a hard-working blue collar worker. After a six-year bull run that brought shareholder gains of nearly $7 trillion, the U.S. markets watched those gains evaporate.

These far-reaching losses punctuate one of the main themes of our book, “The Big Gamble: Are You Investing or Speculating?” The point being that no investment is 100% safe—never has been, never will be. And now, even though we’re eager to accelerate into a New Year, we can’t ignore that we’re still hitched to a trailer load of problems—problems Wall Street wants Washington to solve.

Many economists look to the Fed and the Treasury to re-energize lending activity, by lowering mortgage rates and making a market in bonds backed by auto loans, credit cards and small businesses. That may not be enough. Here are three real-world issues that need to be addressed in order to turn the situation around.

• Restore lender confidence. Even a near-zero fed funds rate has done little to loosen the purse strings at skittish banks when it comes to interbank, business and consumer lending. Most banks have retreated to arch-conservative lending policies, and that’s not likely to change until the structure and value of mortgage-backed securities, derivatives and other exotic securities can be properly understood — or taken off their balance sheets. Such instruments were responsible for undermining investor confidence, and rocking the very foundations of Wall Street, but they will not simply go away. That leaves regulators and lawmakers with a big challenge: Dealing with complex financial instruments in a way that eliminates the uncertainty and restores lenders’ confidence.

• An Obama stimulus package. The Obama administration’s proposed $1 trillion stimulus package includes putting an estimated 3 million people to work rebuilding the nation’s infrastructure and developing robust green energy technology. If Mr. Obama can live up to his promise and make this happen (a big if, considering partisan politicking over the pricetag) it will help revive our economy, albeit not overnight. Look for the rebuilding process to take at least two years.

• A rebound in consumer confidence. Consumers have been sucker punched again and again. First by losses in housing values, then by losses in equities, savings and retirement accounts. Now unemployment is spiking nationwide; nearly everyone knows someone who’s been kicked to the curb. Before consumers venture into the housing market, or even hit the retail stores again, we’ll need to see a significant turn-around in consumer confidence. That’s likely to hinge on what takes place during the first 100 days of the Obama administration

It’s clear that we have a lot of work ahead of us, and even with Tumultuous 2008 now in the past, we are still not out of the woods. It helps to remember though, that since the Great Depression ended there have been 12 recesssions, and we have lived, learned and loved through all of them. To me, that gives extra meaning to the phrase, “Happy New Year!”

This comment was posted by Jose Roncal, co-author of “The Big Gamble: Are you investing or speculating?” – For more information, visit http://www.financialspeculation.com

I think the issue with the CEOs and bailouts. Is there risky behavior and mismanagement hurt the country. Its not just that their bonuses should be taken I think if we are going spend billions bailing them out they should at the least forfeit their last year of salary to pay for part of the bailout.

It’s always better to act as a professional during financial crisis and first thing to do is cutting all the unnecessary costs of the company. This is the best you can do to try to improve your sales outlook.