Who manages the investments in your household? And who tinkers with and sets the budget in your family? Read on and find out who tends to prevail in each financial task.

I don’t want to start a gender war, but I found several interesting surveys on finance that seem to be at odds with each other. I’m sure there are many more such reports and studies out there on this somewhat controversial subject, but allow me to present a sampling. Note that the numbers here have been gathered rather informally (and there’s nothing scientific about them) and thus, I wouldn’t consider them significantly conclusive. However, they certainly offer food for thought:

Financial Surveys Based On Gender

1. 60DaysToChange.com’s survey. I once came across a survey that’s been linked to the site 60DaysToChange.com, where respondents were asked to reveal their top two concerns regarding financial matters and they responded with “debt and budgeting”. Curiously, the answers were very similar between men and women. But the notable thing here was that more women participated in it — “nearly 75% of survey participants were women, indicating that women are more likely than men to seek outside guidance during tough financial times.”

2. Financial Finesse’s survey. On the other hand, Financial Finesse put together their own Q & A, involving 3,000 responses to a questionnaire that were gathered to show how men and women view their personal finances. This particular survey reveals how men seem to be much more comfortable and confident about money than women are.

Here is a peek at the Financial Finesse survey results:

3. Synovate survey. There’s also this international survey by a market research firm called Synovate, that indicates that when it comes to money, women are more responsible than men, with findings that point out that women are less likely to get into debt and are more likely to strive harder to become financially independent. The international study was actually held in 12 countries, so could this imply that gender has a bigger influence on the way we look at money than does nationality or culture?

So which of these findings do you believe? Fascinating how different studies can be in such disagreement.

How Does Your Household Manage Money Stress?

The 60 Days To Change study also tells us something we already know: “over half of the survey participants (57%) admit to having a great deal of money and work stress.” During somber economic times, we middle class and working folks end up feeling kind of stressed. What kind of stressful financial events do we normally experience? A lot of problems that many families face are due to having limited household incomes to tide them over. I’ll ask this tough question: can a modern family live on one salary? Some wise old man will say that it depends on the amount of wages that the breadwinners bring in. But if you’re in a middle class family, you know the answer — you’d affirm that no, it’s a challenge to be living on one salary today, and it would be no surprise that a dual income is required just to make ends meet.

Also, these days, it’s rare to have a family or a couple that doesn’t carry any form of debt. The latest figures indicate that American consumers as a whole owe the staggering sum of more than 2 trillion dollars on their credit cards and retail credit. That sure is something to be stressed about.

Many households now require the teamwork of both wives and husbands (or couples) to survive the financial stress that modern lifestyles bring.

Who’s Better At Managing Money: Men or Women?

This brings to my mind the saying that behind every successful man there is a very smart woman (or something of that nature). I can only say that without the savvy of my wife I would probably be a wino living on the streets of a big city, stretching my hand for a charitable donation. On the other hand, here’s one more point that is not too flattering for the men: I’ve read an MSN Money article that states that we macho men tend to show off our money to conquer the opposite sex. That is, the desire to impress and attract a woman can motivate a man to spend more and to use his credit card more often than he otherwise would. In fact, using money in this fashion can have a negative impact on one’s financial status and health.

And what about these additional revelations from the same article: “Results (of yet another survey) show that women are considerably more likely than men to shred their credit cards (55% versus 43%), while men are more likely to throw them in the garbage (34% versus 25%).” Hmmm….throwing the offers in the garbage is a highly risky thing to do, as any skillful identity thief will tell you. Now if we are to make conclusions based on this poll, you’d wonder whether it’s the ladies who are thriftier and more careful about their money than the men are! But I don’t think it’s necessarily that cut and dried.

Whether or not it’s the men or the women who are better at managing money, we do owe it to ourselves to try to work together as a financial team at home, for the sakes of our families.

So what kind of differences have you noticed between the way men and women handle their money? How does it work in your household?

Created September 7, 2009. Updated April 23, 2012. Copyright © 2012 The Digerati Life. All Rights Reserved.

{ 25 comments… read them below or add one }

I don’t like to admit it but my wife far exceeds me when it comes to money management. We are the weaker sex! Goodbye.

I can agree with a lot of these points, but just from looking at the image of the first survey, I am prone to think that it may have been staged with a bias. The woman stands there in her jeans and vest, looking very casual and carefree. While the man is in a suit with a serious expression. Now, I realize the image and the statistics are two different things, but the way in which the surveyor presents the information suggests bias.

Personally, I know many females that spend, spend, spend. Though none of them are in a serious amount of debt. I also know many males that drop a lot of cash consistently. The difference in financial responsibility may also have to do with the fact that men tend to earn more than women, making their spending more affordable. I have noticed that the males I know make more larger purchases, while the females tend to make smaller purchases more frequently. Either way, the bills for these purchases can get overwhelming if they exceed your income. I think it’s better just to spend well below what you have and always keep a substantial buffer.

In my experience, women are MUCH better than men at handling money.

Maybe because there is an income gap, women understand that they must be the best they possibly can be at this skill. Perhaps women are move concerned about their skills but that worry may be one of the reasons they are better at doing a good job. They are more aware of the need to be on top of this.

This is clearly my subjective generalization. But least, that’s been my experience as a professional.

I really have to question the accuracy of a study that says that 90% of men and only 74% of women pay their bills on time each month. I honestly can’t imagine that is accurate. Seriously, would anyone buy that only 10% of men have problems paying bills on time? I wonder if this is skewed by fewer men participating in household finances and assuming everything is good or men simply being more likeley to exaggerate their financial success?

I tend to think it has less to do with gender than it does with life’s experience. The one who’s had the most recent or severe brush with financial catastrophe seems to be the most focused on money matters, irregardless of gender.

There probably is some self-denial in the answers. Without a survey that strictly defines the questions, it’s easy to tell yourself you are in the “good money management” camp — and perhaps men will make this mental mistake more often since much of their self-image is wrapped around money. What would be interesting is to have another survey that asks “how much %” instead of “do you” and then compare against this survey.

True, surveys only represent a sampling, but I find it interesting, nevertheless, how one survey favors one gender so resoundly while another has the completely opposite conclusion. So which is it? From past studies I’ve read, it seems that men are great with certain aspects of finance (e.g. investing, earning money, etc) while women are stronger at other aspects (such as saving, finding frugal opportunities, etc).

These strengths are so complementary though, that if you get to have this kind of teamwork at your home, you could really find yourself in good shape with your finances!

My husband and I discuss decisions and he give me his input so that our decisions are really made as a unit. I, however, do the actual handling of the money and processes.

Everyone is different. I don’t think gender has that much to do with it. I keep meeting people in life who are in two categories: Savers or Spenders…

I agree with Ellen and Mossy. My first thought was, “How many of the respondents live in total denial?”

Amusing. But you’re right, it’s not a question of who’s better. Particularly more so if you’re a couple with kids, it’s how you play as a team that would make the financial aspect of life more bearable and less stressful.

Men are better than women in financial matters. Although men currently make more than women in the workplace men need to show women their financial power as a show of strength to attract them. Attraction used to be based on a man being physically stronger than the other and now it’s his money. Affirmative action is hurting men in the workplace and needs to stop soon or the disparity will reverse. If the best person is not picked for a certain job then our country will not do as well as other countries. Back to the topic at hand, women spend way more than men on many different things including hair, nails, etc.

@Brad,

Trying to bite my tongue. 😉 Although traditionally, men are the hunters and bring home the bacon, women are the ones who may be seen as managing the money brought in. So in that respect, I’ll agree with you. Perhaps there are two different tasks here — making money and managing it, with men doing a better job making it and women doing the managing.

@Brad,

You’re right – men spend it on watches, fancy cars, golf clubs and boats (huge economic gluts)… the list goes on. Then women get gas over dying roots and meeting other unspoken corporate expectations that differ from those required of men, so everyone can feel good about their affirmative action choice. Aptly put.

I’ve been the one in relationships to put finances back in order, time after time. I’ve also carried the money burden, both coming in and going out, plenty of times. Why? Because I was better at it. It’s not a power thing, objectively speaking – it’s a pragmatic need. When you detach your emotional needs from that, Brad, you’ll see that your grip on the spreadsheets hasn’t made you more powerful – it just disclosed a felt weakness, expressed as a grab for monetary “power.” Either way, the bills get paid – or not. Do what works under your own roof, but don’t expect a happy woman underneath it with attitudes such as your. Life is better when both partners have the shared voice and responsibility. It requires honor, love and the willingness and ability to place yourselves on the same team, regardless of the bills in the mailbox or the (un/)forecasted monetary needs of the household.

Almost everyday, men seem to be proud and to claim that they are superior… but I think women are better at managing money.

Something tells me this is yet another one of those cases where men overestimate themselves and women underestimate themselves.

Case in point: I’m a woman and I know a bit about stocks, bond, and mutual funds. If I someone asked me whether I have a “general knowledge” of them, though, I probably would say no. A man, on the other hand, may have as much knowledge as I do (or even less) would say yes.

We always clash over who is best with the finances. Whilst my hubby ‘takes control’ of our household finances, I’m in charge of the larger expenses such as choosing holidays and such like. Quite a good balance, but I would argue I’m much better than him at saving our pennies!!

Why is it that women always harp and complain about them being the superior gender? You hardly hear men making such claims or statements do you? That is, men are usually able to accept equality with women, but women always try to claim superiority over men. Well, here’s to equality in the financial universe!

A real man handles the money in the family. The greatest fortunes in history have been handled by men. Women do not have the risk appetite nor courage to risk large losses. I would never let any woman touch my money. If I had a money manager who gave spectacular results in a mutual fund then found out that the person was female, I would no longer invest in that mutual fund. This is just an example because I would never put 90% of my money in mutual funds — not enough risk. Mutual funds are for wimps and women.

Most women nowadays don’t even know what a real man looks like. A real man always makes a woman feel like a woman even if she’s a feminazi. I expect women to do whatever I tell them. I never let a woman interrupt me regardless of who she is. If she interrrupts me then she gets a stern rebuke and the following phrase, “Do not interrupt me whenever I speak, for any reason.” Deep in their fragile psyches all women secretly know that this behavior arouses them. Social constructs will not allow women to acknowledge this nowadays.

Taking more risk than you should in order to achieve a certain amount of gain is simply foolish. And so are certain archaic views on social dynamics and relationships. Someone with a limited or narrow way of viewing the world (whether it pertains to dealing with various social groups or orientations) is only inhibiting their sphere and I can only see this as detrimental to their personal, financial or professional development and growth. Such people are missing out. Open-mindedness promotes progress.

@Christian,

I know many families that function with the woman at the helm of the household finances, being mainly the reason and cause of the family’s prosperity. So no, most women I know don’t have “fragile psyches”, while a good handful rule their roost. I gather you haven’t been exposed to matriarchal cultures (or much of anything at all).

I am appalled at some of the men who have left comments. what Christian and Brad seem to think is acting like a man is really acting like an insecure child. 90% of divorces cite money fights or money problems as the primary reason for the divorce, and I’d wager a great many of them come from wives financial infidelity (hiding money and purchases) caused by people as simple minded as you two.

In our house, my wife pays the bills and does the grocery shopping. She is a stay at home mother, and I am a web developer for the local university. We decide together on all financial changes (what services we buy) and large expenditures. We decided together, at my urging, that we don’t want any debt or credit cards. The most important thing to us isn’t how much money we have, but that we agree on what to do with what we are blessed with.

I manage our money and have for years. I do it because I like it and I am pretty good at it.

Certainly I agree to this. Indeed, it has been a proven fact since several years that: when it comes to money, women really are more responsible then men. However, many women believe that it is the responsibility of a man for mortgage or house payments.

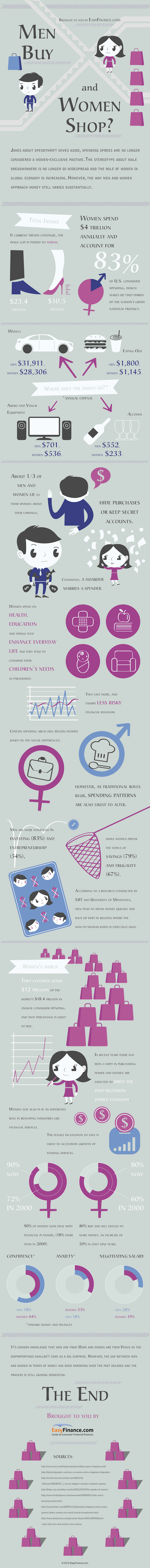

Here’s another interesting graphic about men vs women, as it relates to financial management:

Source: EasyFinance.com

I must buck the trend with regards to financial focus since I much prefer addressing investment and entrepreneurial concerns over anything else — and of course, I’m female. 🙂