It’s as old as dirt and has been going on throughout history, ruining lives across the world. What is this, you may ask? Well, it’s the Ponzi scheme.

My Brush With The Ponzi Scheme

I actually know quite a number of people who’ve been affected by this particular form of fraud (unfortunately, from both sides of the crime). I’ve been “exposed” to Ponzi and pyramid schemes a few times in my life primarily because it’s a common set up in a lot of countries and communities that tend to be closely knit. In many cases, there is a resemblance here to more innocuous marketing schemes that may not necessarily be labeled criminal, but may perhaps be called questionable or ethical by some (e.g. multi level marketing or network marketing). I’ve seen variants of this scheme surface and resurface, oftentimes hitting very close to home. It’s pretty common in other parts of the world, and much less policed elsewhere, given how ingrained in some societies and cultures this money redistribution program happens to be, but it can happen anywhere, as evidenced by the huge Madoff scandal.

When I read about Madoff, and how well-respected he is — being the ex-Nasdaq chief and all being able to pull this heist, I wasn’t as shocked as I could be. Why? Because he looks to me as exactly the kind of person who’d fit the profile of a schemer or embezzler: the unassuming, respectable, dignified, experienced, intelligent, wealthy individual that everyone trusts. When I witnessed my dear family members’ assets succumb to a disintegrating pyramid scheme, it turned out that the very people we so loved and trusted were its masterminds. Our hundreds of thousands of dollars, our trust, our bonds, our relationships that had been on the line….simply crumbled away in those “pyramids”.

Ponzi Scheme vs Pyramid Scheme

Are you familiar with how such a scheme works? A pyramid scheme is a type of Ponzi scheme. With the more general Ponzi case, you are sold the idea that you are investing in something. The con artist will try to recruit you with the story that they have a fantastic investment that rakes in unnaturally high returns. Most of the time, a lot of people you know are already part of the system (as targets). But their participation in this will encourage you to join in. You’ll be convinced to stay in the scheme as long as you are paid attractive returns — which you will, as more victims are drawn in and the fraudster’s pool of funds continues to grow. The pyramid scheme works similarly, except that the recruiting method may involve “innocent” people who are made to take a stake in the “venture” while also serving to get others involved in this activity. Knowing what this scam looks and smells like is the first step towards making sure that you don’t fall victim to this.

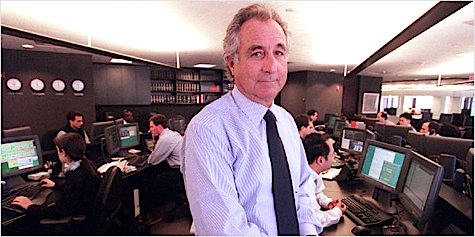

Don’t let someone like this near your money. Photo by The New York Times

Tips To Avoid Becoming A Madoff Scam Victim

So what else should we be wary of? Beyond the scheme itself, it’s WHO perpetrates it. Because that’s precisely how you can potentially become the victim of such a scheme: by finding yourself involved, thanks to a friend, relative, confidante, trusted neighbor who spins you a story about how they can help you grow your riches.

Many times, other victims unwittingly share in that persuasion that urges you to relinquish your savings and to join the rest of the herd, marching to the tune of a Piper who will either eventually get caught, tarred and feathered, or sadly for all, will eventually vanish with everyone’s hard-earned money. So what can we do to avoid falling prey to such a financial mess?

1. Limit any financial relationships with friends and family.

Lots of ponzi schemes originate from your inner circle. When the whole neighborhood is enthusiastically pledging their money to some lone investment plan or business idea that you’re not familiar with, do avoid it like the plague. You want to stay friendly with most everyone, right?

2. Don’t allow people to sway you into investments and business plans you don’t understand. Make sure you do your due diligence and know the kind of financial set up you’re signing up for or committing your money to. Ignorance can bite you in the end.

3. Know where your money is.

The Madoff story tells of many victims who never even knew they were invested with the guy. Also, do the returns sound too good to be true? They probably are! Please don’t invest blindly.

4. Keep up with how your investments are doing.

If you’ve handed your money to someone or some institution, don’t just forget about it. Keep track of your money, stay abreast of developments on your accounts, keep evaluating your investment portfolio performance. Otherwise, laziness can bite you in the end.

5. Always diversify. Always.

Entrusting your entire estate, net worth or asset base to one institution can be very convenient but it can also make you very vulnerable. Spread your money around to avoid 100% losses. You can never be too sure about what can happen. The Madoff story is proof of that — even the most esteemed and respected financial house can go sour at any time.

6. Ask first. Trust later.

That’s my motto. When it comes to my money, I ask countless questions first and try to understand everything relevant to it. The trust and faith may come later, when I understand how much risk I’m willing to take when I fork over my savings. Don’t invest what you can’t afford to lose.

Some Financial Loss Is Inevitable

Of course, even if you abide by precautionary measures and believe that you’ve done everything to avoid financial disaster, nothing is 100% guaranteed. Anything can happen. And sometimes, if you’re unlucky, you won’t know what hit you.

I know my family members didn’t. My friends didn’t. In hindsight, you can say that they should’ve seen it coming. I brag to them that nobody will ever “get” to me. Nobody will be able to sell me on nonsense. I can sniff out a Ponzi scheme, a get rich quick scheme, a scam miles away. Or so I may think.

There but for the grace of God go I.

Created: December 19, 2008; Updated: April 24, 2011

Copyright © 2011 The Digerati Life. All Rights Reserved.

{ 19 comments… read them below or add one }

Oh my god….should I be worried that Buffett is just a huge embezzler? I’m kidding lol. Thanks for the post…it is truly outrageous and saddening to hear about this scandal.

Con men (and women) are good at what they do, otherwise they’d have jobs. You can’t tell who is or who isn’t a con just by looking. 🙂

$50 billion… simply astounding…

@Eric,

I contemplated owning Berkshire Hathaway in the past but eventually decided against it. Maybe I should have put down a little towards it given how it’s trounced the S & P and DJIA over the long term. However, I’ve heard about some people putting all of their money in BRK and that’s something I wouldn’t do just by principle. Again, you never know what may happen to any single investment so it’s just wise to spread the risk around.

@Jim

Yeah, con people come in all shapes, colors and ages. Remember the case of the “fake Rockefeller” who conned his wealthy wife (now ex-wife) and kidnapped their child? I wonder how anyone can possibly NOT know that they’re living with a con? It seems obvious, but maybe it isn’t, and we all have just a tad bit of gullibility in us. As I said, there but for the grace of God go I.

The absolute size of his fraud is just astounding. You would have thought that at least one of his clients would have gotten suspicious….somehow, you know?

@ Jim – good point. I guess they wouldn’t be good at conning if we all could see it from a mile away!

If it sounds too good to be true, it often is. The returns that Madoff was supposedly achieving were questioned by others in the past, but nothing ever came of it. There were some people who were not surprised by what happened, but it is a shame that so many got taken advantage of.

My grandma would fall for all of these types of scams. She simply would believe anything that somebody told her. I am entirely too wary of these; as I know how easy it is to impersonate a ‘reputable party’. My experiences online have taught me how easy it is to make a fake site look just like a real one.

On potentially stealing sensitive information — lots of people use these schemes online to scam people, but they’ll present it as being from a reputable website. They’ll copy the coding exactly, and mask the url to look like the real deal.

It is just amazing to see how many very smart people were taken in. While there are times that we regular folks may envy the very rich, it sure is true that they can have huge losses.

And, they must frequently have people befriending or romancing them simply because of their money.

This is generally sound advice, but I think it might be an overreaction in some cases. For example, in case #2, I think basically any blue-chip investment would fall into the category of “Things I have no hope of understanding. ” For example, I’d have a lot of trouble telling you how the finances at the average bank, insurance company, or energy company work — and I certainly couldn’t explain what process Intel or Microsoft uses to mix smart people and silicon and produce cash. With Madoff, though, his returns didn’t even look like the other super-secretive hedge funds that were nominally doing the same thing.

In the end, a lot of investing is all about buying into stuff you don’t understand. I don’t know how to run an airline, a clothing store, or a bank — but I do know that if I have some of my net worth in each of them, I won’t suffer quite as much if my own job goes down the tubes because of industry conditions.

By the way, I should put another good word in for Berkshire: it is, in a way, much more diversified than most stock portfolios. When you buy Berkshire, you’re buying insurance, fractional jet ownership, bricks, boots, grocery wholesale, utilities, and dozens of other businesses. The stock might be more volatile than the average mutual fund, but the business as a whole is pretty solid.

Wall Street was warned years ago that this man was too good to be true, but ignored all the warnings.

Hi, I’m Isaac Yassar and I help people reach success in self development, business, and blogging for free. Thanks for sharing these impressive articles, I agree with your points. I love your statement “Don’t invest what you can’t afford to lose”, it’s quite similar to my principle “Don’t lend money you can’t afford to lose”. Anyway, I wrote an article Why You Should Never Join MLM, in case you are interested.

Don’t be fooled with online scams, they really suck! I get a lot of e-mails every now and then telling me that I’ve won some sort of prize but the whole thing is a scam and asks you for your personal information.

It’s just a timeless message that’s being repeated: pay attention, or someone will pull a fast one on you! During these times, especially, you must pay attention to where you are putting your money and who is managing it.

They just arrested Sir Allen Stanford today for a 2 billion dollar ponzi scheme.

I agree, you need to be very careful with whom you invest your money with. Madoff was a complete crook whose whole focus in life was to make money any way he could, no matter what the cost. His scam however, caused many people more harm than he ever imagined.

Good advice; it seems that one of the things that never changes about the financial markets is that there will always be those who try to take advantage of others’ ignorance. Vigilance, education, and caution are good pieces of advice, all the time.

#6, so true! always ask questions.. better to know now than to find out later.

One of the best articles that differentiates between a Ponzi Scheme and a Pyramid Scheme. Most journalists slaughter the definitions and some think they are the same thing. CONGRATULATIONS ON THE ARTICULATION!

Rod Cook

Editor

mlmwatchdog.com

@Roger, it seems like it’s big business to prey on vulnerable sitting ducks. Those in a weak position are often too easily lured by the promises of riches and happy endings such that they end up taken advantage of. Unfortunately, short cuts may not always be good for you.

@Amy, agreed. It helps if you are a natural skeptic and are naturally suspicious of everything. 🙂 Healthy paranoia can save you money!

@Rod, thanks! I appreciate the compliment. I try to educate myself on these terms. I find it interesting how there are so many flavors of scams around, but they share a lot of similar characteristics.

If you come across a gig that sounds or looks even remotely like this type of scam, make sure you ask serious questions or even report it to the proper authorities as it may require an investigation.

I wrote about Ponzi a while back. Interesting fella.